Hey everyone. Wanted to share my thoughts on the upcoming earnings report for Sysco (SYY) on Tuesday 02/08/2022 before market open. For this earnings, I’m leaning heavily on the bullish side of this play.

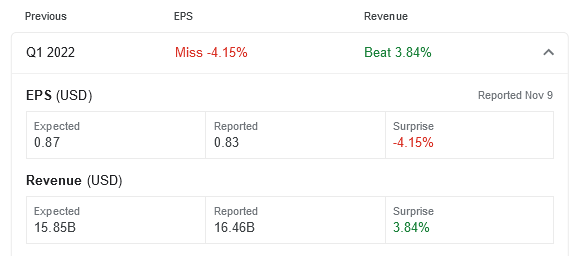

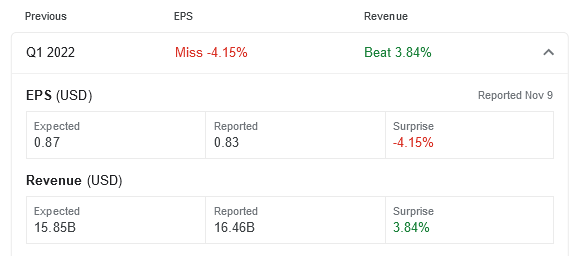

This upcoming earnings, Sysco has been given an EPS estimate of $0.70 and a revenue estimate of $15.88 billion. Sysco in their last earnings reported an EPS of $0.83, a $0.04 miss on their EPS estimate of $0.87. But they beat their revenue estimates of $15.85 billion by 3% reporting a total of $16.46 billion.

I think this go round, Sysco will beat on both EPS and revenue estimates. During the first quarter of fiscal 2022, the company acquired Greco and Sons, which is likely to have contributed to Sysco’s performance in the to-be-reported quarter.

The company has been encountering product cost inflation for a while now. On its first-quarter earnings report, Sysco noted that it was operating in a highly inflationary landscape. The company’s gross margin was hurt by the high inflation rate, which escalated to nearly 13%. Sysco also stated that it expects inflation to continue at a similar rate in the second quarter.

Inflationary issues though aren’t the only thing the company has to struggle with. They are a food distributor meaning they only sell what they can get their hands on from vendors. My wife works in the food service industry and deals with Sysco as her distributor. She has stated that she has at many times been given substitutions for multiple products, or simply just not received product at all due to supply shortage. Again this is at no fault of Sysco and more so on the vendor, but Sysco is feeling the sharp end of the stick as well. But by providing those substitutions for products consistently, it shows me that they have been working to navigate around shortages by utilizing more and more vendors. Also my wife’s account she works for kinda has the mindset of pay whatever is costs, and I feel multiple other large clients of Sysco share a similar mentality. So even if inflation is high, they are a still making sales as usual just potentially not as profitable as before.

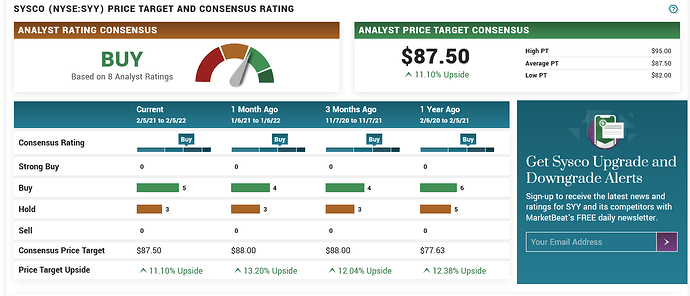

Sysco also has a high “buy” rating by analysts with a consensus PT of $87.50.

OI for $80 and $85 calls for Feb 18th looks pretty decent so will probably be playing those strikes myself.

I do not currently hold any positions in SYY. This is not financial advice. Please do your own research.

3 Likes

Overall, I agree with your sentiment and ultimately believe that Sysco will show promising guidance even if they do not beat EPS estimates. Net profit is still something that they’re challenged with, but are actively improving.

For context, I was a supply chain manager for a $1B regional foodservice brand with several hundred locations during 2020 and 2021 in which we were a customer of several distributors including Sysco. Sysco covered roughly 30% of our network and there were several challenges we had as a customer that made it apparent that Sysco had leverage in the market with current conditions:

-

Proprietary SKU count - Sysco is a broadline distributor that specializes in servicing customer needs through stocking of customer-contracted SKUs (Proprietary to the brands) as well as Sysco-branded stock products which significantly higher product cost and margin to the restaurants. As Sysco and other distributors have analyzed their portfolio of customers, they’re putting pressure on customers to limit proprietary SKU counts and leverage more heavily the Sysco-branded and stocked items. This was a significant challenge for our brand, but because of the pressure from other distributors to rationalize SKUs, there’s less risk of them losing customers from this activity and will ultimately drive them to be more profitable.

-

Customer Rationalization - Overall, Sysco has been actively evaluating customer business for profitability, including our own, and was taking a more aggressive stance to service customers that met stronger profitability. This was largely being done in combination with the reduction of proprietary SKUs as well as more sales of Sysco-substituted items and moving customers into Sysco-procured item contracts. There is a general fear in the food service world around distributor performance and while most brands are not happy with distributor performance, there has been a notable shift in the balance of power for distributors over customers that are allowing them to be more selective in which customers they keep or rationalize. This largely will play into increased profitability for them over this QTR.

Finally, on @Ridn2lo ‘s point on food substitutions: I believe this isn’t calming down for at least another 12 months. In my experience, it is a supply-driven challenge that is affecting both customers’ proprietary SKUs as well as Sysco’s own products; however, I’m slightly biased in believing that Sysco was not maintaining healthy stock of our proprietary SKUs to continue to pressure customers to provide their higher-priced substitutions on restaurants under the guise of supply-driven challenges.

I overall do not have a super positive view on Sysco from a customer’s perspective, but I take an objective approach to say that they’re likely going to see improving positive yields against their activities from last QTR and are likely to shine against expectations.

TLDR: I believe calls are the right play here and I’m looking for entry on Monday, and do not feel like $85 strike would be out of reach.

3 Likes

Looks like we were right about them beating rev guidance, but EPS guidance missed expectations despite becoming more profitable and capturing market share. The right play on this was to purchase $85C yesterday around 10:25am and sell by EOD for 200%+ gains.

2 Likes

Made out pretty decent on a couple of 02/18 $80 calls I was able to grab this morning as I noticed it start to creep up. Monday most definitely would have been the better day to play though.

1 Like