Place for discussion of potential Fed moves and market reactions.

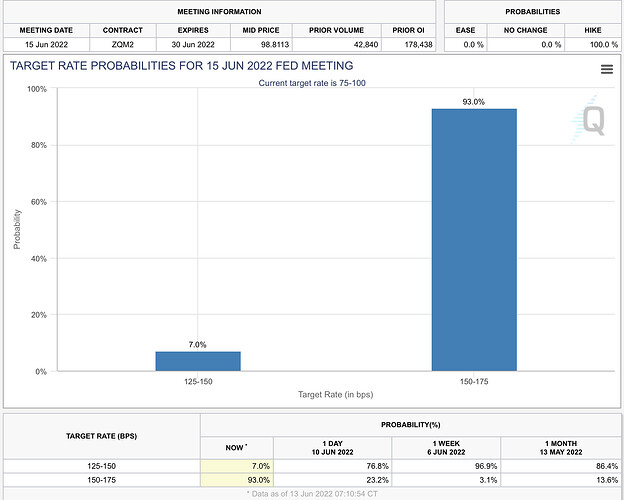

Futures are pricing in:

June-50

July-75

September-50

November-50

December-25 (maybe 50)

Bringing Fed funds to 3.25-3.50% (or 3.50-3.75% depending on December) by year end

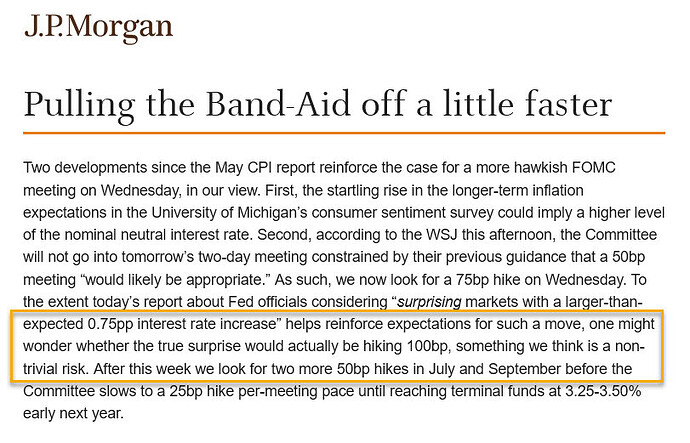

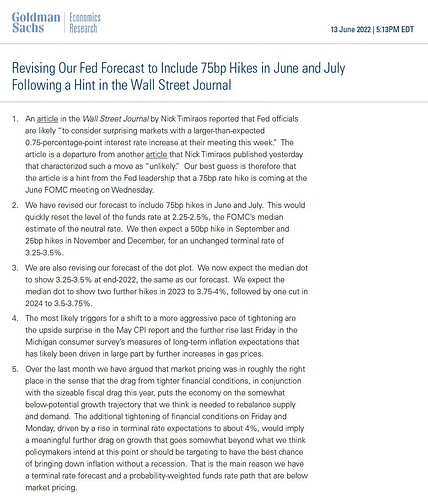

The Fed has been signaling a 50bps rate hike in June for months now. I expect the Fed to continue with this increase notwithstanding the higher CPI numbers on Friday. The Fed has a credibility problem (which is why they keep having to answer questions about whether they have a credibility problem). In order to build trust from the market that the Fed can navigate a “soft landing”, the Fed is going to have to do what it says it is going to do and not deviate from its signaled script. If the Fed were to raise the rate by 75bps on Wednesday, the market would panic because that is a signal of two things: (1) the Fed is panicking; and (2) the Fed’s statements can no longer be trusted enough to trade on.

I do fully expect the Fed to start warning of increasing rate hikes during FOMC and press conference. Maybe even in statements leading up to FOMC. The likelihood of a 75bps hike in the future is high. But I would be very surprised if we saw one Wednesday.

PPI is coming out tomorrow in pre-market. The PPI serves as a leading indicator for the CPI, because when producers face input inflation, the increases in their production costs are passed on to retailers and consumers. Here are a couple of examples of producers passing on costs to the consumer. FYI: just remember, not all companies have the pricing power to pass on rising costs to the consumer.

https://twitter.com/DeItaone/status/1531985509379096577?s=20&t=qXfFBRphKkLGTg95AILfRQ

https://twitter.com/DeItaone/status/1524394339362873344?s=20&t=d-eIWTO32GZQNaPCh5D0UA

https://twitter.com/deitaone/status/1424730043738202120?s=21&t=-xoXhIlU1nDTCKZ_eLepfA

https://twitter.com/deitaone/status/1450800692499783686?s=21&t=-OADuY3Yzj81W9OVFLkKwA

Retail sales come out on Wednesday pre-market. Will there be demand destruction? Find out next time on Dragon Ball Z

We have so many SPY threads.

Please close the others as necessary.

I posted my thoughts here…

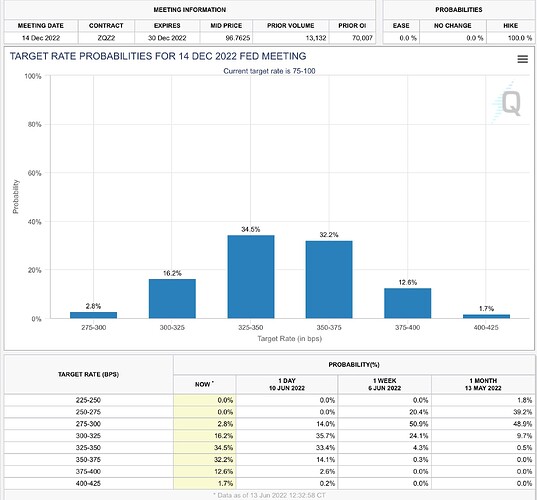

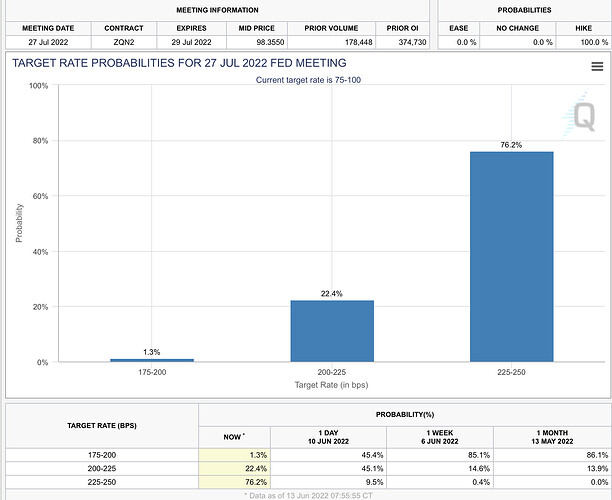

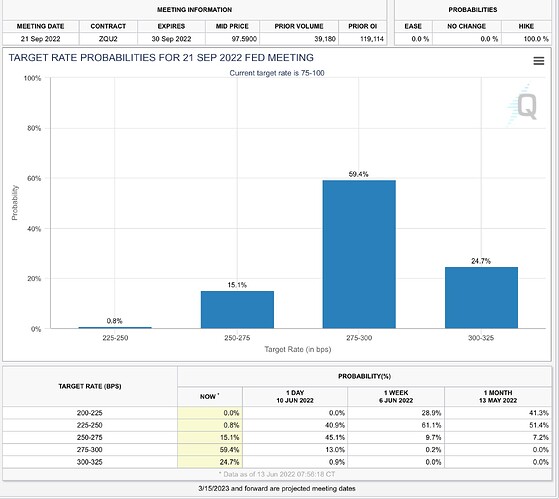

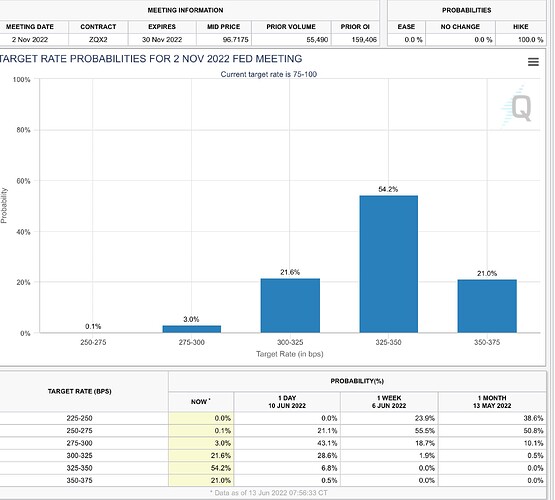

Futures now pricing in:

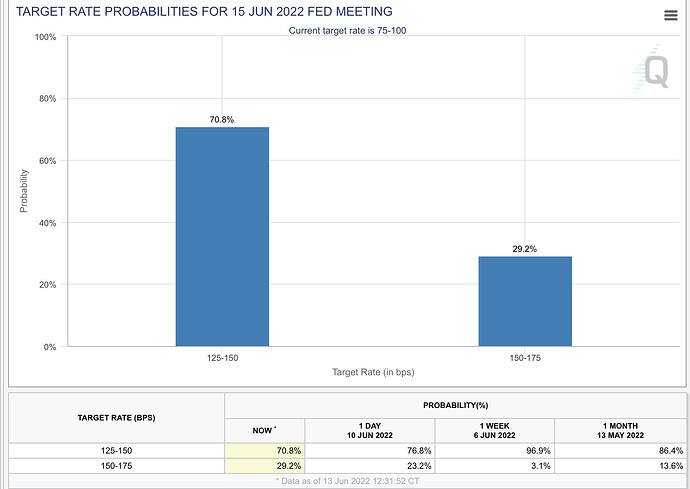

75 for June:

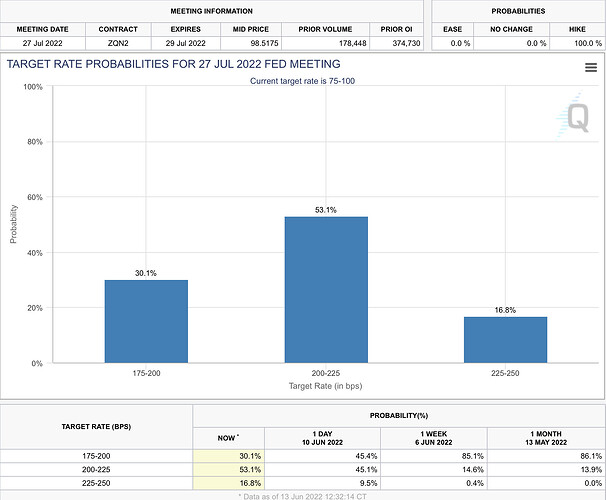

75 for July:

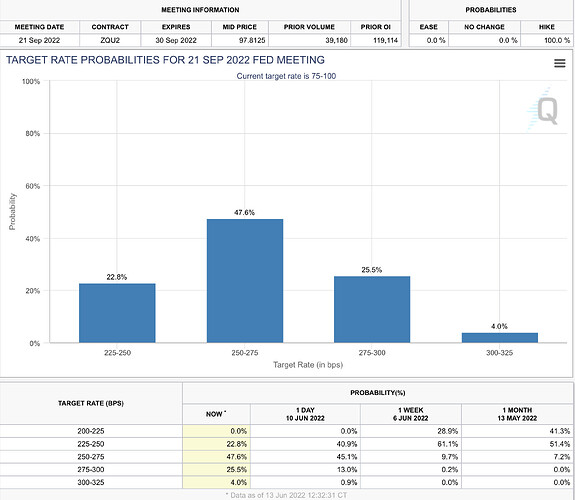

50 for September:

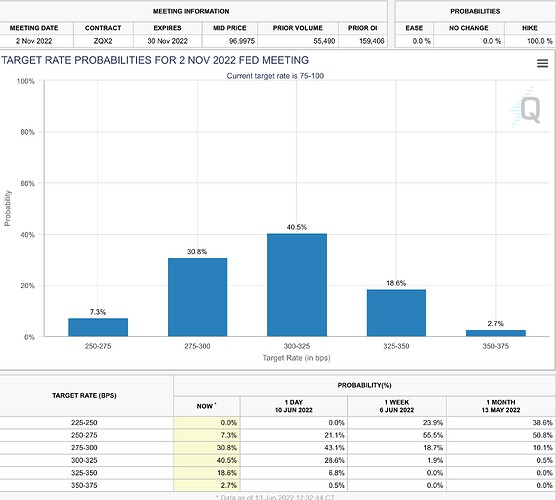

50 for November:

50 for December:

Bringing the FFR to 3.75-4.00 by year-end. The “no way we’re getting 75 this week” trade is looking really attractive right now.

To better consolidate SPY discussions, let’s migrate over here: SPY & The Quad Witching (June 17th)

We’ll start doing a weekly SPY thread and leave the broader SPY analysis to the smarter folks like Rexxx, The Ni, House, Swole, etc.