Feel free to dump your tech anal, charts, trades, and predictions here.

I think that we’re gonna be relatively flat around the 420 level while we wait for the CPI report and FOMC meeting. Afterwards, I think that we’re going to go on a rally. I think that the fed will be more dovish because of the war and weakening economy. They’re probably gonna focus on inflation a bit later as they’re not doing shit already. I’m gonna start to pick up on calls next Monday

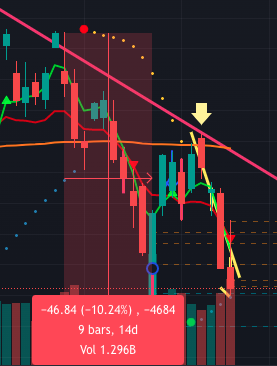

Just your average $10 spy swing in under a day. this is normal now :kekw:

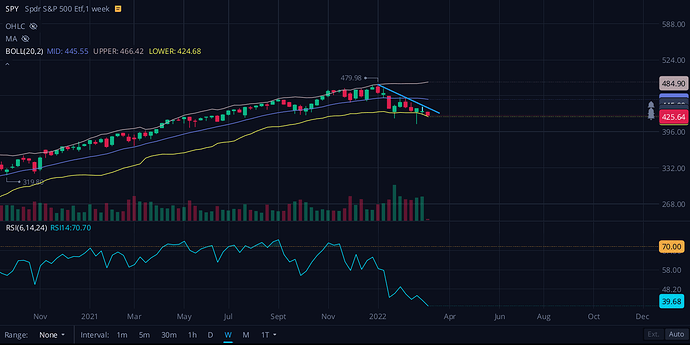

My poor mans TA is spy to below 400. Just the quick math, average all time annual return is 10.6%. If we start at feb 2020 with spy at around 320, then add 10.6% per year it leaves us with spy at around 390. With interest rate hike, war, inflation and me holding several otm leaps accidentally, I think below 400 is probable and lower than 390 also very possible

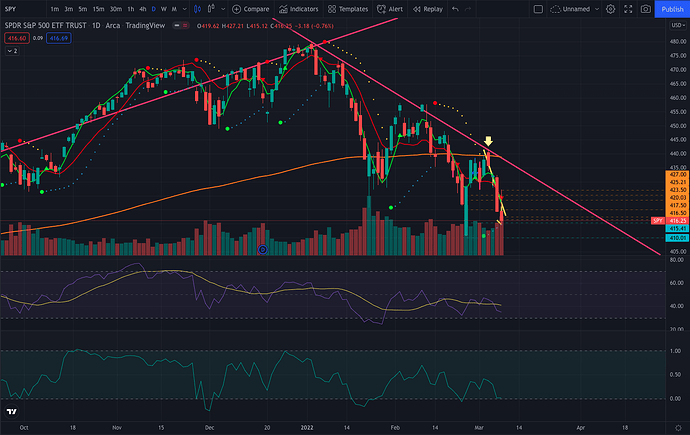

My humble opinion:

I feel like when it tapped the trend line here it got rejected pretty hard.

Comparing with the last couple of times it tapped this line, I’m not sure we’re done yet. The first was a 7 trading day fall from 472.88 to 420.69, ~11%. The second was a ~5% drop then a bounce and a heavy drop into the Invasion news which made it about 10% total.

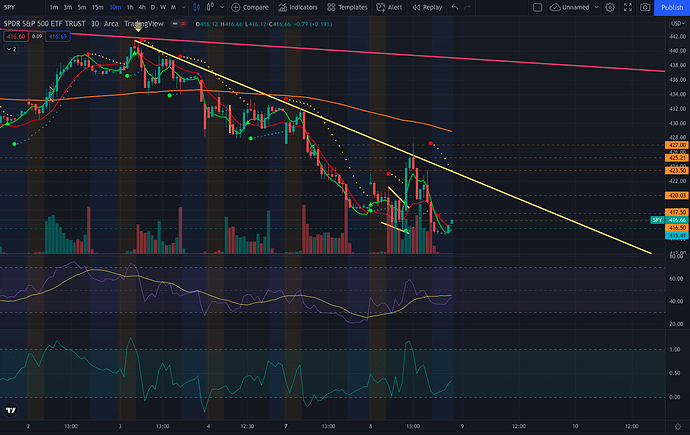

Since the last tap on the trend line above, this has been the 30m chart:

It also broke the 415.50 support it’s had today in AH briefly. Together with the fact that unless the war ends or CPI numbers are relatively better than expected, I feel like for tomorrow it likely trades sideways or even retests 410 into a small bounce. Thursday and Friday will of course depend on the CPI numbers and any war news.