It’s been a hectic week full of ups and downs and life stuff so today will be a novel. I appreciate anyone who sits down to read this one!

The market, as many of us are aware, was all sorts of problematic for anyone trying to pick a direction and I had personally had some great success and some stupid blunders that largely resulted in a loss on the week. These are all learning experiences, though, and is part of the reason I keep my account small. I’ve had the benefit of only seriously trading in a post-COVID inflated market landscape, so these are all experiences I intend to have, screw up terribly, and then learn from.

But lets get into it!

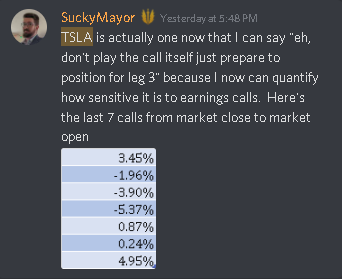

This week I said to myself “I’m going to play 3/5 of FAANG because they’re all up” so I was looking to Google, Facebook and Amazon this week in that order. Understanding that I’m trying to be a better trader and getting less thrills from gambles that go my way, I’m trying to stay away from playing the earnings calls as much especially if I haven’t done DD on them and have no reason to believe that they’re going to move +/-10% overnight.

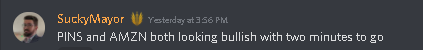

With that said I’m still making calls for y’all, lots of people get value out of it and I hope I’ve gotten some of you out of potentially devastating positions as a result.

[size=4]The Trading Floor Callouts[/size]

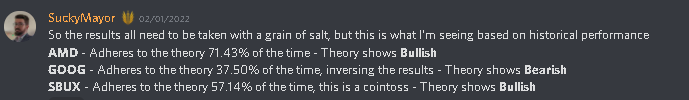

Tuesday, February 1st

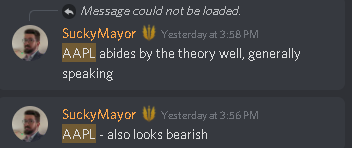

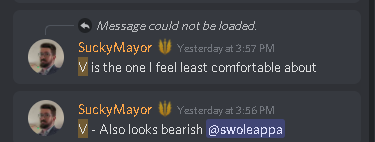

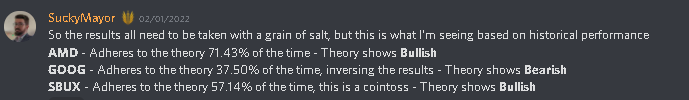

- Starbucks - Called that it looked bullish but also was a “Who the hell knows what this thing is going to do.” I consider this a failure because even though it shot up to $99.15 in response to the buyback, it did technically open lower

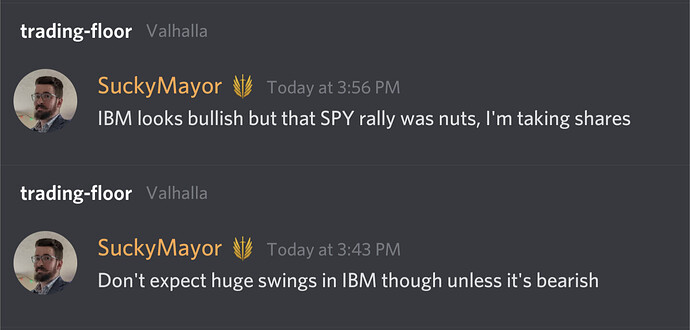

- AMD - Called that this looked bullish and was pretty confident in it, the stock opened at $130.00 and then bled for the entire day (I also played the next day quite poorly, will get into that later. This was a success on the theory.

- Google - Called that this looked bearish even though I really didn’t want it to be. This was not the case, it ended up being bullish but then it bled all of the next day because of a shelf offering. This was a failure on the theory.

Wednesday, February 2

All eyes were on social media on Wednesday and boy did they screw the pooch.

- Facebook/Meta - I called this one as bearish as well and this killed everything. I would have loved to have been wrong here, but unfortunately the market reeled the next day as a result of poor forecasting and missed earnings.

- Qualcomm - I called this one as bearish and it was, so it’s technically a success for the theory. However they weren’t bearish because they had bad earnings, it appears to have been in sympathy with the Facebook devastation that was happening right next door. I recognized pretty quickly after earnings that they had pretty good earnings and that this would present an interesting opportunity to play the next day.

Thursday, February 3

I really only had intentions of looking at Amazon and hoping for the best, but @macromicrodick did ask if I could look at PINS as well so I included that in my chart watching for the day.

- Amazon - I called this as bullish and it was, I also saw a nice pullback happening in the premarket this morning and I knew I wanted to get in on this hyper-expensive premium stock and also made a good win here.

- Pinterest - I called this as bullish and it was, and we also saw great performance by Snapchat. Both of these two were beaten down on the day because of Facebook’s performance, and I know quite a few people played the call. Kudos to all who profited and shame on me for sitting this one out.

[size=4]My Moves This Week[/size]

Quick recap - I started the week with $833.74.

I had a super not-exciting week start to the week. The tickers I played this week included:

- SENS for funsies

- AMD

- QCOM

- AMZN

- RCL

SENS

This one needs the least amount of explanation. We’re building to an FDA approval and while I am not an FDA/Pharma expert I can recognize momentum when I see it. I picked up a single $3 February Call on Tuesday morning and sat on it until Friday when I sold it to go stupid into Amazon.

| Ticker |

Type |

Quantity |

Buy |

Sell |

Profit |

| SENS |

$3 Call |

1 |

$0.19 |

$0.40 |

[color=#00FF00]$21.00[/color] |

AMD

Oh AMD. You enabled me to screw myself super hard this week. I felt wildly confident walking into this play and during it I was doing all of the right things. Except submitting my orders. When I failed to

I opened (3) $130Cs and very very stupidly took a completely unnecessary loss on 2 of them.

| Ticker |

Type |

Quantity |

Buy |

Sell |

Profit |

| AMD |

$130C |

1 |

$1.27 |

$1.90 |

[color=#00FF00]$63.00[/color] |

| AMD |

$130C |

2 |

$1.27 |

$0.05 |

[color=#FF0000]-$244.00[/color] |

So I ended my first actual trading day down $181, really hurting my returns last week and entering day two with $652.74.

QCOM

Redemption play! QCOM had great earnings but got a bad response because of the FB nonsense, so I figured there would be a good opportunity to play a corrective wave. I jumped into $200 calls on Thursday morning and got them at an average cost $0.60 per contract. I only grabbed two because I got burned going overzealous into AMD, but was able to get out of both at $1.20, a full 100% return.

| Ticker |

Type |

Quantity |

Buy |

Sell |

Profit |

| QCOM |

$200C |

2 |

$0.60 |

$1.20 |

[color=#00FF00]$120.00[/color] |

This helped offset my dumb loss on AMD, putting my balance at $772.74.

AMZN

This is where I took my SENS gains from earlier, putting my balance back up to $793.74.

Amazon was the one I was looking forward to the most. Their call was on a Thursday night, killing IV going into a Friday morning and setting up a potentially very profitable play this morning. Again still reeling from my dumb AMD move I opted to buy a single 3300C contract at $0.61knowing that it probably wouldn’t go ITM. I was able to get out of it when the premium had nearly doubled to $1.21, securing a profit of $60.00.

| Ticker |

Type |

Quantity |

Buy |

Sell |

Profit |

| AMZN |

$3300C |

1 |

$0.60 |

$1.21 |

[color=#00FF00]$61.00[/color] |

And this is the exact point I should have stopped trading. I was up to $854.74, which would have been a total profit of 2.5% on the week - not too shabby and certainly admirable enough, but…

RCL

I went stupid again. I bought $79C for RCL thinking I saw a cup and handle forming but instead it was a fake out after a double top. While these were cheap, $0.10 per contract, I did buy 5 of them and they surely lost all value. I actually paid an additional $50.00 to roll these options to next week, so I lost $50.00 on this play. That put my weekly total to $804.74, or a total realized loss of [color=#FF0000]3.5%[/color] on the week.

[size=4]What Did I Learn This Week?[/size]

I am actually really good at strategizing what to play when it comes to these earnings. What I need to learn is to stop overextending myself and trying to do things that aren’t a part of that strategy. This means that some days I will not trade at all, and that’s okay. I also need to recognize when I’m actually too busy to make a play that I want to, as this is what happened with AMD - I got busy and made a mistake. Next week will also likely be very boring for me as I’m going to be very busy and I need to recognize this up front.