Here’s the SQ chart over the past few months

I’m seeing a double bottom and good reason for it to turn around, at least briefly here. Consider the RSI when oversold in every scenario on this graph.

Based on TA alone I think the risk/reward is pretty decent. I feel confident I’m buying at the bottom and can set a very strict stop loss.

However, let’s consider the situation that has brought SQ to this point.

SQ reported terrible earnings of 0.37 on Nov 4, compared to 0.66 the previous ER on Aug 2. On Nov 8, Paypal (PYPL) released some pretty bad earnings as well, causing SQ to fall even lower. This downward momentum has eased off as SQ has hit a level of long-term support and Paypal itself rebounds.

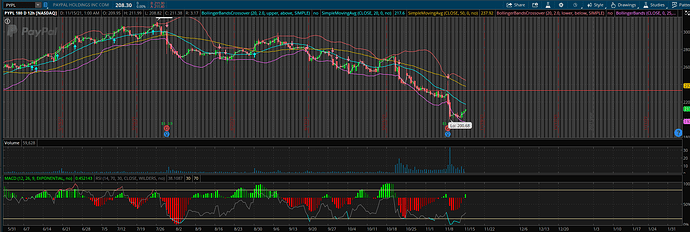

Here’s Paypal:

Now that both stocks have fallen a good bit well into oversold territory, they are recovering. I’m playing on this recovery. I expect it to last for 2-3 days and have bought call options 1 week out. Currently holding SQ 11/19 250C. Entry at 0.30 on 11/12.

EDIT: In case you’re wondering, I’m not playing PYPL because the TA doesn’t look great.

1 Like

I’m not super good at this yet, but the 5 year chart and/or if you zoom out on this chart, it looks like a giant double top. I might straddle this just to screw with the universe and make it go sideways.

I’m playing short term based on the more recent level of support. Bad news coming from PayPal out of momentum. Other stuff. I need time to write the full DD.

OP updated

1 Like

SPY is knifing today on rate hike fears. SQ followed suit. I sold right before this news. Amazingly lucky timing. Up 360%. Looking for a juicy reentry.

If you bought at open for ~0.42 you’re still green even with this knife.

UPDATE:

After the crazy day we’ve had with SPY I’m going to let this one ride into tomorrow. If it stays level AH into tomorrow PM I’ll pick up some calls in the AM. If I’m wrong and it rockets AH/PM I will not take entry but will instead bask in the 360% gains from today.

2 Likes

that was a great call out, thanks!

1 Like

11/17 PM. Today is the last day of the play. If you bought at open like I did yesterday on SQ you should have made out pretty good. The theta on the 250s being so far OTM makes it hard to make profit, which is why the closer to expiration you should either move your calls further out or lower the strike. I’ll be watching SQ today and seeing if it affords a good entry for 11/19 240/245. There’s a slight SPY correlation on larger SPY moves. So keep that open next to your SQ chart.

SQ could go as low as 235 before reversing and heading up for the day. We’ll see just how much momentum it has off this rebound, which was the entire play.

With this morning’s dip I’m completely out. Lost some money fluffing my entry, but not much. I was looking for strong upward momentum after the initial dip, but didn’t see it. This play, imo, is over.

1 Like