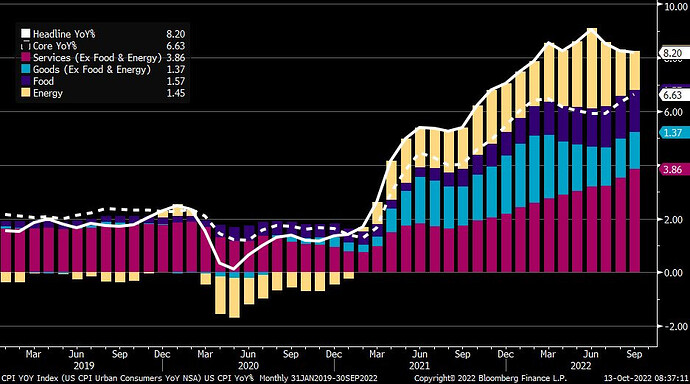

Parking this for future reference - both headline and core inflation came in hot.

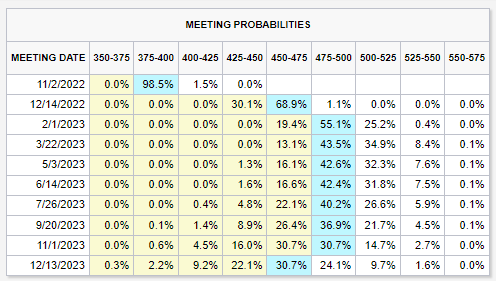

The bond markets almost immediately priced this in as “more pain”. From:

To a wholesale move of the entire curve by 25bps across the board:

Markets did the expected thing at first - sold off. But as a testament to how often the tail wags the dog, the market did the opposite as a result of positional flows. The details are not for discussion in this thread, but what we should note is that if we believe that: a) inflation was hotter than expected, and b) bonds priced this in right, then this move up makes little sense in the long term, and that we should be prepared for more downside because of this CPI print.

Now, if that happens or not depends on other things - Q3 earnings, Britain, Russia, etc. But in and of itself, the CPI print seems to have been interpreted as unequivocally bearish.