Started the day with a heavy strangle, that quickly moved to the bear side as calls got cut and I played the selling pressure, manually moving SL’s until closing bell. Holding my May 20th and June 17th strikes, mainly HYG with a few small positions in ARKK and CCL that have done well this week. And a few runners in the indexes.

Had a tough trading day earlier this week, was trying to trade while in and out of meetings and was reflected in my performance. 5K Loss. Ouch. Learned a valuable lesson there. Regrouped and had a nice recovery and closed the month with a trading P&L% of 178%.

A few thoughts heading into next week.

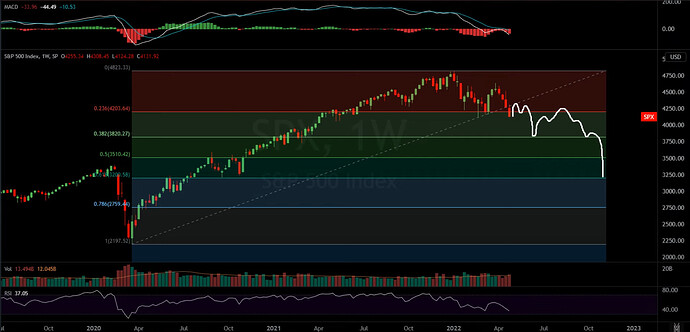

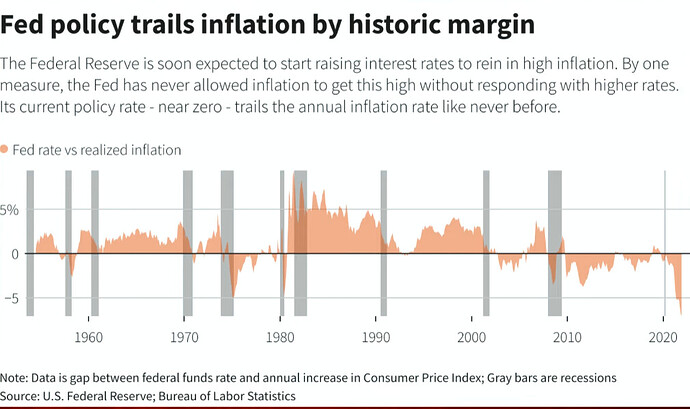

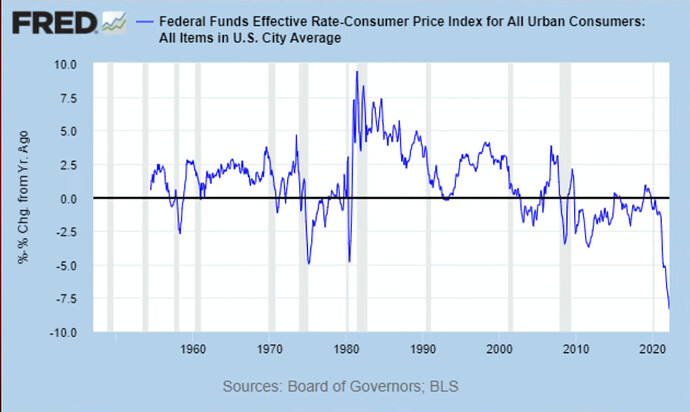

We have FOMC meeting on Wednesday. This one is interesting, I’m expecting like everyone else we get a 50bps hike to Fed funds rate. Now, before today I would have thought that this news would be seen as short term bullish because that is what is expected. However, I believe we are starting to see some weakness to the euphoria the equities market has grown used to. This psychological paradigm shift is important. Too much negative sentiment and “Buy the dip” turns into “sell the rip”. Couple that with less liquidity and I’m expecting volatility and big swings both directions. Key Key support for SPY sits at 410, I think we test this soon, and if and when it breaks, brace for impact. Until then, be prepared to play both sides. Bear market rallies and massive swings are to be expected, nothing wrong with making money on both sides.

Trading Strategy and Useful Indicators

With the help of members of this great community, I have continued to try to optimize my trading strategy. For scalping and swings, I have had success starting the day 50-75% cash, looking for early key support/resistance (Thanks JB and Rexxar) and opening a strangle. After trend confirms, cut most of the losing side, and watch for the next support/resistance line to take profits or reposition. losing trades cut early for small loss, while winners run with manual trailing SL.

HYG

This has not only been my 2nd best ticker trading this year, its also turned into a great indicator. I always watch the movement of HYG throughout the day. This again is junk bonds, it moves like a cruise ship, not like a jet ski, so less violent swings. This gives an advantage imo because if SPY’s volatility or algos moves SPY up while HYG stays flat or red, I’m more confident that SPY will pull back closer to HYG. Or if spy knifes but HYG doesn’t follow, Im more inclined to think spy is oversold. There are select days where they dont move together, but those are rare, and as @Kevin pointed out, historically SPY & HYG are highly correlated.

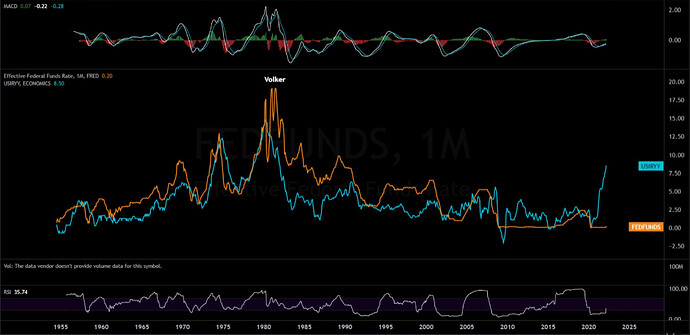

Treasuries

I track the full yield curve premarket every day, Im looking at treasuries and SOFR swap rates, but in webull I keep these up on my main watchlist so I can easily glance at it throughout the day. Its not 100%, but if you see these green and daily % 5yr is higher than 30yr, more times than not the market is red.

Unusual Whales

I track this periodically throughout the day. I like setting a 150-250K filter, taking out the major indexes and see what pops up, if there are a significant amount of trades in that range I will move the filter up to 500k-1mill. I don’t necessarily trade based on UW, but I do think the info is valuable and I take it into consideration when thinking about what the market is doing next.

Large order Inflows/Outflows

I check this throughout the day also, but mainly on large advances or declines. super simple through webull. This gives you an idea of what the big players are doing during in the day and current week. So on a large green day, are they selling? On a large red day, are they buying?

This is Apple this week below.

Meme stocks

I watch meme stocks as a temperature gauge on retail investors sentiment.

I mainly watch this on green days, if meme stocks are rallying across the board during an overall market green day, while none of the actual companies have any bullish news, AND low volume, more times than not it is a relief rally.

I don’t think any of these indicators are significant alone, but together they help me paint a better overall picture of what the market is potentially doing. They may seem very basic to some, but I have sure found a lot of value using them together and wanted to share as it may add value to someone else.

Hope everyone has a great weekend