Hey bud, I’ve only been testing spreads since December–and only on the Buy side, not sell (yet).

Here are some pointers one might benefit from, based on my short experience:

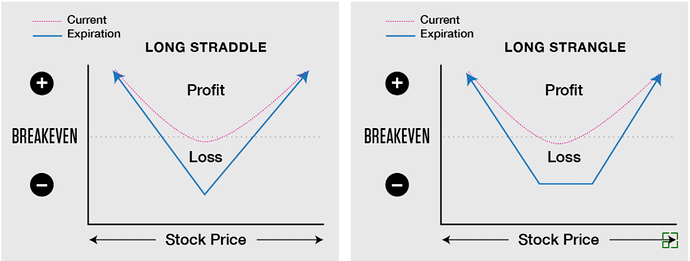

A) You are on track about it benefitting from volatility from both sides, so that’s what you want to watch out for.

Look for Low Volatility days and time frames to enter on your chosen tickers.

Each have varying factors like price, sentiment, market ranking and/or funds listings, news and events.

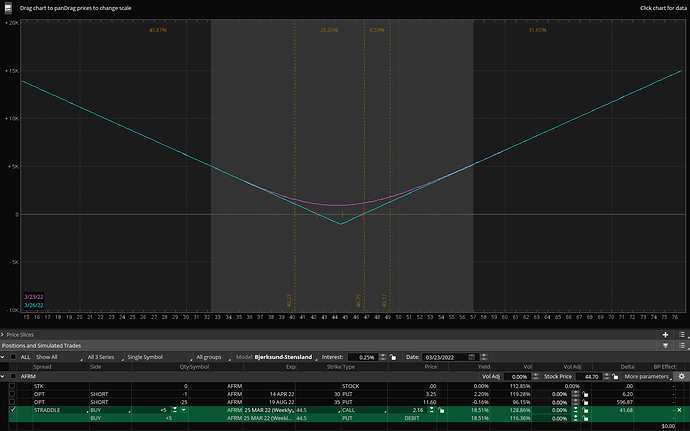

B) You want to follow 1 ticker at a time. For me it was AMC that I tracked and tested first, then it was the EV tickers.

It takes time to mark high and low premiums in my mind, so it took me a while for each ticker.

You’re probably better so it can be faster for you, but take notes.

C) Strangle strat is very specific–it doesn’t benefit every play.

You’ll have to compare it with Straddles, Vertical spreads, and other spreads.

Every spread strat will require a lot of testing.

D) You will also need to match the strats to your emotions.

Basic, I know. But what helps me now is the discipline I’ve been training myself with.

I see gains, I exit before the day ends–unless I see more volatility ahead and other stuff that I mentioned above.

E) Specific to Strangles now, I find it really useful for plays that I need legs Near or ATM.

Straddles are more for OTM and with even greater volatility.

For example today with AMC, I pick strangles since imho, AMC won’t be jumping past 25 yet.

I only know TradeStation that has an Options paper trading feature.

They require one to deposit $500 to a Live trading account, before you’re given access to the Options paper trading.

And there are details about it that’s best discussed on another thread, but you might want to look into that for testing, before you go live with spreads.

Others should jump in here soon now. Have fun!

Since going live with spreads, it’s proven to be the most consistent profitable approach for my trades.

It might work for you too, but again, you’ll have to test it first.