Valhalla Trading

TheHouse

Stagflation leading to Recession - The Kodiak Bear Thesis

Tickers: SPY, QQQ, IWM, JETS, HYG, and AAL

Topics Covered: Structural and Cyclical Drivers, Eurodollar Futures, OIS Yield Curve Inversion, Housing Market, Crude Oil, Inflation, and Monetary Policy.

This is the sequel to my last DD. I realize that while the market and sentiment has moved in the direction of my original thesis posted on Feb 14th, there were things that were missing that I want to cover here. The disclaimer stays the same, this isnt financial advice, understand the risks and make your own trades. I also think it’s worth mentioning again that even if this thesis does not fall in line with what you believe, every good investor should still know the Bull and Bear case on a macro level.

My conviction remains high, I’m still learning as much as possible and through this process I have come to believe that the Federal Reserve does indeed have levers that directly affect the market, but big picture, they respond more to what the real economy is doing vs being the significant catalyst that drives it.

This is the way I’m thinking about this now. Even with years of accommodating monetary policy (Low rates and QE), we have a slowing economy. We are moving into a new phase where we still have a slowing rate of growth, but now we are taking away the accommodations due to inflationary pressures.

This is an important distinction, this means that even while we had the most ideal monetary policy circumstances for over a decade, our economy has been slowing down and now we are going to take away the accommodations. The reasons why we have a slowing economy is something that for the most part I missed in my last DD, because I only started diving into this recently.

So big picture, why is the economy slowing down? Let’s look at some economic drivers.

Structural Drivers: Demographics and Productivity. This is the real economy. Demographics is population growth and labor market participation, so how many people are actively contributing to the economy and how productive are they? These are structural drivers. Population growth has been slowing down in the US since the 1950’s and is projected to continue slowing down well into the next century. We are still seeing growth in our GDP but if you take out the covid dip and post covid boom, you are left with a slowing GDP since 1999.

Cyclical Drivers: These are drivers that sit on top of the real economy, but the biggest drivers are monetary policy and credit, which as you know go hand in hand. So how much credit does the private sector and thus the average American have access to? Outside of fiscal policy, credit is the real way money gets “printed”

There is only so much credit that we can grant the private sector, and only so much credit the average American can take on UNLESS productivity and real wages continue to grow at a faster pace.

Here’s the problem:

On a structural level, our market participation is sub optimal, and has been declining since the year 2000. Our workforce is generally getting older. Since 2011, 10,000 baby boomers turn 65 years old every single day in the US and this is projected to continue through 2030. The average baby boomer age for retirement is 61-65 years old. I think this played a bigger role in the post covid labor market squeeze than almost anything else. Headlines like to say that people are lazy and there are a bunch of people that would rather eat cheetos on the couch than work, but with a 3.8% unemployment rate I think it is far more likely there were a large group of workers that were 1-5 years away from retirement that enjoyed life at home during shutdown, so they decided to make it permanent. It’s much more convenient to vilify a younger group of workers than to admit we have structural issues at play. We have a shrinking workforce that isn’t as productive as we need them to be to keep the party going.

Then we get to the cyclical problems, we are simply at the end of the greatest debt cycle our country has ever seen. I could rant about the excessive American exceptionalism where everyone believes being rich is a birthright, and how that leads to over comfortability and entitlement. Or about our fiscal and monetary policy decisions from our country’s leaders that for the most part think kicking the can down the road and stealing the prosperity of future generations is doing a good job (both sides of the aisle btw), but to keep it Macro focused, let’s talk about a great perspective called the wealth illusion.

The wealth illusion basically says that because credit is easy and because credit stimulates the economy, businesses and people alike perceive to be in better financial shape than they really are, they are more comfortable taking on more credit. We see this in housing, businesses, over leverage in the stock market, consumer debt, student loans, etc.

This works extremely well until it doesn’t. You get into a scenario where people have equity in their homes, and they are making “more” money so they feel like they are doing good, and that sentiment and access to credit makes them feel like they can afford more than they can. This was also magnified when we sent out 2 trillion dollars in stimulus checks. I remember being dumbfounded when people were using those checks as downpayments on cars, RV’s, and 4 wheelers. (I live in Idaho, so this is what I saw) but this is a great example of the problem at hand. I also saw someone post in TF that there was a new “home equity credit card” scary stuff. This is the wealth illusion, and I would argue that it has been going on since the 80’s, but extremely magnified now.

Eventually what happens is cyclical growth creates bubbles and inflation and the chickens come home to roost because Cyclical growth isn’t sustainable. I believe that is where we are at now.

Real wages in America are going down, while all asset classes are inflating. Real wages is the median household income minus inflation. So the cost of goods are going up faster than the average American’s income. This means that everytime housing, food, and energy increases in price, the everyday Americans discretionary income goes down, and without as easy access to credit this problem quickly spins out of control. Less discretionary income means less demand on everything except what people need to survive. That is the main reason you will hear people talk about gas prices, housing prices, and food prices so much, you can decide not to buy the latest iphone or take the trip to Hawaii, but you have to put food on the table and a roof over your head.

This is why raising interest rates is such a delicate game. Take housing for instance. It doesn’t matter where you live, home prices increased double digits last year alone. Everytime interest rates go up that means monthly mortgage payments on a new mortgage go up too. Meaning that every time rates go up there are less people that can afford to be in the housing market, and eventually prices have to come down, and keep in mind home mortgage rates crossed 4% last week. I think we are already seeing this,I find it very telling that home inventories remain at all time lows, but median home prices are cooling off.

So if we have significant Secular and Cyclical headwinds in a slowing economy, why isnt the equities market running for the hills? I believe it is 3 things:

1: Geopolitical tensions- What is happening in Ukraine absolutely affects the markets, not just sentiment, but actual supply chain challenges, global finance risks, Commodity surges, etc. But I do believe that the market, mainly retail investors believe that the bear trend we are seeing would resolve if it ended tomorrow. But keep in mind the indexes were already falling since the beginning of the year, way before Putin was amassing troops on the border.

2: Jerome Powell and the Federal Reserve- J Pow has a great gift of putting the markets at ease when he talks, he speaks calmly and answers questions with confidence. However all it takes is looking at the what the data shows vs what J Pow says, and what action his team takes to see that there is either a great deal of deception or incompetence, or possibly both. It is interesting that last week they decide to raise interest rates 25bp and say everything is under control, then a few trading days later today, he is whistling to a different tune and sounding much more hawkish. The problem is the equities market HAS taken him at his word. When he says the economy is strong, and that they are going to tackle inflation through raising interest rates and starting QT, but there is nothing to worry about, it is taken as a sign of relief, and it fits most peoples cognitive bias, so most people leave it at that.

3: Euphoria- This last Bull run was one for the record books, it is hard to think about a significant market correction or crash when things have been going so well for so long. It has been long enough that a significant amount of retail traders and even professional traders havent ever actually seen a market crash or correction, so they downplay the likelihood dramatically. It also comes to no surprise that the last few weeks large order outflows have outpaced large order inflows. This tells me that wallstreet is unloading on retail investors that are programmed to “buy the dip”

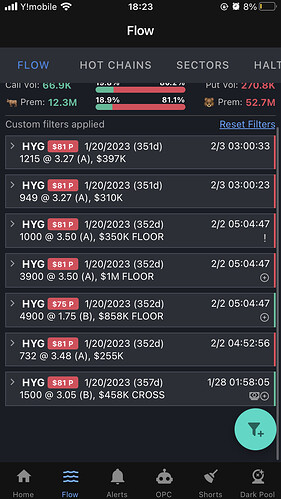

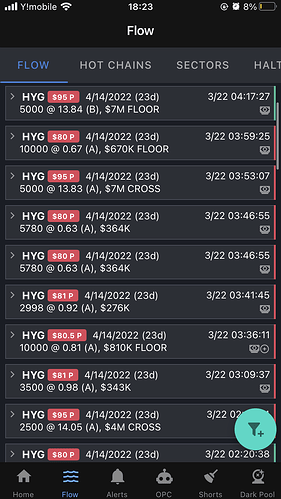

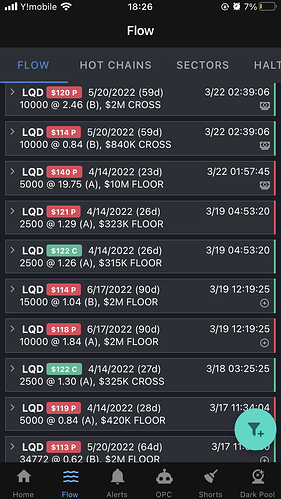

So who is ahead of this and bracing for impact?

The Bond market.

The Bond market is generally known as the “smart money” this isnt just the boring part of your 401k your advisor has a fiduciary responsibility to tell you to have a little exposure to. This is the big money. Global wealth, Fixed income, massive pensions, mega endowments, even governments of other countries. And the Bond market has been giving us signals since last year.

Part 2, 3/22/22

If you are not familiar with the bond market, just think “credit” market, because that’s what it is, its a place to issue new credit and trade credit securities and products.

What helped me wrap my head around the bond market is to think of another stock market but instead of equities being traded they are trading credit (bonds), and they are betting on the same information that we are. These are actual BIG “fuck you” money institutions, trading in a 41 Trillion dollar market, the smartest men in the room most powerful men on earth type people, and everything that you read about or hear about, they are making trades too. So when these guys are betting that the stock market is going to feel massive pain, we should take notice, and the best way to do that is with the yield curve.

I think there is some confusion about the yield curve. From an equities perspective, it is used as an indicator. But I hear people talk about it like it’s more of a RSI or EMA type indicator, based on data alone.

Now keep in mind, the bond market does two main things, issues new bonds (think credit) and trades those bonds and other credit securities.

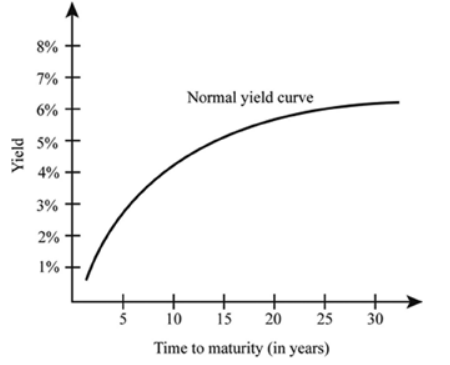

All the yield curve is, is actual bonds spread out at different maturities, and the actual yield you get from them plotted on a line graph.

Why is this important?

Let’s look at a few yield curves. (and I’ll explain how they are saying different things)

A normal yield curve is the bond market saying “We are happy with the economy and are comfortable investing in it”

Now when the curve steepens, this is the bond market saying “We are optimistic of the economy and see strong growth ahead”

Well how does it say that?

When you think yields, they move opposite of price (this threw me off for awhile)

So when the yields of long term bonds rise faster than the those of short term bonds

That means that long term bonds are underperforming short term bonds in price.

This is a flattening yield curve.

This is the bond market saying “We see slowing growth ahead”

But again, why?

This means yields of short term bonds are rising faster than those of long term bonds.

Again, yields and price move opposite of eachother.

So that means that long term bonds are outperforming short term bonds in price.

If you were a lender and are worried about the economy would you want a bunch of short term debt on your books? And if you did want to take that risk, would you demand a risk premium?

Of Course you would, that’s why in this scenario short term yields are rising faster

And very rarely do we see the curve become “Inverted”. This is the bond market saying “We see a recession or crisis ahead”

This means that short term yields are ACTUALLY higher than long term yields.

Let’s think about this another way, to prove how crazy it is. It would be like you going to the bank to invest money in a CD and leaving your money in a 3 year CD gave you a better interest rate than leaving it in a 10 year CD.

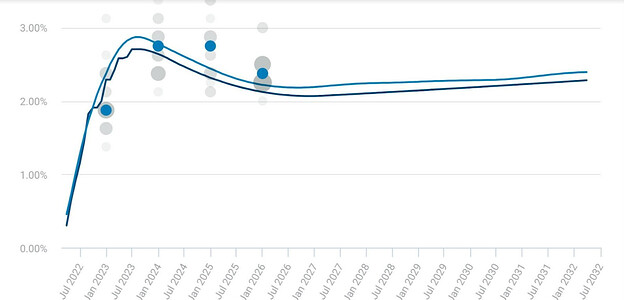

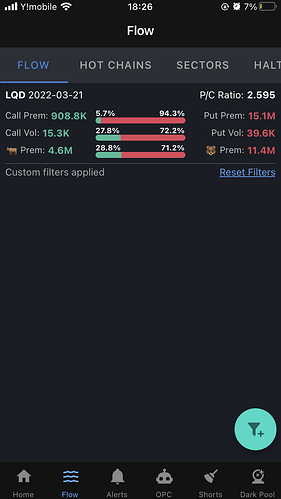

This is the current yield curve using SOFR or Secured Overnight Financing Rate (The closest thing to OIS without a Bloomberg Terminal)

Last time this yield curve inverted was in 2007.

Same story, Ill have to finish this in the next few days. Part 3 will be how monetary policy ties into this.