What with interest rates going up, the market has taken a chainsaw to the stock prices of overvalued tech companies. This earnings season has been brutal, with many losing 15-30% of their market cap overnight with earnings releases. We’re about half way through, but perhaps there are some still left that will be sheared down to size with earnings and guidance.

This thread is an attempt to identify some of those stocks, to short in some manner.

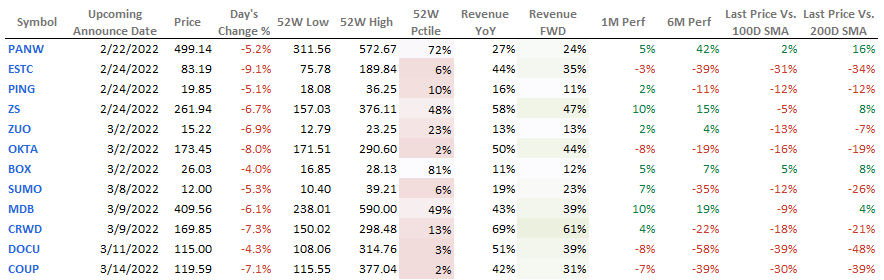

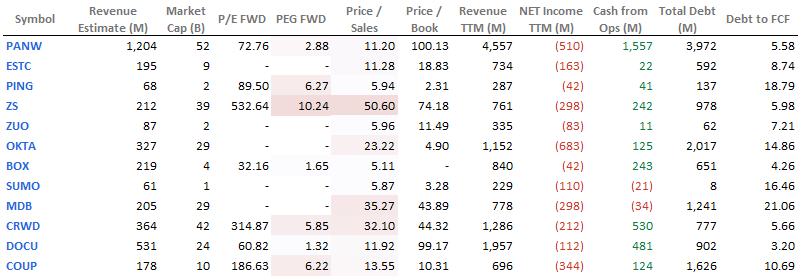

This is the shortlist I’ll be working with: BOX, COUP, CRWD, DOCU, ESTC, MDB, OKTA, PANW, PING, SUMO, ZS, ZUO

They were chosen because most of these apply to them: a) they have a market cap in the billions, b) their revenue is in the tens or hundreds of millions, and c) they have negative net income in the order of tens or hundreds of millions.

(Data from SeekingAlpha data tables; sorted by earnings date.)

I will be collating brief DDs for each of these over the weekend, but wanted to share this list now so that anyone who knows these companies well can pitch in already. I have at least passing familiarity with all of them, not an expert by any measure. A crowd-sourced short-list would therefore be great.

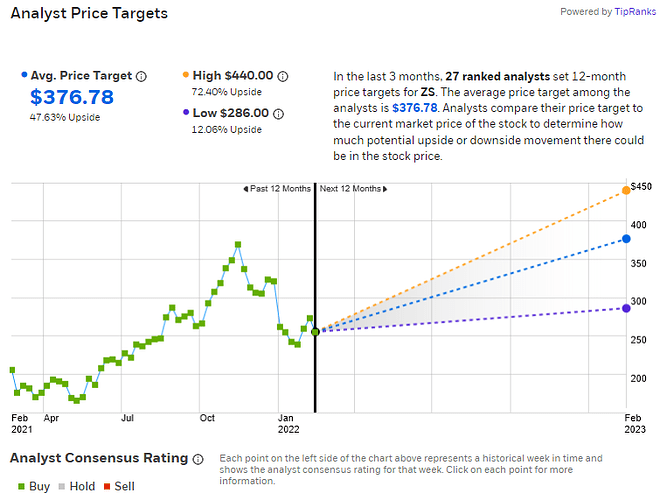

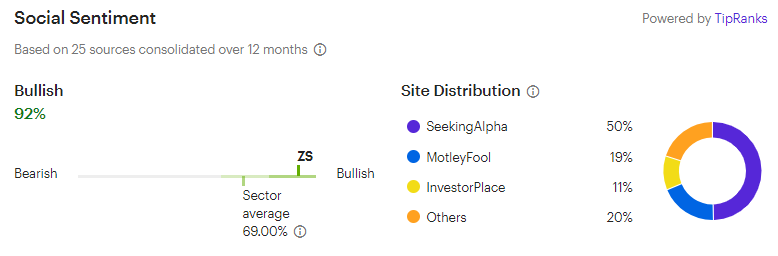

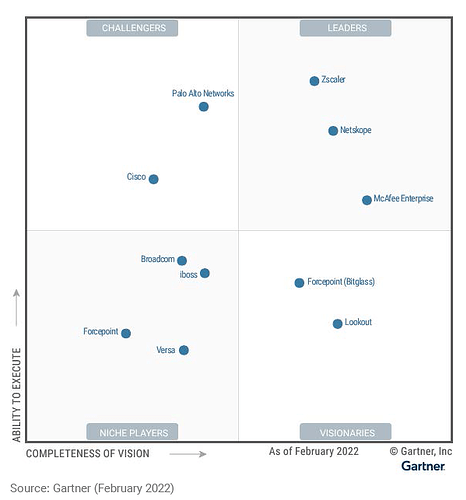

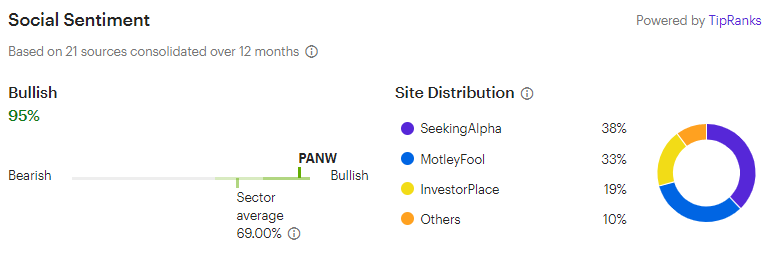

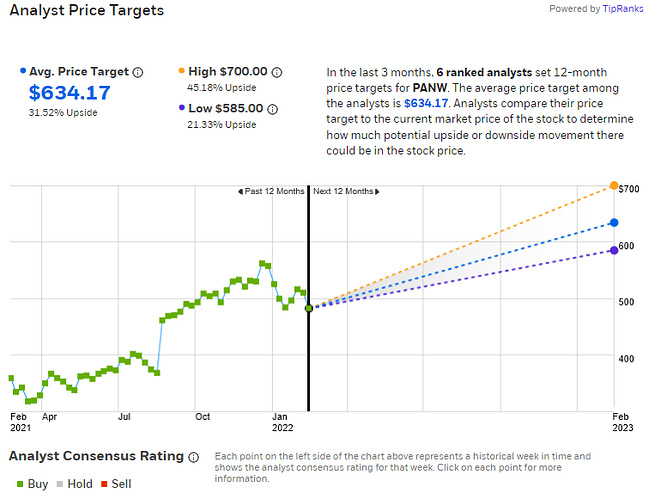

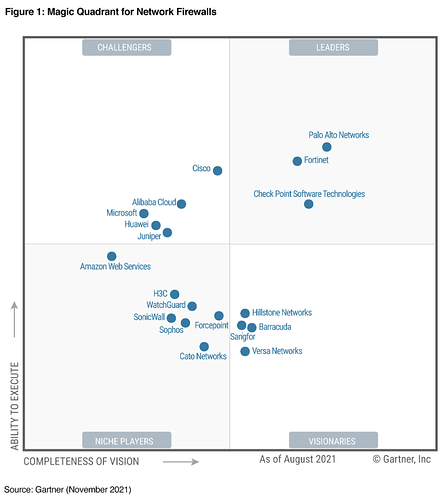

A note of caution: earnings plays are extremely tricky. For example, if played with options, they can result in significant loss due to IV crush. It’d therefore only make sense to short if we feel reasonably confident that there will be an earnings miss and/or will guide below expectations. As an example of the challenge we face, CRWD, MDB, OKTA, and ZS seem particularly bloated. However, they are also best of breed, and have had stellar performance so far. If winners keep winning, are these really the ones to short?

And while this is not the focus of this play, it is possible that some of these have been beaten down too much already and may rebound on earnings. Let’s point them out too.