Options are in another column (Excercised) as far as I can read that. My standing is that no matter what the guy’s background is that compensation shows lack of responsibility considering the stage and progress of the project. This is just based on my personal experience. It’s a huge turn off for me but I hope people do well if they are invested in this.

Very interesting! Granted, the current gas boom could see them put the $2.5B to good use otherwise, but as you note, a couple of things line up for them to be a possible equity partner to TELL.

The terms of SOFR+235bps max also seem quite reasonable. And it is unsecured credit. Hope PNC knows what they are doing ![]()

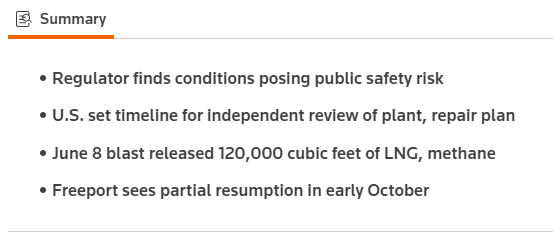

Incidentally, Freeport is not going to open even partially until October.

So until the FID, TELL will probably keep drifting down, along with gas prices.

Thanks for this. I have a TELL for October I think it is. It’s basically break even, but I guess I’ll cut it next week and just be patient. Natural Gas has had some pre-market pops and even some climbs at open, but it always seems like it bleeds down during the day.

Interesting comment on TELL:

Seems like UNG is up, too. TELL is probably moving in correlation.

The UNG bounce seems to be based on EIA data today that nat gas build was lower than expected - 60 bcf vs 73 bcf expectation.

Last week, the opposite had happened:

The Energy Information Administration (EIA) reported another larger-than-expected 82 Bcf injection into storage, confirming looser balances as a result of an explosion at the Freeport liquefied natural gas export terminal.

If build continues to be lower than expected into winter, and with exports resuming when Freeport opens, could make for decent spikes in nat gas into Q4.

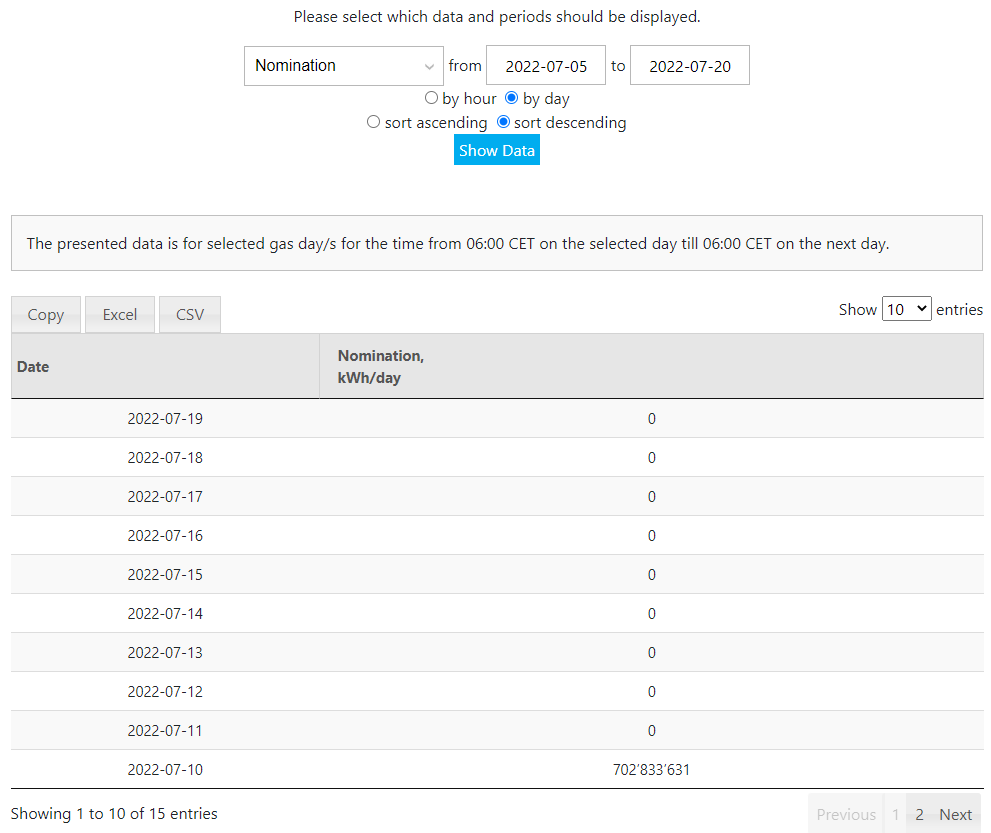

Tomorrow is the day when Nordstream is supposed to be turned on. Russia is playing cat and mouse with this, with us hearing both that gas will be turned back on, and that it will not. Multiple European politicians have warned their citizens to be prepared for gas not to be turned on. And of course, there are some say it might not be turned on to full capacity, which is neither here nor there. We can track the flow from this site:

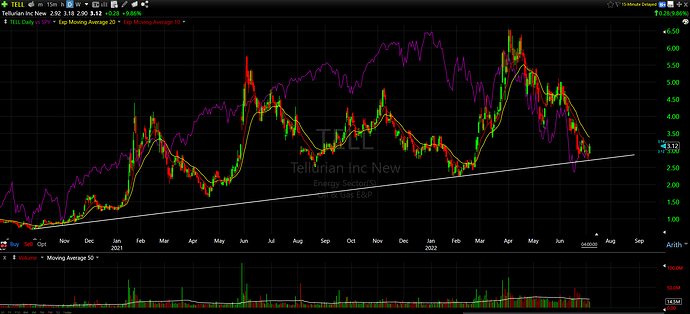

TELL continues to soldier on, both on this news and chatter that the FID is near. It bounced off of that support line very nicely, and I only have a few calls to enjoy it. Never ended up getting into commons. Their CEO Souki was apparently in Europe lining up deals, btw.

Over a three month period TELL is still lagging UNG. Also included EQT for comparison. The price action has also been helped by the rising price of natural gas, because of the high temperatures.

Play: Will reassess once we have definitive work on Nordstream.

Saw the news this morning that gas is flowing once again.

These 3Cs got limit sold at $1.25… one of the downsides of having standing orders, as TELL seems to be on a bit of a uptrend:

No news, likely on sympathy with natgas. Considering getting LEAPS-like options here though just to have a toe in the game. No sign of FID, but even without it, TELL seems to keep making incremental progress.

Tellurian Inc. (Tellurian or the Company) (NYSE American: TELL) today announced that, due to uncertain conditions in the high-yield market, it has withdrawn its proposed public offering of units consisting of 11.25% senior secured notes due 2027 and warrants to purchase shares of Tellurian common stock.

(Source)

They had even offered warrants as sweeteners on top of the high coupon, but looks like there just wasn’t enough interest.

This is a little odd as the are well placed to benefit from high natgas demand. The massive investments needed seem scarce though. Charif was recently in Europe trying to raise financing, but didn’t score.

Perhaps this provides another opportunity to get in when it reaches the trendline again.

Got it, looking for entry at 3.1

I think the postponing of funding is really the key factor here, investors are just bored of their constant “funding secured-we can get it anytime” news without real news and lack of progress in building… Once they really get it, it will probably jump quickly, but looks more like speculative long term stock play than options at this point.

For the sake of science (@bigglyoptionoligist ), sold CCs on TELL. Bought 300 commons at $2.97 and sold 10/7 (17DTE) calls for $0.23, so $2.74 net outlay.

There is a good chance this goes lower, in which case will probably get another lot once a bottom is found, and do CCs on those too.

Any advice or feedback on this would be much appreciated!

Read this and thought I would drop it in the thread for anyone interested. Apologies for the paywall.

Saw several news articles mentioning: Tellurian will seek equity partners to fund Driftwood LNG, CEO says

Stock has been bouncing back today.

TELL up 4.7% even though market took a dump. Looks like it’s playing on that trendline. 1D and 5min charts below.

Bad news for TELL. Shell and Vitol were Tellurian’s upstream partners. Suggests TELL doesn’t think Driftwood will move ahead anytime in the future. Especially with the very recent failure to secure debt funding.

On September 23, 2022, Tellurian Inc. (“Tellurian” or the “Company”) received a notice of termination from Shell NA LNG LLC (“Shell”) with respect to the LNG Sale and Purchase Agreements 1 and 2 between Driftwood LNG LLC and Shell, each dated as of July 29, 2021, as amended (the “Agreements”). The terms of the Agreements are summarized in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 29, 2021.

Also on September 23, 2022, the Company delivered a notice of termination to Vitol, Inc. (“Vitol”) regarding the LNG Sale and Purchase Agreement, dated as of June 2, 2021, by and between Driftwood LNG LLC and Vitol. The terms of that agreement are summarized in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on June 3, 2021.

(Source)

Price crashed to $1.50 from close to $3, and is now at ~$2.

Will have to see what to do about the CC above, which is very underwater at the moment.

Took the L, closed this out at $2.10 (-24%). Because of the spike in IV, the 3C lost relatively less value so I could have waited a bit longer, but then the underlying could have gone back down again.

Tell has fallen from $4 to $2 in the space of less than a week. The next step might be for them to stop work on Driftwood, which will make it go lower. And at this point, their only real option seems to be equity financing, which will make the price go lower still.

This seems like a dog for the short term.

The CEO is dynamic, they have an underlying natural gas business that is generating cashflow, and the macro natgas situation is going to be tight well into the future. Thus, not a total write-off yet, so will keep tracking.

https://finance.yahoo.com/news/tellurian-updates-financing-process-driftwood-181600124.html

Looks like there was a small pop shortly after this statement was released. I think they are committed to Driftwood and agree it would really hurt the price if DW was canned. This article pretty much reiterates what The Ni has said above. TELL hurt me yesterday and today as I’m relatively heavy into TELL (heavy by my standards). I have some puts I sold that are killing me but still have time on them and I’ve rolled them several times to lower cost basis. I have 5k shares at $3.92…ouch. Looks like I’ll be hanging on to them for a while and will need to look at selling some CC’s. But I’ve been kind of hesitant/scared to do anything at the moment.