Not enough chain meaning not enough OTM strikes or not enough OI like you said in the original comment?

Since there is no NAV floor on this, wouldn’t playing the other side be a good play? Seems the only thing running this up is the low float, retail pump, and OI in comparison to the float.

What is the fundamental case for the underlying company?

Was thinking the same thing. IV on these options aren’t TOO bad. Thinking I’m going to wait to see how it runs now and the coming days. ITM, sell as soon as the likely dump happens.

This play is honestly a matter of finding the right time to get puts.

If you’re playing out next month ITM, thinking those would be best. February is profitable, but really unsure how long these can go on.

Will definitely be watching the movement on that side of the chain tomorrow since the low OI and volume may just make it pointless to enter them.

Definitely considering March 10p. However, waiting for the IV to cool a bit after today’s run. If it goes up another dollar tomorrow, I might as well go in.

I would be cautious with entering puts further out than February here. This could at some point in the near future be a candidate for a gamma squeeze but is not currently a candidate for a gamma squeeze. I would hate to see people get burned by March or April puts and not taking profit when the drop occurs. If you are going to acquire puts, I would plan to cut them shortly after this dumps but before significant OI begins to accumulate on the ITM calls. There is probably a sweet spot here on timing, but I’m not experienced enough to time it right so I will sit this one on the sidelines and watch the OI on calls with great interest.

Very well, I will then do the same as my last wish is to relive what happened with PTON.

I’m curious why you think this? There are only 8 trading days left for the Feb puts, is that not risky by definition?

Yes the March puts are expensive, but my thesis is this will below the NAV floor after this retail semi gamma squeeze is finished, but we don’t know the timing. Buying the Feb Ps may end up being completely worthless.

Jeez SST still moving. 10K OI ITM now plus serious volume on options so we will have to see update in the morning. If this does play out as a semi-gamma I will definitely buy puts in the middle of expiry week if it’s at ATHs.

If I get in this I’m gonna go with some 12.50c with an eye on it to unload. If for some highly unlikely reason Reddits ticker ADHD doesn’t set in before OPEX and it continues to run up to. I may look at puts on the Monday after since more than likely they will be holding out for their mythical T+2 theory.

Theres not enough OI throughout the OTM strikes to sustain any sort of serious movement. It’s also really likely it’ll drop through the $12.50 and quickly lock all the OI OTM pretty soon as a result.

sold my 12.5C’s today at open. This will drop below 10 after this initial pump and hopefully the chain will have the ramp we are looking for.

I started opening some 3/18 7.5/10 call credit spreads that were filled at a very good price IMO.

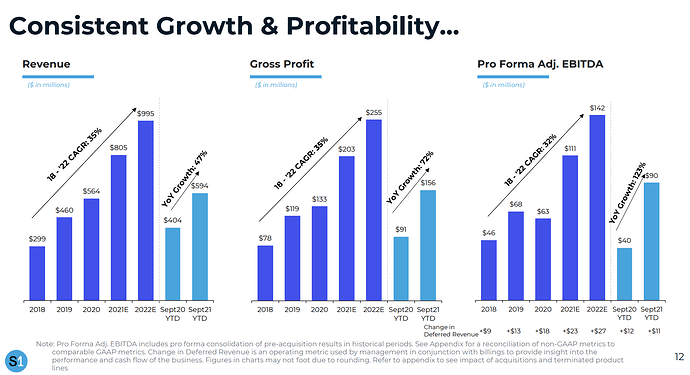

However I want to caution betting too much on expecting this to fall through the NAV like other DESPAC dumps. Unlike other DESPACs, this is not a shit company. It is already profitable and has grown YoY. From my research, this company essentially holds a lot of internet properties (e.g. websites) where they have built an advertising business.

Financials don’t look bad, at $10 this will have a PE ratio of roughly 13 and a forward 2022 PE ratio under 10. It’s not terrible in this market, but I cannot find a comparable company to measure this against. Possible Bear case for this company is I do not expect this to grow organically YoY at the rate they have laid out. They will require acquisitions to grow which are costly. Also some of their premium websites may have traffic die out overtime which will force them to acquire other properties (they have Mapquest for gods sake, who still uses this?).

I’m not expecting this to fall heavily below the NAV floor, maybe around $8-$9, but given its rise meteoric rise in the last couple days, we may see a hard dump below that after we hit a ceiling and retail does its thing. Be careful with OOTM puts and time your entries.

This has fallen below the $12.50 strike locking most of the OI OTM. It really hasn’t accumulated much of a chain still, but some additional pumping could change that. Still not really an interesting play as of now.

Isn’t the chain built better than ESSC’s at this time? The 15c and 17.5c for SST are also better ramped than ESSC’s as of market open at least through to 17.5c.

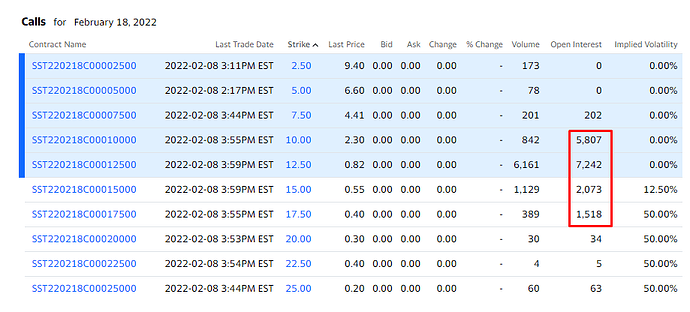

SST at a float of 700k shares:

- 85.8% of the float at 10c and below.

- 189.3% of the float at 12.5c

- 242% of the float through the entire chain

ESSC at a float of 1.19M shares:

- 51.2% of the float at 10c and below

- 132.4% of the float 12.5c

- 193.2% of the float through the entire chain

Although, ESSC has redemption floor protection.

I’m not saying ESSC is going to run either, ESSC has catalysts coming though that SST doesn’t and is trading near NAV. SST is a company nobody believed in which is currently likely elevated above its fair value.

The OI % of floats look impressive, but the way the OI is spread will not sustain a movement. The 12.5 alone isn’t enough to propel it above the 15 and you’re dead in the water over that.

You don’t just need OI, you need a well developed chain.

S-1 filed to register warrant shares Inline XBRL Viewer