Post from Sloppy this morning. Interesting take.

System1 ($SST) DD - Retail About to Run the Jewels (703k float; 150%-ish SI)

System1 ($SST) DD - Retail About to Run the Jewels (703k float; 150%-ish SI)

Heyo, your spire captain is back for the rebirth of the deSPAC (never forget). We rode the rocket +95% last chapter and I missed you all so much that it felt right to get the gang back together again.

I was in-spir-ed while gnawing on cold off brand pop tarts pondering “what happened to the squeeze”? Every idea has been a dumpster fire for retail and pockets of reddit look like the Donner party (amiright?). Even MTCH, WSB was right and the company flopped on earnings, yet it rockets?

Retail keeps losing because institutions have been selling into retail’s rip on name brand tickers. Bond rates are on the rise and tutes are pivoting away from equities. It’s the re-redistribution of wealth to boomer ass bonds. Your friends are telling you to buy puts but you’re watching the steep premium melt into the pockets of market makers.

We’re taking the goddamn ball but we’re going to a place tutes can’t go. You heard me. That place is ultra low float deSPAC and the new playground is $SST (System1).

Tutes can’t touch SST for a couple of reasons:

- 98.6% redemptions leave only 703,108 shares. Small fish to tutes so they don’t care to touch.

- The entire float is actually locked in option delta hedging. Not talking simply ITM OI degenerates; I did the ACTUAL calculations (more on that later). Leaving no shares for tutes to buy.

- Tutes have too much money…. They can’t play in low float because it’s a liquidity trap. They’d scorch the earth they need to plow if they tried.

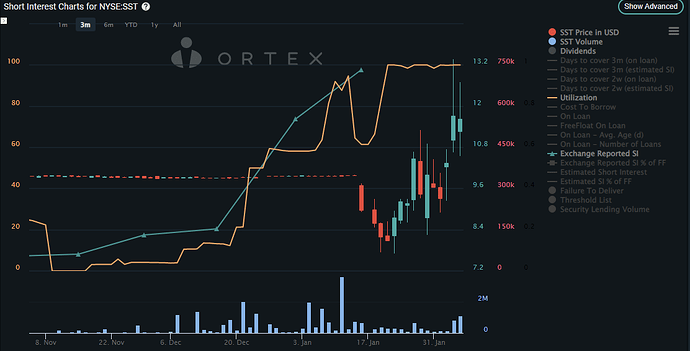

- No short shares available. Zip, zero, nada ya tuna fish smelling boomer. Major shorting can be inferred by 100 utilization leading up to Jan 31st and I estimate SI to be 150%ish. That’s important, read on.

The conditions make this an edge case in the market, we’ve seen edge cases before; crazy SI (GME), crazy low float + options (IronN3t) or a mix of both. Tutes can’t sell into retail’s rip because they got nothing to sell or short, so let’s make some money.

Business Combo Dumbo

The deSPAC is back. You might be smelling something like another favorite deSPAC from episode September that rhymed with Ironjet (ehhh?). That gem was born out of a high redemption, forgotten world of SPACs. Sound familiar to the current state of the world?

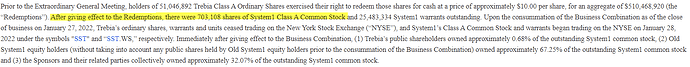

SST completed its SPAC business combination on 1/27. The ticker changed from TREB to SST. In the middle of this rebirth, 98.6% of the free float was redeemed leaving only 703,108 shares available. See the snipped from the super 8k (here):

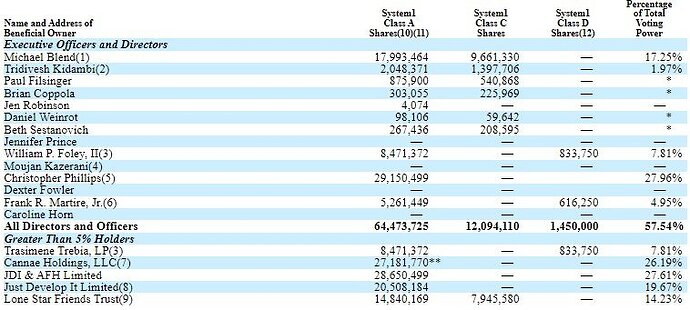

Now before you get your panties in a wod about $50mm of backstop investors, let’s point out those aren’t registered. Currently, the shares registered via the proxy of 64,530,520 were the original 51,750,000 TREB shares plus 14,625,000 original founder shares minus forfeited founder shares. Registering those shares typically takes 30-45 days which means end of February into March. Founder shares are subject to lock up. We gucci homies.

How about the heavy handed PIPE? My friends, we have none here. No PIPE boxing shares, no selling calls, and no PIPE rug pulling. They don’t exist in this deal.

For more fundamentals, and what this company actually does I defer to this bro (here). Not here for that right now, just know it’s not a shitco.

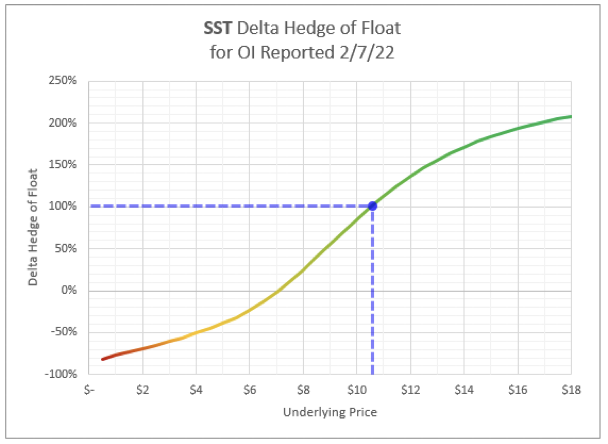

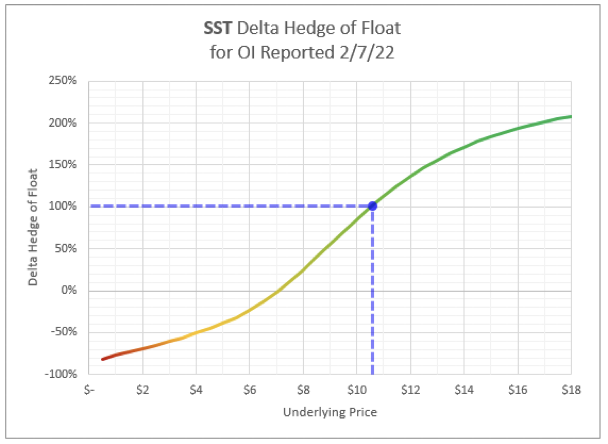

Calc-ul-us for Idiots

Let’s calculate option hedging using net delta dynamics as price changes; assume calls are long and puts are short. The amount of shares MMs hedge depends on IV and price action. So I simulate it and make fancy charts.

This rigorous calculation shows that 100% of the float is currently hedged in options at $10.60. Btw this stock probably shouldn’t have options. Anyway, things get crazy above this price where we see potential for 150% to 200% of free float. This is why there isn’t liquidity. The MMs are bag holding it.

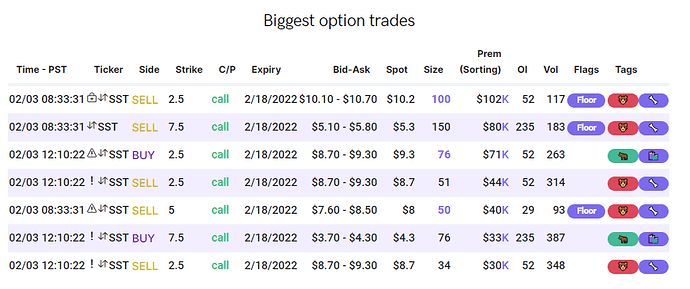

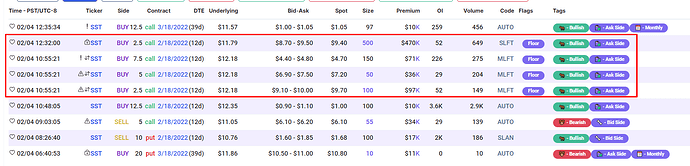

Options locking up the float is further corroborated by (1) most days 70% of volume is darkpool (2) deep ITM calls are being purchased in blocks end of day by MMs to reduce price impact. The timing of these deep itm purchases match the timing of other despac squeezes – eod.

Liquidity Flaccidity (that’s a real fucking word, can you believe it?)

SST slides across the chart on little volume. 3,000 to 4,000 volume can produce a 1-2% price move. Takes one person buying (65) $10 calls which, in the big picture, is nothing. Imagine how much this moves with option action like we’ve seen on other SPAC/deSPAC flavors.

Zoom out and we can see beyond the flat trading. Last week a falling wedge resulted in a big breakout. If we look at the current setup, we see the same.

We look for a double bottom followed by an upward break out. At that point, I think this can clear $14 and potentially higher. Not sure if it happens today or tomorrow but my crayons show the wedge is tightening.

Shorties got Hell to Pay

We’ll look at FINRA short data because it’s not a calculation. It hard data:

12/15/21 …. 153,000 …. 13% utilization

12/31/21 …. 554,000 …. 58% utilization

1/15/22 …. 733,000 …. 61% utilization

1/31/22 …. ? ? ? ? ? …. 98% utilization

Back in mid-January, shorts were the smartest traders in the room. Hammering the SI up to 100% of free float; leaving some juice in utilization (61%). Price clearly dropped after the NAV floor was removed.

Later in January though, price got squirrelly and jumped above $10. Shorts decided to double down and go for 100% utilization because stonks only go down. This stonk didn’t.

If the utilization was only 61% when 733,000 shorts were opened then how many shorts are there now with 100% utilization? I did some linear regression like a retarded magician and got something like 1.1mm shorts. If that’s true, we’re talking about 156% of float is shorted….

So why isn’t this on anyone’s radar? Cause Ortex sucks at float calculations and those numb nuts think the float is 75mm. Ortex doesn’t account for redemptions and lock ups. (Actually his name is James and he’s a really nice guy. James, please forgive me but it’s for the peeps).

Here’s where things get exciting. FINRA reports short data for 1/31/22 this Wednesday (2/9). The short data for the double dip to 100% utilization is posted. When that data exposes the shorts, we could see fireworks.

Wrap it up Buhler

We’ve got an optionable deSPAC in a corner of the market that tutes can’t and won’t touch. Meanwhile, shorts are underwater and out of ammunition and we estimate short interest to be near 150%. Grab another canister of kerosene, MMs have 100% of the float locked up in options delta hedging. With liquidity so low at 703,108 shares, retail can run the jewels.

Keep in mind, none of these punks thinks we’ll light the match. SPACs and deSPACs alike have been left for dead. Surprise mother fuckers, we’re back!

Positions: