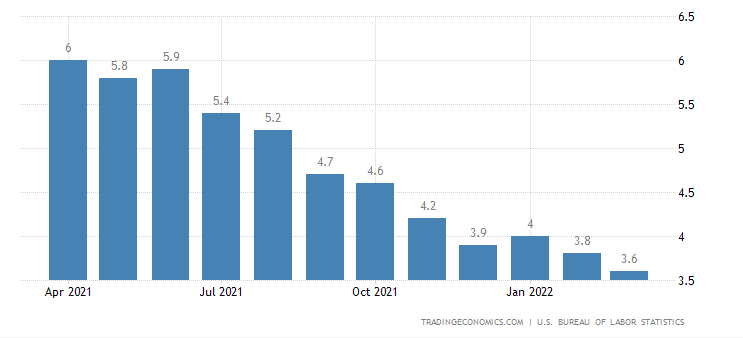

US posted low unemployment numbers which is a great sign of economic growth.

How does it relate to the overhead fears of recession?

One Reddit user provides this comment as insight. Seems interesting.

Comment pasted below:

Look at any chart overlaying unemployment rates vs. recession. Recessions always occur right after a low point in unemployment. Just because we’re hiring now, does not support the idea that future employment will be strong. Basically, a recession is the cause and high unemployment is the effect. You won’t see high unemployment until after the recession has started. I’ll give you a chart straight from Department of labor: https://www.bls.gov/spotlight/2012/recession/

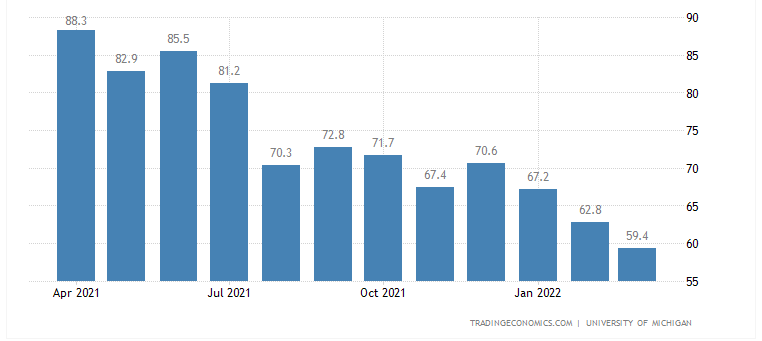

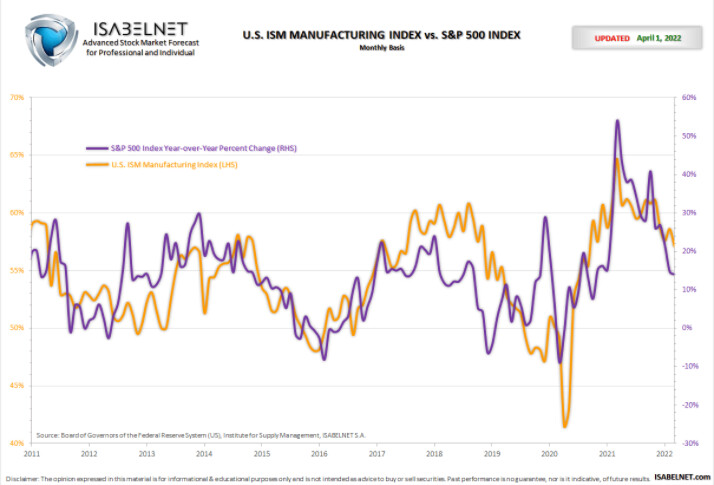

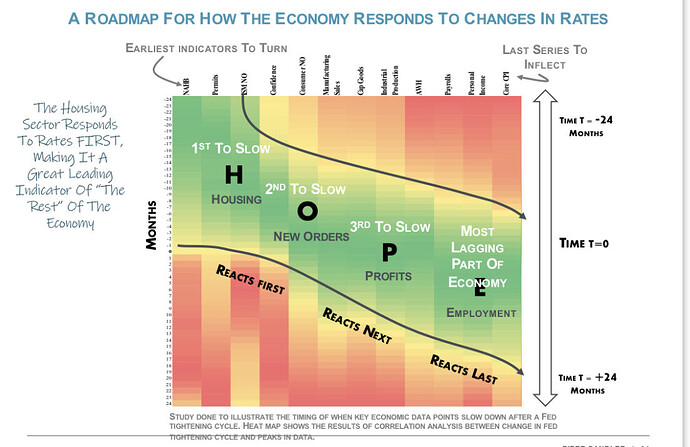

Recessions are predicated on a contracting economy, which usually occurs after strong growth (low unemployment). So just because we’re doing well now, doesn’t mean we wont be in the coming years. This is why the yield curve inverting is such a big deal. It in an indicator of the loss of confidence in the near term growth of the economy. If anything, a low unemployment reading with reduced consumer confidence in my mind suggests companies are hiring based on todays demand and not forecasting the drop in demand coming as prices soar and consumers spend less. If that happens (drop in demand) companies will have to lay off these recent hires and start a cascading effect. I think this is supported by the graph I attached, the unemployment reaches a low trough and then accelerates very quickly upward ultimately creating conditions conducive for a recession.

The readouts from China yesterday showed their economy is contracting. Ours is starting to show signs that it might contract. The EU is about to contract based on massive increases on energy costs in addition to rising inflation. Russia is obviously already in a manufactured recession. It means that we should exercise caution in the coming 18-36 months. It appears this will be a worldwide recession.