thank you @rees for finding this play.

Disclaimer: High Risk as this is a Binary event for TGTX and the PDUFA date was previously extended to Dec 28th. Given the holidays we can see as well an decision before Christmas.

- TGTX is a biopharmaceutical company focused on the acquisition, development and commercialization of novel treatments for B-cell diseases.

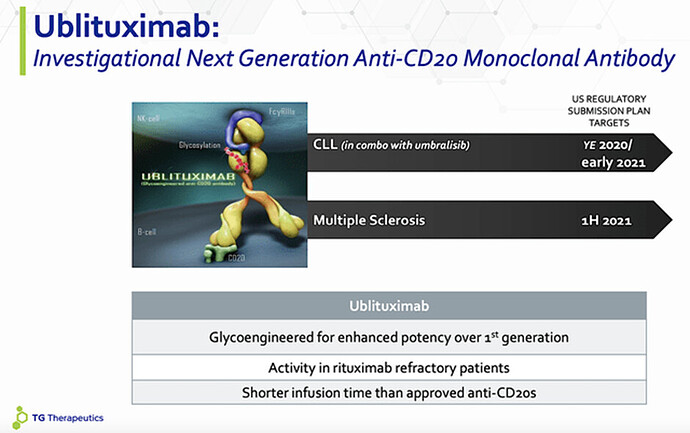

- In addition to a research pipeline including several investigational medicines, TGTX has completed a Phase 3 program for ublituximab, an investigational glycoengineered monoclonal antibody that targets a unique epitope on CD20-expressing B-cells, to treat patients with relapsing forms of multiple sclerosis (RMS)

- Cash, cash equivalents and investment securities were $197.7 million as of September 30, 2022. The Company believes its current cash, cash equivalents, investment securities and capital available under its debt facility on ublituximab’s approval will be sufficient to fund our planned operations into 2024.

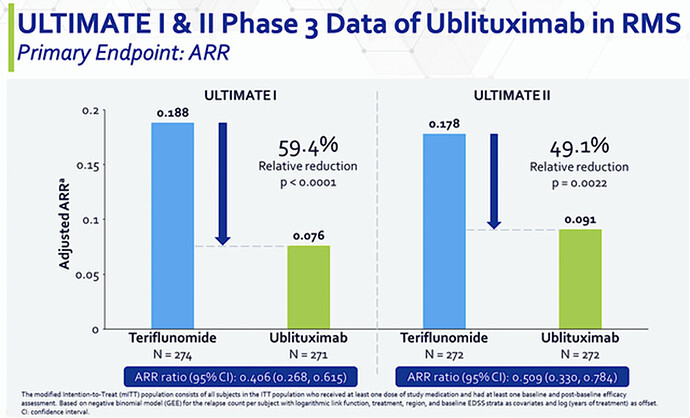

- Both trials met their primary endpoint with ublituximab treatment demonstrating a statistically significant reduction in annualized relapse rate (ARR) over a 96-week period compared to teriflunomide in patients with RMS.

From the figure below, you can see that Ubli trumped teriflunomide by 49.1% to 59.4% as it has superior reduction in annualized relapse rate (i.e., ARR). With both p-values all less than 0.05, you’d know the results are real rather than random occurrences. In the statistical and clinical sense, those results are statistically significant and clinically meaningful.

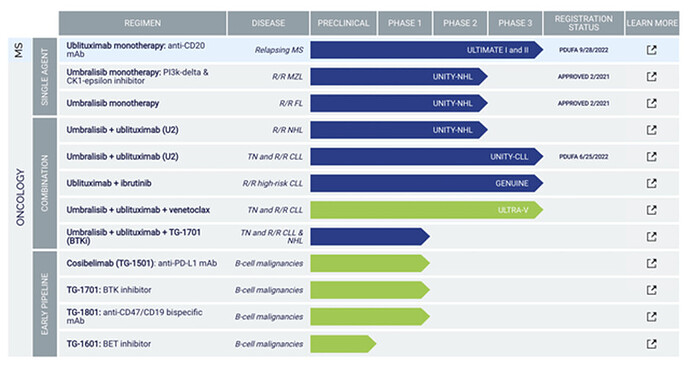

Pipeline of TGTX

Due to safety and efficacy concerns, TG pulled Umbra off the market for its approved indications marginal zone lymphoma (MZL) and follicular lymphoma (i.e., FL). The company also canceled their application of the U2 (Ubli plus Umbra) combo for chronic lymphocytic leukemia (CLL) and small lymphocytic lymphoma (SLL). So by now it should be clear why this is such a binary event.

About Multiple Sclerosis

Multiple sclerosis (MS) is a potentially disabling disease of the brain and spinal cord (central nervous system). In MS, the immune system attacks the protective sheath (myelin) that covers nerve fibers and causes communication problems between your brain and the rest of your body. Eventually, the disease can cause permanent damage or deterioration of the nerves. Signs and symptoms of MS vary widely and depend on the amount of nerve damage and which nerves are affected. Some people with severe MS may lose the ability to walk independently or at all, while others may experience long periods of remission without any new symptoms. There’s no cure for multiple sclerosis. However, treatments can help speed recovery from attacks, modify the course of the disease and manage symptoms. Multiple sclerosis - Symptoms and causes - Mayo Clinic

Ublituximab Mechanism of Action (MOA)

Ublituximab is an investigational glycoengineered monoclonal antibody that targets a unique epitope on CD20-expressing B-cells. When ublituximab binds to the B-cell it triggers a series of immunological reactions (including antibody-dependent cellular cytotoxicity [ADCC] and complement dependent cytotoxicity [CDC]), leading to destruction of the cell. Additionally, ublituximab is uniquely designed, to lack certain sugar molecules normally expressed on the antibody. Removal of these sugar molecules, a process called glycoengineering, has been shown to enhance the potency of ublituximab, especially the ADCC activity. Targeting CD20 using monoclonal antibodies has proven to be an important therapeutic approach for the management of B-cell malignancies and autoimmune disorders, both diseases driven by the abnormal growth or function of B-cells.

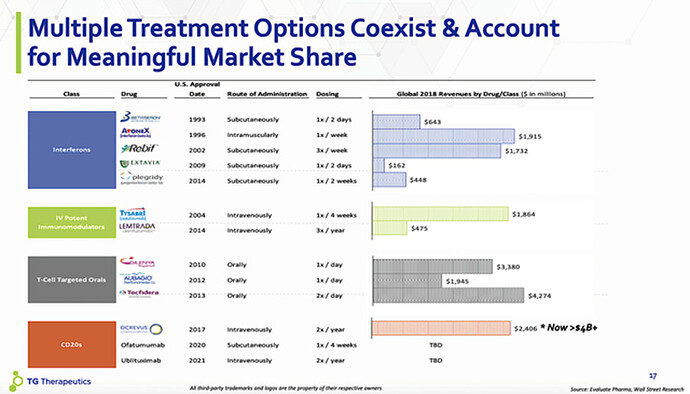

Multiple Sclerosis Market

By 2025, this global market is expected to grow to $30B

Position: TGTX JAN23 10C as Christmas Gamble