ZScalar (ZS)

ZScalar seems too hot to short. It has a massive 50x price/sales ratio, based on a projected growth rate of 40% for the next five years. Started my analysis with ZS since they seemed most bloated, and therefore more likely to be susceptible to correction. However, I have not been able to find any data points that suggest any obvious weakness.

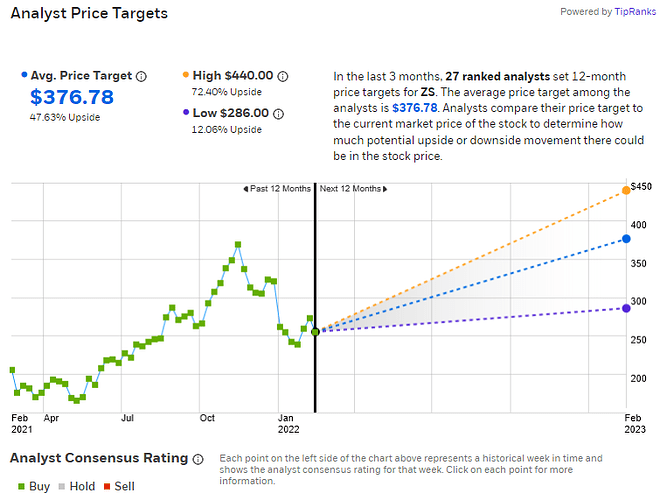

Analyst PTs all have upside, with their faith in the revenue growth relying on large contracts coming in for them.

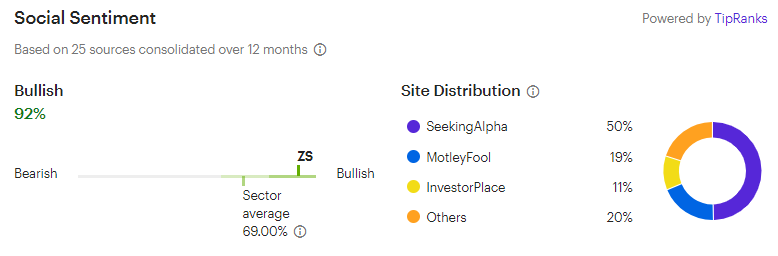

Tipranks sentiment is very bullish.

The SA thought pieces can be found here: https://seekingalpha.com/symbol/ZS

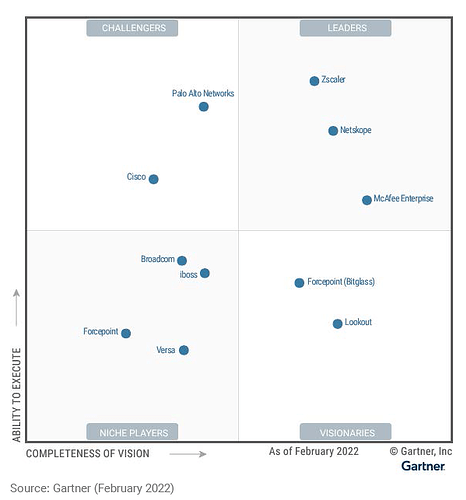

And Gartner confirmed their status as a market segment leader in Feb 2022.

Now, analyst PTs, sentiment etc. all lag actual news/data, but all this is to say that there doesn’t seem to be anything here that makes this an obvious short.

ZS will have to be their own undoing. If the forward guidance fails to confirm the 40%-over-5-years expectation, this stock will crater so hard. I’ll therefore wait until their earnings, and react accordingly.

[Edit 2/22 - please continue discussions on ZS here: ZS - 40% growth over 5 yrs = 50x P/S? Guidance is all]