Sociedad Química y Minera, or SQM, a Chilean mining company trading on the NYSE, just reported a big increase in fourth quarter net income to US$321.6 million from US$67.0 million in 2020. Mostly, this attributable to the increase in lithium prices. The stock is trading at all time highs of $78.60/share. As we know, higher oil prices accelerate demand for electric cars and lithium ion batteries. But that’s not the only piece of the action I’m interested in.

In 1986, the Chernobyl nuclear disaster created spawned a radioactive cloud which spread over Europe, creating cancer clusters. Looking at the hysteric reaction of the near-misses on the Ukrainian training facility at Zaporizhzhia nuclear power plant last week, it is not surprising why there’s a shortage of potassium iodide in Europe at the moment. Potassium iodide is iodine taken in consumable form, which protects the thyroid gland against absorbed radiation. Belgium, for example, gives out iodide tablets to anyone living within 10km of a nuclear plant. Europeans weren’t exactly thrilled by Lukashenko’s offer to host nuclear weapons in Belarus.

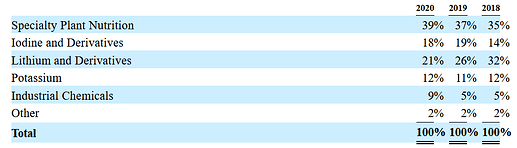

What stock has investments in iodine? SQM of course. It has fertilizers, too. And, Lithium was only 21% of 2020 revenue. SQM could see another jump if demand for iodine rises:

Might also be an opportunity to play a repeat Zaporizhzhia scare, if the front lines get closer to Ukraine’s other nuclear plants:

Risks and bear case:

- Ceasefire

- Major oil price correction

- Dollar strength versus Chilean peso (Fed raises rates > dollar strengthens > SQM stock may fall)

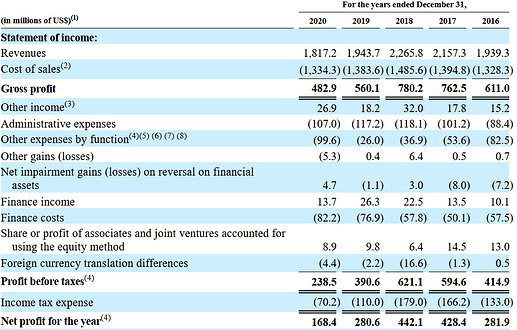

- This is very much a commodities boom and bust stock. 2020 income is lower versus 2016 (however, this does not include 2021, obviously):

Positions: none currently, but eying some shares and perhaps a few Mar 18 or Apr 14 ITM calls: