WeBull account starting balance: $1000

Biggest wins:

CRWD +$110

TMUS +$63

SOFI +$44

Biggest losers:

UPST -$414

DELL -$240

CMA -$155

BUD -$83

Current balance: $255.63

Inside my mind.

I have a habit of trading with near zero emotion. Total stonewall when it comes to positions. The emotional trader makes rash decisions and loses from my research. This methodology does not work for me as I have found. Watching positions burn to ashes just doesn’t seem normal. So I have attempted to implement stop losses and as a result I still have yet to see success.

With debt ceiling resolution on the table, analyzing past market performance indicated a fairly certain sell off post-signature of the bill. With this historical data in mind, PUTS were loaded at the top in preparation. The following week this sell off did not happen. Instead the market pushed up and continues to do so today.

In an effort to hedge my 30DTE PUTS, I began to take positions with weekly CALLS and not “fight the trend.” Being heavy into UPST PUTS (still holding) and seeing the price action continue to rise, I started there with short term CALLS. My first attempt at CALLS was taken here on 6/5 where they got obliterated. Had I not implemented a stop loss and continued with my stone wall approach the following day they would have been up massive.

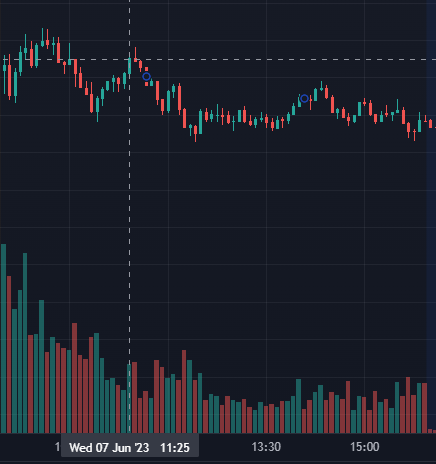

My second attempt at CALLS was taken here on 6/7 seeing how the previous day was a big recovery from my last failure. But would you believe it, another sell off killed them and they were closed for near nothing.

Today UPST pumps right back up to new highs and is kicking me while I’m down. My PUTS are near worthless and my attempts to play CALLS made it worse.

I started to look at TSLA and yesterday decided to go with the market. I took a CALL here and almost immediately it started to go red FAST. The position was cut as I’m trying to use discipline with stop loss.

Today, TSLA goes on a spree and beyond green. I take a 6/16 PUT here to mirror the movement of yesterday and it just runs, still running, still holding the PUT.

My account is down about 80% from the start and while it’s not zero, I feel like it’s going that way. My win to loss ratio on trades is without exaggeration 1:8 at least. I’ve tried playing CALLS and I’ve tried playing PUTS. I’ve tried swing trades. I’ve tried following the trend. I’ve tried ER plays. I’m just at the point where the second I’m about to take a position I should do the exact opposite. Even gambling the win ratio should be higher than this. It’s embarrassing and disturbing at best.

When the account is zero I will not be trading options anymore. It’s not a lot of money to me but it is shameful.