Here’s my trading journal for my $1K to $1M challenge that I started today 2/7/21. I forgot to make the transfer before the weekend and did so in a hurry that I accidentally started the challenge with $1,000.60 as I’m using an old account that had a balance of $.80 cents in it on TD. Anyways here’s a recap of my trades for the day, some wins and some losses along with a few holds overnight that are TBD exactly how they’ll pan out. Will try to update daily but as some know I have six kids and another job that can be pretty demanding at times so may have to do some bulk updates as time permits. I’ve been here since September and this place has taught me so much and I think my reflections in my trading journal are going to teach me a lot more and hope they also help some of you. If there’s something else I should include below or would be helpful please let me know.

A little background, I do most of my research at night and in the morning when the rest of my house is sleeping, most trading I do in on my phone in the car or while I’m at work.

Bought 50 shares of SENS @ $3.45 and sold at $3.63 for a quick $9 profit as several people on TF were taking profit and I got in early on this one for a quick swing. I had been watching SENS and decided to switch to options so I grabbed 5 4/14 - 4’s for .60 an flipped them pretty quick for .72 profit. Lots of discussion on TF made me confident in quick entry/exits on this one as well.

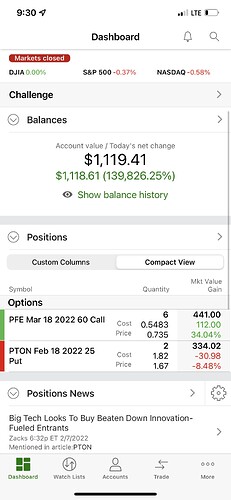

I’ve been trading PFE for quite some time and have done very well on it mainly due to the DD and several callouts on the server, it took a dip this morning a day before PM ER and I was confident in the DD that it would have a little run-up today so I grabbed some 3/18 60’s for .55 to hold for IV spike or through ER as I feel like PFE is going to come in with a big surprise and great guidance. Will update this hold O/N as I also added one more call today at .54. Currently sitting at 6 calls with a cost basis of .5483 and closing price of .735 so they are 34% green and even if it dumps post ER they have time to come back being March monthlies.

I also decided to grab a DIS call this morning for ER run-up on Wednesday and this one didn’t play out so well, I bought it pretty early and it was a 3/18 160 for 1.85. At this time I had way too many balls in the air and DIS was dipping with the market. Also trading in my bigger account still and was flipping SPY but it took a lot of my focus so I got out at 1.67 and took a quick loss as I’m not confident in DIS ER after some ER plays last week and DIS being multi-faceted so too much of a gamble and didn’t want to take a bigger L. Hindsight is they were March expiry’s and I probably could have held. Current option closing price is 1.74. I was overtrading here as it was a good one brought up this morning and I like DIS in general so I FOMO’d in for a quick call and didn’t pick a good entry either. This is old trading habits I’m working on getting rid of.

Final trade of the day was PTON Put after the price run-up due to buy-out rumors over the weekend. I traded these in my other account early in the day with success and decided to try again, this time I grabbed a 2/18 25 for 2.00 and then PTON started running to 30 again so I averaged down and grabbed another for 1.65. I’m a bit concerned about this position as there’s some retail sentiment I feel driving this price action but also think ER will be horrible tomorrow AH so it should tank anyways. Currently sitting with both calls O/N at an average cost of 1.82 and price is 1.67. Will most likely cut these at green tomorrow unless sentiment and media calm down on these BO rumors.

First day keeping a log and my biggest reflection is stop trying to overtrade and focus on a few at a time that I know well. PFE I’ve been successful with for three month’s and was confident the dip this morning was just that and it worked out so far. More updates to come tomorrow but overall a win in my book for day 1.

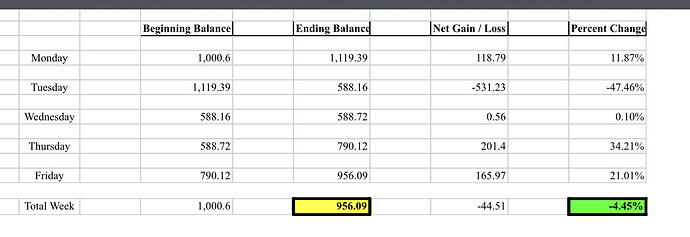

Starting Balance - $1,000.60

Ending Balance - $1,119.41

Day Profit - $118.81 / 11.87%

Data from screen shot includes transfer in this morning so included photo of that for reference as well.

3 Likes

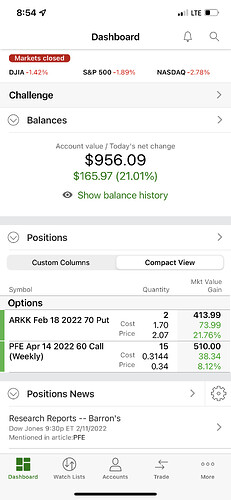

So yesterday wasn’t a great day for me but I know it’s important to reflect back on what I could have changed, below are how my positions played out with PFE and PTON (neither had ER that worked in favor of my positions). My biggest takeaway from the last two weeks is I need to stop playing ER so far and especially holding through them, I’ve given up a lot of recent gains on these plays and have learned that my logic doesn’t always align with the logic in the market for valuations (i.e. Tesla).

PFE - sold my calls yesterday morning for a pretty good loss but didn’t see PFE coming back to 60’s by March as I think it’ll take some time so felt it was better to redeploy this capital. Ended up selling the contracts I owend for .55 each for .16 each. I can do better at holding these long dated calls for a bit of a spike back up and need to work on this.

PTON - the CEO step-down which from face value I took as bearish yesterday morning then spent some time watching the stock hit bottom and bounce up and I quickly realized the market is going to take this as positive news which it did. I cut these at open for .51 each.

SENS - I redeployed the balance of this account into SENS on the dip yesterday morning, didn’t time it perfectly but am currently holding several of the April $4 calls for a decent cost basis of .58 and are showing about 10% green this morning.

My current account balance is $588.16 or a -47.46% day.

My plan for today is to hold/watch these SENS calls, if we run up a bit I may cut a few and reposition into something else but am being cautious with CPI numbers being released tomorrow. If I see a decent lift in these SENS calls today I may sell all of them before close and carry cash into tomorrow before I reposition.

My other main trading account got hit but yesterday but not as significant with the PTON and PFE ER’s, I was able to almost get back to green for the day swinging spy calls/puts between the Bollinger’s. Busy week with my two kids and three step kids back at home for Mon/Tues along with some meetings at work this week I can’t be quite as active to find another play so my plan today for my main account is going to be swinging spy as it continues to be very good to me with quick 5-20% gains. This big pre-market green has me a little cautious and I’ll be watching the big players and how they are moving along with spy.

Biggest lessons for the week - stop over trading on good days, let the cash hang out overnight. Stop holding through ER’s!

Will post updated pics/account balances at EOW.

2 Likes

I used to play as many ER calls as I could because about 10% of them end up being very profitable. But hitting on 10% and missing on 90% most of the time is breakeven at best. The IV crush will murder your positions almost every time even if it moves in the right direction, but the next day after earnings there are usually opportunities to make a quick 5-20 minute scalp for significantly less premium.

It’s a hard lesson especially after seeing SNAP and FB have such wild earnings reactions, but I’m happy to see you came to that realization!

I’ve accepted that I don’t have skills in earnings or at least not yet so it’s something I definitely need to spend more time on, definitely going to look at some post ER scalps in the near future! Thanks for all your market close ER callouts as well and all the time you’ve put into that system, they’ve been extremely helpful and something I’ve been trying to follow and help as I learn more on direction post-ER. Same as spac’s I’m just going to stay away from the hot stove other than some quick scalps for the time being and build on some of the other trades that I’m having success with.

Not a lot of activity in my challenge account today, got thrown off by the market direction this morning and was scalping spy heavily at open in my bigger trading account which I had great success. Full disclosure that account has a much larger balance and is the one that’s feeding my early retirement passive investment funds which I’ve built up nicely since finding Valhalla and will get a lot of my attention until this account builds in value. I ended up selling all my SENS calls today for a good profit near the top which felt good after my PFE and PTON plays that didn’t work out so well.

As we got to late morning I was uncertain what to play but my highest conviction play was a spy dump into close and a drop at some point over the next few days whether that’s at open tomorrow or into the weekend. I ended up grabbing a monthly 450 put when we approached 457 today as it felt like there was some good resistance there yet SPY gave us the surprise with the end of day run-up. I’m still feeling confident at some point we’re going to see a dip back towards 450 or lower so I decided to average down at what I thought was once again the peak of the day for SPY and feel like I got it somewhat close. I grabbed another spy put near end of day for next Wednesday and tried to maximize the remaining funds in my account but gave myself some time with a 2/11 447 which is more OTM than I would like and should have played something shorter but closer to the money in retrospect. I feel as though CPI is going to come in strong tomorrow and isn’t necessarily priced in so I’ll be able to exit this position but SPY definitely threw me for a bit of a loop this afternoon so TBD on tomorrow.

My current positions are listed below, I’m a bit red on them but plan to exit at some point tomorrow on a good dip depending how things are looking. I also have time with these so depending on overall sentiment/news and movement I may hold them a bit longer than tomorrow but they’ll most likely by EOD. Plan to dig into several of the great forum DD posted today and spread into a few of those positions tomorrow with calls on that same dip.

1 - SPY 2/11 - 447 - .65 cost / .485 price

2 - SPY 2/18 - 450’s - 2.80 cost / 2.65 price

Cash - $9.22

For the day I was up .56 cents or .1% which is at least green.

1 Like

Today was a great day, my CPI bet on SPY with puts played to my favor and I took green at open on all my positions I held overnight. Sold my 447 for 1.25 and my 450’s for 4.70 and 4.42. My wife was sick this morning so I was on baby duty as the other five kids were with their other parents and spy seemed to be bounce pretty hard off low 450’s and didn’t want to take a chance of CPI being priced in with how crazy it’s been as of late. When SPY turned around and I thought it was headed up for the day I grabbed some DKNG calls and a bigger position in my other portfolio along with a longer FB call (which I don’t feel great about but may hold through the weekend so I can get out green), retrospect it was a big position for my challenge portfolio but wanted to get into something that wasn’t going to require day to day attention since I’ve been working on my spy scalps with continued success in my larger cash portfolio as I’m flagged/restricted in this account which I had forgotten about until I was scalping on Monday when I began. I averaged up on my DKNG calls because SPY was running/looked like it was back to going up and I didn’t have many funds left but believe in the forum DD and increased attention around Super Bowl along with ER run-up. I finished things out with a PFE call because I think it’s oversold from ER right before the fed announcement of turning up the heat on rate hikes. I had a big overall portfolio gain today but things look choppy ahead so I’m going to watch the market, down pretty big on my new positions today but up overall from the day before in account value with the big spy gains this morning. In retrospect I probably should have taken more time today to see market direction before jumping into another position but I have some longer calls so there’s plenty of time, another reason this portfolio is good for me is it’s forcing me to slow down and let some trades come to fruition before panic selling on a dip. The problem is I just like to trade but with my long term goals/plan I need to get better at letting trading plays actually play out.

I also wanted to summarize some spy scalps I did in my other portfolio today, it was an exciting opening where I scalped spy calls after taking some quick positions in FB, AFRM, DKNG on the opening run this morning. All forum DD (AFRM I was late to the party and got out in time…another reminder of how I need to stay away from these ER plays). I was conservative and took 10-20% profit on all of them but still extremely happy with how they panned out and I’m realizing how easy spy is to follow (knowing I will lose on a play here and there but positions are typically 1-2K and small compared to my overall). I’m planning to share my percentage gains in that portfolio here weekly so I can reflect back on things and also share my journey with everyone here. Overnight I’m carrying 98% cash with a small PFE and DKNG position that has lots of time so I’ll probably average those down tomorrow. or early next week if anything. It was a busy day for me so I didn’t get to spend much time on TF like the rest of this week as the other job has been busy and family life. This account I intentionally took below $25K after ESSC 2.0 and usually kept it just over so I slowed down my trading as I’ve learned many times in the past a bigger account balance for me just makes stupid decisions and I want to slow down before I get back to making bigger plays with some consistency as there’s money to be made in this market regardless of direction.

So grateful for this place and hope someone finds a few nuggets in this that help them trade better and make some more money. I’m also going to start sharing some of my thoughts for tomorrow and positions I’m planning to play, most things I find are in the forum and I try to add where I can as time permits. I feel like SPY is going to be red tomorrow so planning to scalp puts at open but will evaluate when I wake up. I’m intrigued by GGPI for super bowl exposure, LFLY de-spac (not sure I’m ready for this yet), CHPT leaps per DD as a smaller play in trading account to start holding things longer, BRCC may enter puts but not sure. Going to monitor DKNG, PFE, FB and may add to current positions if I see bottom on SPY that’s clear.

1 - SPY 2/11 - 447 - .65 cost / .485 price - sold for 1.25

2 - SPY 2/18 - 450’s - 2.80 cost / 2.65 price - sold for 4.70 and 4.42

Cash - $9.22

Beginning Balance Today - $588.72

Ending Balance Today - $790.12

Current Positions

DKNG - 3/18 30’s - 5 - .904 cost / .675 current price

FB - 3/18 250 - 1 - 5.40 cost / 4.07 current price

PFE - 4/14 60 - 1 - .33 cost / .305 current price

Cash - $14.62

I have some work to do but thinking overall SPY is going to bounce up in the next week or so and felt good about the headway I made today but same as every day in this crazy market I learned a lot! Thanks everyone who takes the time to read my ramble, hopefully it helps someone!

Another good day in the market, my quick recap below. I didn’t like how the market looked this morning or the emergency fed meeting scheduled for Monday so I decided to cut the open positions I had this morning, I sold DKNG too early and took a small loss as I wasn’t prepared for it to run like it did. I didn’t like the direction of FB at open or such a large/slow position tied up in it so I also cut that for a pretty good loss to free up the funds for faster plays (the impatience in me). I added to my PFE position and averaged down a little bit as it seemed to have strong support all day at $50.50 even with the market crashing and the FDA approval pushback. When Ukraine news heated up early afternoon I didn’t like the theta on a spy call (nor did I have the funds for a closer ITM call so I went with an ARKK put that expires next week as I feel we’re going to see some more red into Monday morning. I wish I could have sold when it hit 40%+ profit today but my account has already had the PDT removed once and I’m not adding capital to get to $25K, lesson learned is to not burn those up for a quick scalp but rather keep one in my back pocket for situations like today. Still up at close along with my PFE calls (not sure about the AH activity need to look into that).

Will try to post another update over the weekend but I was able to get my account almost back to $1,000 after the poor trading decisions early on, I’m hoping for some red Monday to turn flip my ARKK call for some good profit but theta is going to be ugly over the weekend. I’m hoping PFE continues to hold $50 but I think it’s going to be a wild week so I may get out at open when it runs usually. Positions and account history posted below. I learned a lot this week, most importantly that I have a lot to work on with my emotions and trading decisions. I have a pretty high risk tolerance on some of my trades but it’s what I’m comfortable with and makes me enjoy trading.

Overall my week was extremely successful as I was up 38% in my other trading portfolio which was quite a bit above my goal of 25% for the week, the trading restrictions in my challenge account are going to make this tough so I might need to look at changing it over to one that’s not restricted so at least I can day trade with settled cash but ended up at -4.45% for the week so things worked out better the end of the week for me.

Another great trading day after I quickly got out of both my positions this morning at open and even stayed green on ARKK (noticed over the weekend they have a big stake in RBLX which I didn’t realize when I bought versus SPY on Friday). Not sure how I managed that this morning but worked out ok. I got out of PFE at open as well, no good news and nothing on the horizon so I cut those calls early as well.

I was scalping SPY calls early this morning and did extremely well after an early entry and having to average down pretty quick following JB’s callouts and listening to VC but when SPY did it’s early dump I sold everything for very good gains. Scalped SPY on and off all morning in both accounts for some good gains. Got bored in the market early afternoon and started a position on SOFI which I averaged down all afternoon on and am holding ten calls overnight. Also got into XOM after some quick DD and Conq’s callouts as I’ve been following Fed and Russia pretty close and feel rates are going to go up and russia is going in so playing it that way and got confirmation after reading Conq’s summary on XOM tonight.

Here’s my final stats for the day.

Balance - $1,038.64

Day - +$82.55 / 8.63%

Overall - +$38.64 / 3.86%

Also wanted to share that I’ve been tracking my trading pretty closely (still learning) and since ESSC 2.0 things have improved greatly, currently up 126% in the four weeks since the last Tuesday/Opex week drop. This place has taught me so much and I’ve become a student again which feels good. Here’s my big lessons for today.

*start small position and average in (hopefully down but up if you have conviction and you should if you’re buying) - SPY at open, I kept averaging down and ended up w/ much larger position than intended but then it dumped and paid very well

*take profit even after a big knife and don’t be greedy thinking it’s going to keep dropping, they never go straight to zero…EVER - had to repeat this to myself with SPY drops today but I listened and made good money

*it feels good to go to bed every night at almost 100% cash - only trading positions are in my challenge account, main trading account is 100% cash

*keep taking profit

*need to watch my entries, especially when grabbing plays other than SPY for O/N holds because I don’t like to hold SPY overnight when there’s no clear direction

*keep learning

*just started book the lords of easy money - it’s good and makes me want to go 100% cash gang on everything - not doing it but learning a lot

Tomorrow I’m going to see what the news/sentiment is and scalp off it, I don’t think SPY has found bottom yet though just not sure how deep this trip red is going yet. Going to scalp and play accordingly but few if any overnight holds most likely again, too much going on that can push market one direction or the other.

Also some good stuff in TF tonight but missed some of it, lot’s of questions on relationships/marriage/financials. My only advice from personal experience is take it slow, there’s no rush, you start to figure yourself out in your 30’s. I have an incredible life but I didn’t start really figuring it out until 35.

Interesting day that didn’t start out that great as I made the mistake of getting to work before market open and had something come up at 8:28 that threw my routine off. Normally I trade from my car or home when the bell rings but home has been too distracting lately so changed up the schedule this morning and it didn’t work out so well. Should have told myself there will be plenty of plays for the day but got impatient and traded through most of my cash pretty quickly with very small gains in my main account.

I didn’t like the Ukraine news this morning or my XOM position after it bounced under $78 so I eventually cut it for a small loss (should have been patient as I could have broken out and made green) but the market on edge and unknown news I didn’t feel great about it anymore and spent some more time on it’s charts before open this morning and felt like it’s run-up quite a bit already. Remembered my conviction rule and cut it all for a small loss, put that into Sofi where I’m currently at 100% and feel even with a potential dip due to spy this week with FOMC and Russia there’s still plenty of time before ER and Upstart’s ER was promising. Not a fan of this Yolo strategy as it’s what I want to stay away from but I have conviction and have now been watching the stock and spending some more time on DD so I’m confident it’ll play out and get me back over my starting balance. Still a work in progress here.

My main account had a small gain, still at 3% for the day which is a little below my 5% goal but after 20%+ yesterday I’m almost over my goal for the week and it’s not even Wednesday.

Tomorrow I’ll try to scalp SPY and probably go deeper in Sofi in my main account, need to dig into some more stuff tonight but watching FOMC closely tomorrow. Need to work on not trading through all my cash so I can grab little plays that caught my attention for a scalp or a hold for a bit as I’ve now built this portfolio back up quite a bit and don’t need to use all my settled cash scalping spy every day.

Got a bit behind on this over the last couple weeks with work and family stuff but need to get back in this habit. Going to include my challenge/non-challenge for today. Continuing to learn A LOT!

SPY - 3/14 - $420’s - took a position yesterday morning and averaged down all day, was red at close but sold everything at open this morning. Cost basis was $3.42 / sold all for around $4-$4.10 at open

ZIM - 4/14 - $80’s - took a position on these this morning and had to quickly average down, cost basis ended up being around $1.30 and I sold them all into close around $1.75 - $1.80. Going to reposition into 3/18 strikes tomorrow and sell before EX date

WEAT - 3/18 - $11’s - I dumped all these this morning and it was a pretty big position after averaging down yesterday. Just didn’t feel good to me like I was being greedy so I got out pretty red at around .50 cent fills w/ .80 cent cost basis. This is one where I needed to cut and preserve the capital, I hate taking losses but felt it was necessary

NOV - 4/14 - $22’s - took a position on these yesterday when oil dumped, cost basis was $1.60 overall and I cut them all into close around $1.80. Trying to go all cash into the weekend and keep things as stress free as possible.

SLB - 4/14 - $45’s - still have a position here that I took yesterday as it just barely got to my cost basis of $2.41 into close, I’ll plan to average down and cut these tomorrow before the weekend

Takeaways from the last few weeks for me, these are the things I need to focus on and keep working on as they’ve helped me to continually make good money over the last couple months.

Scale into positions, stop taking positions at open and averaging down in the first hour. Patience!

Positive sizing to portfolio size - 10% rule

Averaging down - this is my magic sauce and has made me a much more profitable trader as of late

Being almost all cash keeps the stress from trading away, I do this because I enjoy it but also to find full financial freedom, I have a very stressful day job still and a big family. I need to continue to keep the stress out of my trading as much as possible

Below is my progress since I started, the challenge account being small doesn’t get a lot of my focus right now but I’m going to work on that, I was green before I got greedy on WEAT and need to get back there.

Main Trading Account +127% (29 days)

Challenge Account -12.7% (29 days)

Will work on getting more regular with my updates but may take some time off when I’m on spring break with the family starting late next week. Or if anything just spend less time trading and recharge a bit.

Quick update from yesterday, went into the weekend at almost 100% cash so I could spend some time focusing on the family. An ok day but got deep into SLB averaging down and cut it at break even before it broke through $43, lesson learned on this one not to get so deep on an average down and also be patient when something is attempting to break through as it most likely will run a bit after. Overall a very good week in both portfolio’s.

SPY 3/16 420 - scalped these in the morning for decent profit

ZIM 3/18 80 - scalped these for great profit, sold a few on the way to peak of day but sold most at the peak, will probably scalp again early next week before dividend payout

SLB 4/14 45 - averaged down a lot on these and ended up with way too much capital in this trade, could have made great gains but instead used up half my trading account to be even for the day

PFE 4/14 52.50 - scalped a few of these on the 50 break for a quick 10%

HUT 4/14 6 - scalped a few of these when it hit 5 and went to 5.15, quick 10-15%

Trying to play the IV ER spike from the forum with my change that was leftover from the day, only two positions I’m holding through the weekend.

FDX 3/18 250 - .66

DG 3/18 230 - .40

Main Trading Account

Day +5.10%

Week +29.08%

Since Beginning Challenge +135.85%

Challenge Account

Day +27.13% (All ZIM Calls)

Week -4.32%

Since Beginning Challenge +11.02%

I’ll be trading a bit less over the next few weeks as I take spring break with my family and focus on some work stuff but trying to stay on track with updating my trades daily. Need to work on position size overall in portfolio and be ok with a lot of cash available for trade. I find myself trying to find a home for this cash too often and overtrading. Major changes with the success of my portfolio and with both trading/challenge combined I haven’t had a red week in the last 7 weeks and an average overall gain of 29.49% weekly gain. I feel for everyone that got hurt on RSX this week and I learned some of my own lessons with WEAT. Love this community and everyone here, can’t wait to continue to improve my trading and continue to contribute more here.

1 Like

Working on limiting my plays for now especially with my overall bearish feel of the market, in my challenge account I stuck with a single SPY play and did ok on a 3/16 415 but didn’t like where spy was headed early in the day and thought things might be green so I sold it for a quick 4% gain on the day as I got in deeper on a few other positions in my trading account and needed to focus on them. Played ZIM calls early and missed the big run late in the morning as I got deeper than I wanted early and just wanted to get out with how the market has been. Did well on some PFE calls early with the China news and may play these again tomorrow. Also had a heavy SPY PUT position today that I made some good green on but wasn’t confident of the day being red so I took gains around 10-15% instead. No regrets, glad to hold cash overnight. Will be starting a longer Spy PUT play tomorrow and scalp as well. Need to work on keeping positions down as part of my total portfolio and not get in so deep early in the day.

Challenge Account +3.64%

Trading Account +8.15%

1 Like

Didn’t do as much trading today as I normally do, scalped some SPY puts early for a quick 10-15% gain in my main trading account and my challenge account. Started a position in KWEB and FXI as I feel China has some room to go down yet with covid cases, state of their economy, and Russia relations. Averaged down from my initial entry and continued to do this most of the morning. Finished the day red on these but hoping for a gap down in the morning so I can get out green or I’ll average down and hold for a few days if needed as I bought 4/14’s to give myself some time. Overall a small position in my portfolio and the only thing I’m holding overnight over than a SPY put for 3/18 that is extremely red right now in my challenge account but I’ll average down in the morning and get out later in the day tomorrow or hopefully Thursday. Position sizing and keeping cash for averaging down are key, should also remember not every day is red even in a bear market.

Main trades for the day - all puts

SPY 3/18 415’s

KWEB 4/14 20’s

FXI 4/14 24’s

Will be watching the market closely tomorrow, a lot going on with Biden/Ukraine/FOMC so it’s sure to be a volatile day and hoping we can all trade on the right side of it and make some money. Been busy with work as I’m heading out for spring break with the family Thursday, not sure how my trading will look the next few weeks as I want to focus on them but I’m sure I’ll be around a bit.

Challenge Account -18.18% (damn spy put)

Trading Account +2.32%