Hey everyone.

Today’s DD is for one of WSB’s most popular meme stocks : WISH.

Brief summary of WISH from Wikipedia:

Wish is operated by ContextLogic Inc. in San Francisco, United States. The platform employs browsing technologies which personalise shopping visually for each customer, rather than relying on a search bar format. It allows sellers to list their products on Wish and sell directly to consumers. Wish works with payment service providers to handle payments and does not stock the products themselves or manage returns.

Essentially, they are a middle man that connects sellers to buyers. Their ideal demographic is people who are willing to risk quality for the sake of discounted prices. It may sounds funny and a “why would anyone buy anything off WISH”, but it’s become lucrative enough for them to be a multibillionaire company today.

With their earnings coming up, I thought it’d be a great idea into digging up some information to best predict how they’re going to perform in q3. In doing so, I’d like to present some hard data so we can pin point the most likely outcome.

1 Last quarter earnings report

If you read their earnings report, they missed HARD on their revenue mark citing two major headwinds: rising advertising costs (due to iOS change) and vaccines beginning to encourage shoppers to go out and purchase goods elsewhere. To combat this, their gamble for Q3 goes as follows:

-

Enhancing product quality and selection. Wish users should always feel satisfied with their purchases. As we improved logistics, product-quality issues became the number one reason for customer service requests. Under a new quality score system, we are now prioritizing products and merchants that receive positive ratings and

feedback from our users. We also are adding more globally-recognized brands and items that users know and search for, which we believe will drive more frequent purchases and higher average order values. Since Wish was built as a discovery-based ecommerce shopping experience, we are focusing product selection on categories like

apparel, home goods, and gadgets that translate well into an “online treasure hunt” experience. We will leverage our user activity data to strategically select attractively priced, quality products that we believe will delight our users. -

Providing an unmatched fun and entertaining shopping experience. Wish users should always experience a fresh feed that elicits a joyful feeling, as if they have entered a store that prominently displays only products that pique their interests. To meet those expectations, we are investing further in our platform and data-science capabilities to develop a more engaging, personalized, and discovery-based online shopping experience for our users. We are

leaning into social commerce and entertaining features, such as video reviews and live streaming shopping events with the goal of engaging users and increasing time spent on the Wish app. Over time, we expect these innovations to drive new buyer conversion and existing buyer retention, and to encourage more frequent usage. -

Improving the performance of the app. Since Wish was built on a culture of innovation and experimentation, there have been a high number of ongoing platform tests designed to advance innovation. However, the volume of those tests resulted in a slowdown, or latency, of the app’s speed. The slower platform performance impacted the user experience, particularly for our existing users. We have since conducted a thorough review and cleanup of all open tests and this has already resulted in significant latency improvement. Going forward, we will strive to more effectively balance platform testing to advance innovation with the need to maintain optimal platform performance for our users

I share this not to repeat the same shit of “haha they missed earnings” but there is a HUGE underlying message many people have missed here. In this section, as well as other parts of the report, is a self-admission of “we do not expect new user growth.” Instead, they are banking on making making more money off each existing user.

This is extremely difficult, because it assumes they will not bleed any users while also increasing revenue per user.

This is a HUGE red flag as any application, especially an ecommerce platform, should be focusing on obtaining new users.

Less MAU (monthly active users) = less chances for revenue. This has a rippling effect down the money line. IF they were to increase their revenue per user, they would need to increase the money made off users 50% (since their marketplace rev was down 32% YoY) while retaining 100% of spend users. For any ecommerce business, this is near-impossible to perfect and execute within a quarter, let alone a year.

[left]2. Competition - logistics and ecommerce[/left]

Oddly enough, one of Wish’s big money maker’s is their logistics department. As they used to be only a marketplace, they grew in their logistics revenue 126% year over year.

While this could be a bullish case for adding another revenue stream, there are a couple things to consider.

- There are more companies, primarily Uber and DASH, moving into the logistics space, with more users on their app already than WISH. This will limit/hinder WISH’s growth in logistics.

- WISH did not mention any headwind in their last report about supply chain issues. Considering a vast majority of their products come from China. We all know supply chain issues are completely fucked right now. With rising oil costs and delays in deliveries of goods, this should eat into their margins for logitiscs revenue.

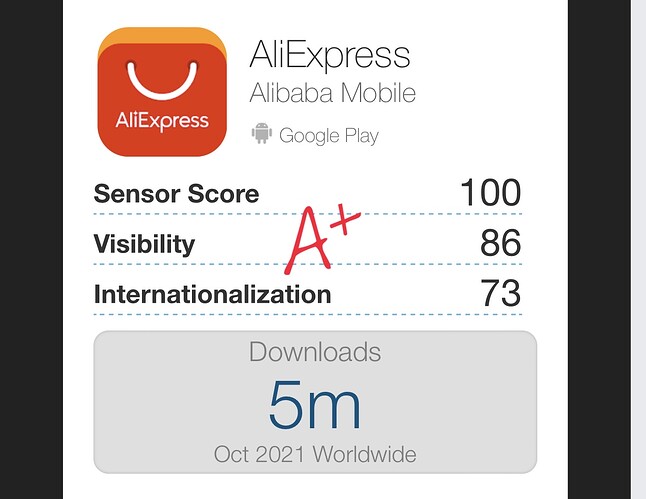

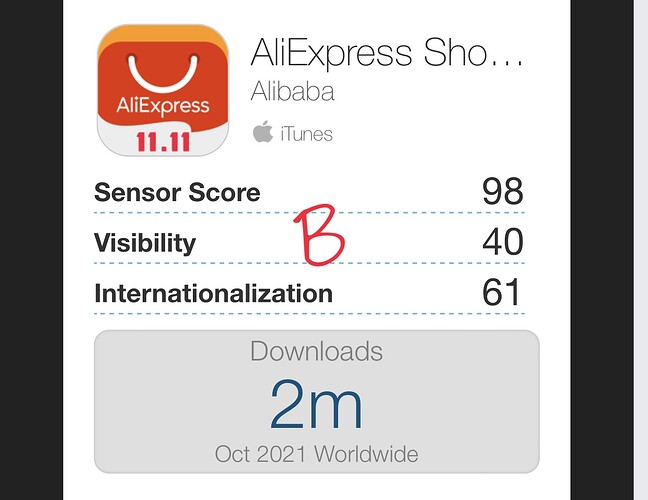

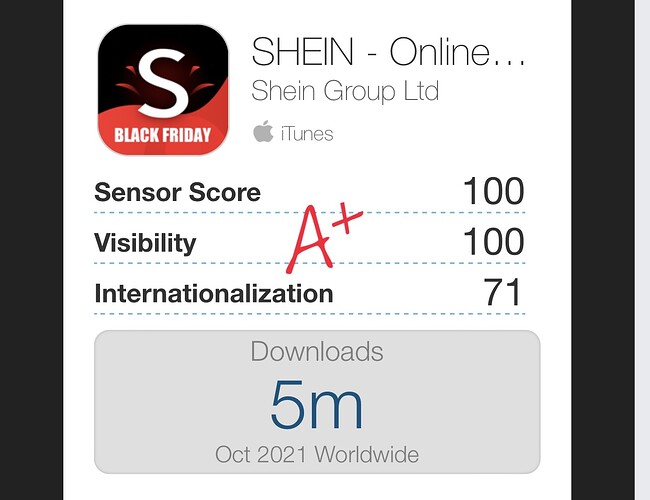

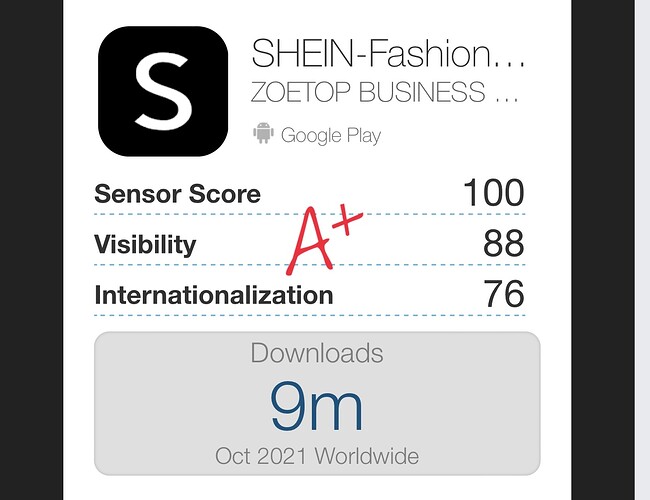

Another point to consider is general ecommerce competition. I’m not talking about ecommerce marketplaces only, but large retailers that have ramped up their ecommerce efforts (Target, Walmart, even Dollar Fucking General). Taking a look here, WISH has dropped from top 10 to top 25 and is now out of the top 30. This drop has happened in a span of months.

So both in logistics as well as online marketplaces, WISH is continuing to lose market share.

3. User data/growth

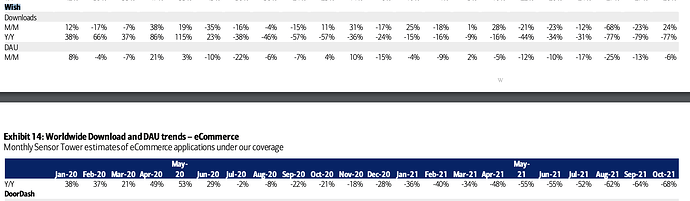

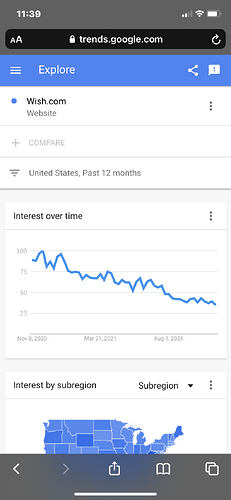

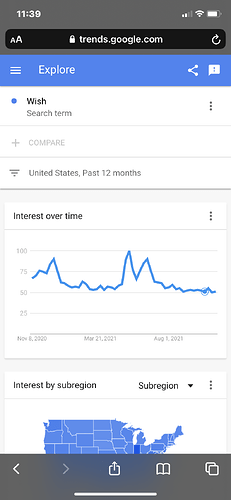

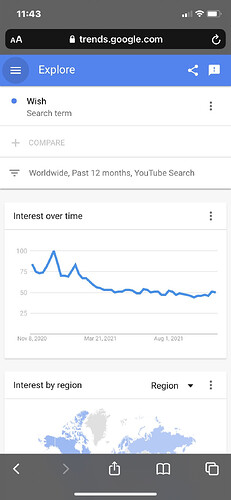

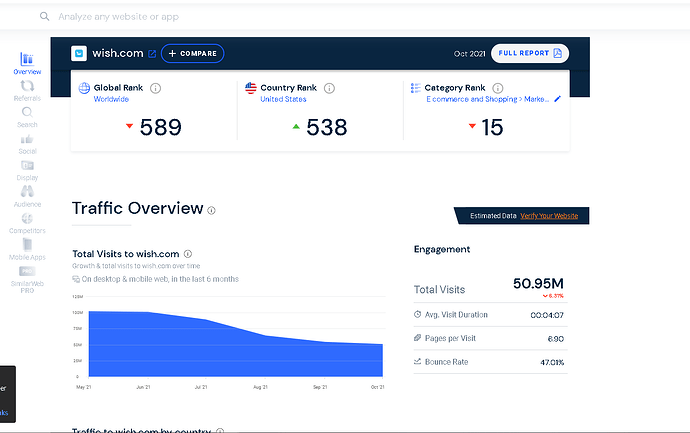

One of the main things WISH is counting on for q3 is to retain the same amount of users and make ~50% more off of each user. While it’s easy to go find points of data showing they’re getting less traffic to the site for new users, a BofA report recently showed their DAU (Daily Active Users) is also decreasing at a significant rate.

This shows us they’re losing even more people every month that goes by, meaning they have to continually and try to make more money off their existing users, which again, is unlikely.

4. Leadership

This part of my bear case is purely skeptical and anecdotal, so if you’d like to skip it, please do.

I think the CEO is an absolute fuckhead.

I’ve personally met and hung out with Peter in a private setting (~20 people) and he had the makings of every single douchebag CEO in SF.

Every other word out of his mouth was “WISH is my passion, I love how it’s changing people’s lives” followed by “We’ve raised tens of millions of dollars”. He doesn’t fucking care about giving a student in latin america the ability to buy a notebook, he cares about his ego and how much money he has. He has a private instagram that is filled with a faux-Dan Bilzerian lifestyle. WISH is not his focus right now, living the .1% life is.

Worth noting, I think he’s smart in that he made an ok product, sold it well to investors, and cashed the FUCK out. If you look at insider trading history, he immediately sells every single stock option as soon as he receives it. This is in sharp contrast to other leaders at companies where they expect growth. When they exercise options, they either sell some or hold onto all of it. In Peter’s case, he immediately dumps it at market price. If the CEO of a company doesn’t want his own fucking stock, then who would?

Now for some tailwinds to consider

-

Meme status - WISH is unfortunately a WSB favorite. It’s a meme stock. Like CLOV, SDC, and a few other tickers, people have no problem throwing 20-30k into it and “hodl-ing” even if it means burning free money. Taking a look at the WISH stock subreddit, it’s also clear there’s people who are convinced WISH is a $100 billion dollar company that’s undervalued. When entering a short/put position, you have to take into consideration people may see this as a buy the dip opportunity.

-

Numerical Support - It’s always held pretty round nice numbers for support. If it “guhs” then it may quickly find support around $4 or $4.5. There is a high chance this becomes a slow bleed, not an immediate knife.

-

Surprise acquisition - If I were a big company or an equity firm, I’d be licking my chops at acquiring WISH. I would not acquire WISH in continuing it as is. I would buy the company and strip it apart (users, shopping data, logistics, etc) and re-sell them for parts. Considering WISH’s downtrend, I can see this happening as an out for everyone involved in the company. If or when this happens I don’t know.

-

Surprise buy back - This is another scenario that can happen on the earnings call. Who knows, maybe Peter actually does love the company and has had a change of heart. He could announce he’s buying back a ton of shares (which would make sense at this low price) in order to help those who have bought WISH stock and inject new life into the company.

CONCLUSION

All this said, I lean pretty bear on the stock.

Before Q3, WISH was bleeding new users and revenue was drilling. If companies like SNAP and FB were still citing iOS changes as problems for advertising, i don’t expect a company like WISH to have fared any better.

Their Q3 goal was to improve their product to extra more revenue per user, but looking at how many users they’re bleeding, it doesn’t seem likely they’re going to hit their revenue or user goals.

Their logistics leg was their one shining moment, but considering their main product source is China, that is unlikely to do as well in the future as it has done in the past.

In my opinion, they not only miss on their revenue, EPS, and user metrics, but also downgrade their future guidance.

There’s a lot more that point to bear but I think these things are the main things to look at. I welcome any discussion for bull cases so we can have the whole picture.

ALL THOUGHTS ARE MY OWN AND NOT TO BE TAKEN AS FINANCIAL ADVICE.