Well, I figured I’d start one of these since I’ve nearly managed to trade my way out of a hole that was combination of my one degen long taking a dump and trading like it was 2021 in early 2022. My goal with this thread is to share my insights and some of what I’ve learned, as other here have so graciously done for the rest of us.

Some details:

-I’m trading a small account. I just got back to $2k account value today, which is pretty close to what I started this year with. I had a lot of lucky success trading in 2021, so even today, my account is still larger than what I started with despite taking some losses making mistakes along the way, as well as having to essentially pull all of my profits out of the market to take care of bills due to life happening.

-I have one long position, MVIS, a LIDAR and Augmented Reality company. I’ve taken some profit and reduced this position to 100 shares and one 2024 ITM call option. I mostly leave this alone. While not as profitable as it was last year, it has come back a bit recently from lows and

my shares are essentially free. As this is somewhat of an emerging industry, I’ll probably diamond hands this a bit longer… but if it decides to go 2 mun WSB style again, I’m going to learn from my mistake last year and take the money and run.

-

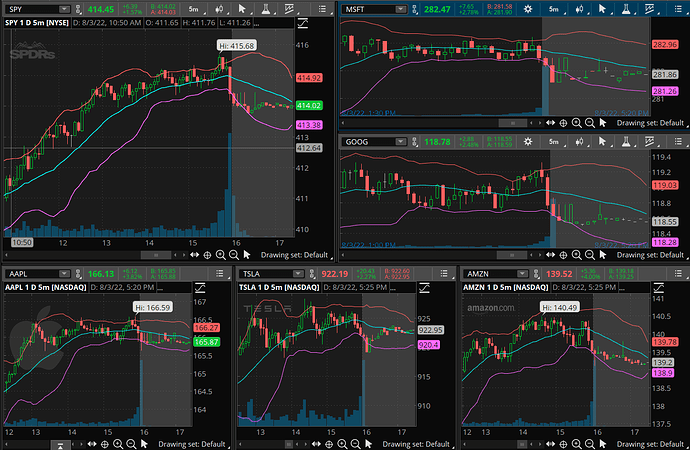

I have been exclusively trading SPY since I really started posting on TF. My strategy is specialization… learn one stock and how it reacts to things, and make it yours. Is SPY the best option for this? Probably not. But the challenge of doing so and coming out ahead will hopefully make me a better trader. Plus, since SPY reflects an index fund, I’m hoping what I learn from it will be applicable to any other stock I choose to trade in the future.

-

I only trade options. Since my account isn’t huge and SPY options are expensive, I’m usually trading 1-5 DTE somewhere in the realm of reality as far as the strike is concerned (Within $10 strike of where the stock is at upon entry).

-

I try to manage risk by taking only small positions and being ready to cut at certain targets, win or lose. I trade one or two contracts at a time, typically with no more than $200 at risk at any given point.

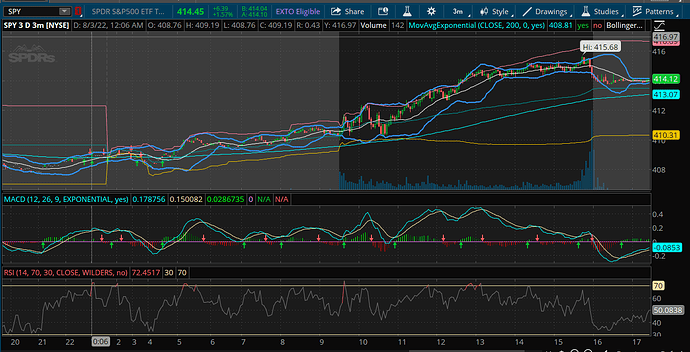

All that boring stuff said, here’s where I stand today. This hole at its deepest was roughly $900 and some change. It has been a struggle, but there’s a light at the end of the tunnel:

![]()

My goal is to try and finish the year with my account at at least $3k.