Overview

Atlassian is a software company that has benefited from the covid pump along with all the other tech/remote work companies. You may already be familiar with some of its SaaS solutions, such as JIRA, Confluence, and Bitbucket.

From May, its stock has more than doubled, topping out at 483 before dropping the past month. You may ask if this was from its latest earnings? Surprisingly it was NOT. In fact, TEAM increased ~10% the following day from their latest earnings. After reading the Q1/22 report, it did come out overall positive, but I noticed some concern that they discussed in their fiscal 2022 outlook. I’ll try and sum it up here:

- Cloud revenue will continue to increase, but data center and server revenue will be mixed.

- They’re stopping the sales of their Server Licenses to push Cloud and Data Center offerings.

- Gross and operating margin will decrease.

- Small share dilution (2%).

They do not paint a stellar picture for next year in my opinion. I’d love to see if anyone can also dig up some information regarding their subscription sales. Maybe compared to ClickUp?

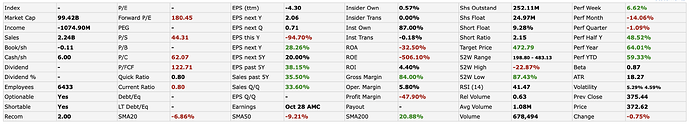

Not to mention, they benefit from high institutional ownership, ~86%. Overall analysts rate them high, see below, but could they start seeing competitors eat into their growth?

Their latest earnings report was in late October, I am really curious how the market would have reacted if they reported in December instead. In any case, their next earnings are late January (estimated Jan 26, 2022 - Jan 31, 2022). Not a direct comparison, but if you look at Asana they reported higher losses compared to last year and it tumbled 28% in early December, MF ASAN Ref.

What do they do?

Atlassian Corporation Plc is a holding company. The Company offers a range of team collaboration products. The Company offers products, including JIRA, Confluence, HipChat, Bitbucket and JIRA Service Desk, for software developers, information technology (IT) managers and knowledge workers. The Company offers JIRA for team planning and project management; Confluence for team content creation and sharing; HipChat for team real-time messaging and communications; Bitbucket for team code sharing and management, and JIRA Service Desk for team service and support applications. JIRA allows teams to organize their work into projects and customize dashboards for those projects to keep their teams aligned and on track. Confluence provides a system for organizing, sharing and securing content in spaces arranged by team, project, department and others. The Company also offers additional tools for software developers, such as FishEye, Clover, Crowd, Crucible, Bamboo and SourceTree.

How do they make money?

License or subscriptions to use their suite of tools.

Why are they important?

They are one of the largest and well known team based productively tools.

What are their products?

- Jira

- Confluence

- Hipchat / Stride

- Bitbucket / Bitbucket Server

- Bamboo

- Fisheye

- Crucible

- Trello

- Atlassian Marketplace

- Sourcetree

- Crowd

- Statuspage

- OpsGenie

- Jira Align

- Halp

- Mindville

Competitors:

- ClickUp

- monday.com (15.17B market camp)

- Github

- Trello

- Rally

- Asana (16.97B market camp)

- Pivotal Tracker

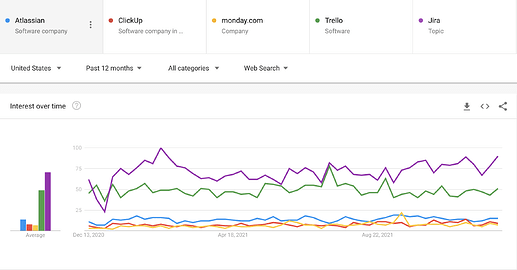

Google Trends

Trend is flat with Atlassian as a whole, but Trello and JIRA dominate.

Fundamentals

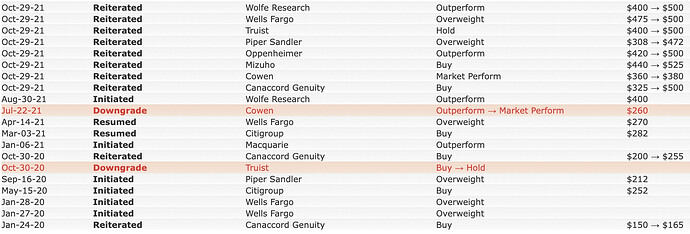

Analyst Ratings

Analysts have done nothing but rate this thing higher.

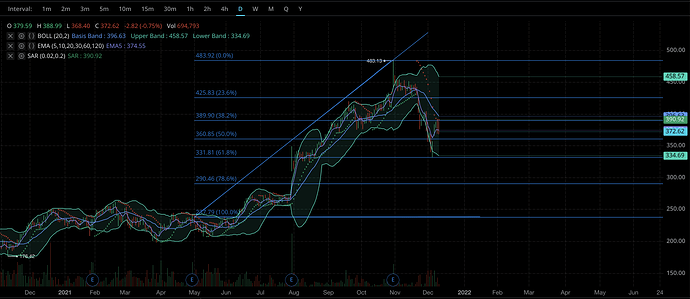

Technical Analysis

As I mentioned earlier, it peaked at the end of October and has been trending down. I’m surprised of how well the fibonacci retracement levels fit into the May to current day trends. I’ll be looking to see if it breaks through the 50% level or gets rejected and heads further down closer to the May 2021 price.

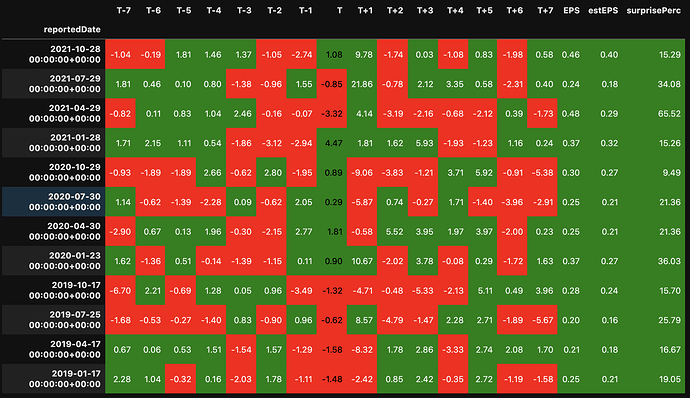

Earnings Heatmap

This is really not an earnings play, but worth looking to see how they have been performing in the past.

TLDR

Overall I’m bearish on TEAM in the short/medium term. From their last earnings report, they are already casting doubt if they will have as much growth as they had in 2021. As they transition to being a cloud only company, they may lose some clientele, and furthermore they face rising competition by new competitors which may continue to slow growth. They warn their margins will not be as good as they have been, which combined with a potential upset in growth, could really disappoint.

This is a longer term play, but will be looking if they continue to uptick again before I place any puts. I have no position currently, but would love to have any feedback. Consider this a Jira ticket for your next sprint.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing in this DD constitutes professional and/or financial advice, nor does any of this information constitute a comprehensive or complete statement of the matters discussed or the law relating thereto.

Reference Links

https://www.chartmill.com/stock/quote/TEAM/profile

https://finance.yahoo.com/quote/TEAM/key-statistics?p=TEAM