Please post here and continue to tag @dooknukem until he completes this thread.

I was at Target tonight. It was as busy as it usually is at 4PM on a Friday. There’s only ever one cashier on. Everyone else is filtered to the four self checkout registers. One of those self checkout registers never works. None of them can do cash payments or give cash back.

@dooknukem I would love your perspective on if you think Target is cutting costs by leaning heavily on their self checkout registers. What is the cost of an average cashier? Is my experience similar to others who shop at Target?

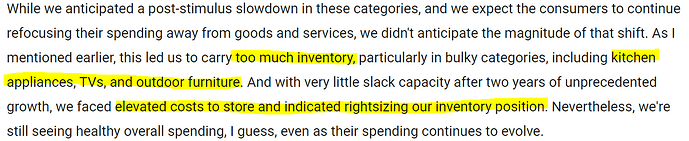

OK so! obviously Target had an awful q1 due to costs of merchandising transportation (insane fuel prices), the mass amounts of unbought inventory due to misreading customer/market dynamics, and what they were selling, was not reaching the shelves due to supply chain shortages.

First quarter operating income margin rate was 5.3 percent in 2022, compared with 9.8 percent in 2021. Targets EPS had fallen from $4.17 to 2.19.

Targets Q2 estimated EPS is $0.72

After a terrible q1, Target did announce that things may get worse before they get better. For instance, they announced that operating margin range will most likely fall more from 5.3 to around 2%. HOWEVER expects margins to start going back up in the backhalf of the year to around 6%

Target planned several actions in the second quarter, including additional markdowns, removing excess inventory and canceling orders. The action plan also includes the addition of incremental holding capacity near U.S. ports to add flexibility and speed in the portions of the supply chain most affected by external volatility; pricing actions to address the impact of unusually high transportation and fuel costs; and working with suppliers to shorten distances and lead times in the supply chain.

Additionally, the Company is further accelerating work that’s already in flight, including rapid revisions to sales forecasts, promotional plans and cost expectations by category. Specifically, the Company is planning for continued strength in frequency categories like Food & Beverage, Household Essentials and Beauty, and is planning more conservatively in discretionary categories like Home, where trends have changed rapidly since the beginning of the year. The Company is also pursuing aggressive options to control costs, including ongoing work with vendors to help offset inflationary pressures, driving continued operating efficiencies, and reducing costs while preserving a strong guest experience. Finally, the Company continues to build additional capacity in the Company’s upstream supply chain to support its future growth by adding five distribution centers over the next two fiscal years.

Target got ahead by letting investors know that earnings would be rough for the next quarter or so going forward. Writing off all that inventory, and working with new means of transportation and networking may help get their numbers back up higher than expected doing things like this, but I am still thinking that the market may see a bit of a drop in price in target this coming week, but think we may see a rebound relatively quickly.

Tuesdays Walmart earnings (pre market) will give us an idea of what’s to come.

If they were overly pessimistic about q2 in the q1 meeting then even a decent performance will mean alot for the reaction. Setting expectations low makes it easier to beat.

A couple things to just chime in with.

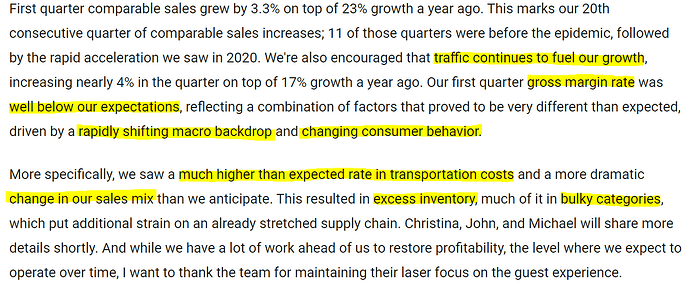

From the Q1 Earnings Call.

Q1 was hit hard from big increase in transportation costs and also inventory issues that resulted from the change in sales.

So the sales hit were to larger items and I would guess big ticket items. AFAIK, big ticket items usually have bigger profit margins. To help clear that inventory and all the storage that takes up they had to reduce prices and have discounts to move inventory.

Going on, Q2 would be in the brunt of the highest increase in costs of fuel/transportation.

The lingering inventory issues seems to be a pretty big factor, especially in the manner they stress the wide range of operating margin when they previously were guiding 8% for the year.

So guidance is down to more along the 6% line for the full year and working to get back to the 8% goal.

My concern is this. The product mix is shifting more towards “food and beverage, beauty and personal care, and household essentials”. In terms of food/bev and beauty/personal products, I would guess that such items and brands are highly price sensitive. With how consumer behavior is quickly changing, I would have concerns about how quickly they can pivot to accommodate the sales change.

Now with all of this being said, I do think that TGT did take a MASSIVE hit for their Q1 earnings. It also did take a big hit when the WMT news did drop.

I think that much of the negative news has already been “priced in”. I think that Q2 numbers will come in a bit bad but with better Q3 and rest of year guidance I think that would cancel out the bad numbers.

If I were a betting person I would think of a straddle but I would think macro factors are a pretty big player and I would really focus on WMT earnings to see how to play this.

Guys. The entire market has been running for the past two weeks.

Here’s how Target did for the three-month period ended July 30, compared with Refinitiv consensus estimates:

- Earnings per share: 39 cents vs. 72 cents expected

- Revenue: $26.04 billion vs. $26.04 billion expected

Target on Wednesday said its quarterly profit fell nearly 90% from a year ago, as the retailer followed through on its warning that steep markdowns on unwanted merchandise would weigh on its bottom line.

The big-box retailer missed Wall Street’s expectations by a wide margin, even after the company itself lowered guidance twice.

Yet the company reiterated its full-year forecast, saying it is now positioned for a rebound. It said it expects full-year revenue growth in the low- to mid-single digits. Target also said its operating margin rate will be in a range around 6% in the second half of the year. That would represent a jump from its operating margin rate of 1.2% in the second quarter.

Shares of Target fell about 3% in premarket trading.

Chief Financial Officer Michael Fiddelke defended Target’s aggressive inventory efforts. He said the retailer had to move swiftly, so it could clear the clutter, gear up for the holidays and navigate an economic backdrop clouded by inflation.

“If we hadn’t dealt with our excess inventory head on, we could have avoided some short-term pain on the profit line, but that would have hampered our longer-term potential,” he said. “While our quarterly profit took a meaningful step down, our future path is brighter.”

Inventory was still high, though: $15.32 billion at the end of the second quarter, compared with $15.08 billion at the end of the first.

But CEO Brian Cornell said it is a more favorable mix, as Target leans into high-frequency categories like food and household essentials along with popular categories like seasonal merchandise. It canceled more than $1.5 billion of orders for discretionary categories with lower demand.

Fiddelke said the inventory number is larger because of cost inflation and receiving inventory earlier to make sure Target is ready for the holidays.

In the second quarter, the company’s net income fell to $183 million, or 39 cents per share, from $1.82 billion, or $3.65 per share, a year earlier.

Total revenue rose to $26.04 billion from $25.16 billion a year ago, driven partially by higher prices due to inflation.

Quarterly profits got squeezed in many different ways. Sales of a lot of merchandise became less profitable as it got marked down. Freight, transportation and shipping costs rose, as fuel prices increased. And the company had to add headcount and cover more compensation in distribution centers as it dealt with a glut of extra stuff.

Copypasta from:

You got this one right homie, congrats.

Adding for learning purposes, the expected move on TGT from the market was ±7.8% - with the move of just under -3%, no put options were profitable from yesterday into today.

This topic was automatically closed 14 days after the last reply. New replies are no longer allowed.