Numbers Updated: 10/23/2021

Summary:

Here I present two things that I think may be of interest to Valhalla.

- Introduce an initial dataset of all the bot options calls (ai-option-calls channel on discord) and invite others to analyze.

- Some preliminary, descriptive analysis of that data.

Motivation

I’m a really new trader, and rely on others’ DD in order to make plays with my small account (started with ~ $100). In fact, my motivation for trading prior to finding Valhalla was trying to make enough money for one pizza a month following wsb plays. Through y’all, I making a pizza a week, thanks! One of my main strategies each week is playing the bot. When you begin to play the bot, the floor (including me!) will suggest “folk theories”. Things like:

Just play the rocket emojis

I only play over

Xconfidence levels

The bot is only good at reading popular tickers

The puts are sus.

These are folk theories in the sense that it lacks rigorous justification because they rely on few cases and lack testing for the meaning of provided data points (assumptions of what ai confidence measures is prevalent). I want to provide some opportunity to make AI Bot suggestions less of a gamble. I am currently a bit busy with life things to conduct the thorough analysis the Bobby data deserves. So I am trying to handoff this data to y’all.

I wrote this all up in R. If you want to see the data-cleaning code, or how this document was created, DM on discord.

The Data

About the collection: So I tried to write a scraper to take all the stuff from the ai bot channel. It was more work than it was worth. Instead I just highlighted and copy/pasted it all. Then cleaned the set. Here’s a sample of 5 rows (YMMV on seeing all 15 columns of the tables):

| symbol | date_of_signal | strike_price | expiration_date | option_order | buy_sell | time_expectation |

|---|---|---|---|---|---|---|

| XPEV | 2021-06-21 | 45 | 2021-06-25 | Put | Buy | 1-2 days |

| SOFI | 2021-09-22 | 15 | 2021-10-15 | Call | Buy | 1-2 days |

| COIN | 2021-10-14 | 260 | 2021-10-15 | Call | Buy | 1-2 days |

| RIOT | 2021-08-27 | 37 | 2021-09-10 | Put | Buy | 1-2 days |

| BA | 2021-06-03 | 252 | 2021-06-04 | Call | Buy | 1-2 days |

| ai_confidence | rocket_emoji | oi | called_prems_spent | approx_prems_spent | volume | boom_emoji | tracking_link |

|---|---|---|---|---|---|---|---|

| 58.6 | FALSE | 9.58e+03 | 129K | 1.29e+05 | 411 | FALSE | https://tradytics.com/bullseye-dashboard?alert=-ZZJfI-t0Xaq-jov3C-WX5gg-PYIB3 |

| 53 | FALSE | 2.87e+04 | 689K | 6.89e+05 | 3.2e+03 | FALSE | https://tradytics.com/bullseye-dashboard?alert=-BeCfj-YGNR1-8OzlK-dl4N3-9imKh |

| 54.5 | FALSE | 5.15e+03 | 317K | 3.17e+05 | 1.16e+03 | FALSE | https://tradytics.com/bullseye-dashboard?alert=-YG1Ml-WVOxt-0yxJh-rSKtE-6dnSJ |

| 58.5 | FALSE | 232 | 3.36M | 3.36e+06 | 1.48e+04 | TRUE | https://tradytics.com/bullseye-dashboard?alert=-BP4bR-6lFw4-2FOni-mLa6l-HZqrH |

| 54.2 | FALSE | 1.33e+03 | 179K | 1.79e+05 | 740 | FALSE | https://tradytics.com/bullseye-dashboard?alert=-QmAF1-dBRlL-RYJlo-qFpZ3-6q2me |

I think this is an indispensable set of information for getting rid of the folk theory play on Bobby, and would therefore like to invite for others’ analysis.

Some questions of interest to me that I don’t have time to look at right now that requires querying other data:

- How often does the signal pay?

- Are rates of success related to the confidence rating? The ticker popularity?

- Are the emojis actually useful?

- Can we build a predictive model using the historical bot data to determine when bot plays are worth it? (Hopefully free of overfitting, but we’re already without data, so i’m sure that’s fine)

- How frequently does news excite the bot to signal incorrectly?

Although I do not currently have the time to conduct this analysis myself, I’m hoping this can be a start for others.

For now, I can present some description of the data as is.

Descriptives of Current Set

The data is currently all dates from June 01, 2021 to October 20, 2021. I’ll take my referenced folk theories in turn, not to debunk them (yet), but to provide context for questioning of what assumptions we make on Bobby.

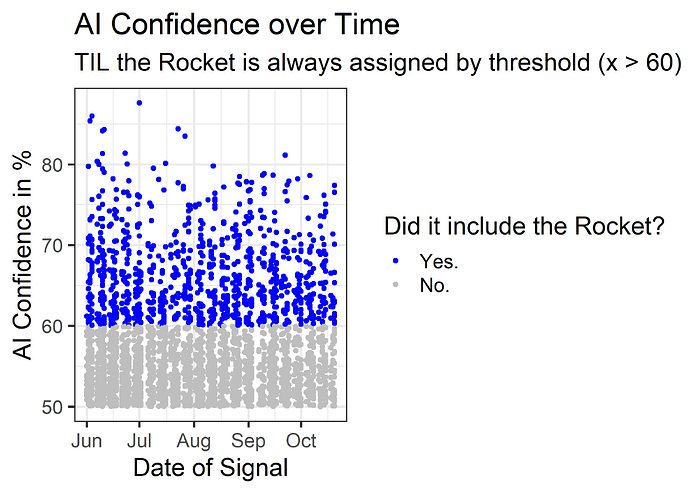

Just play the rocket emojis.

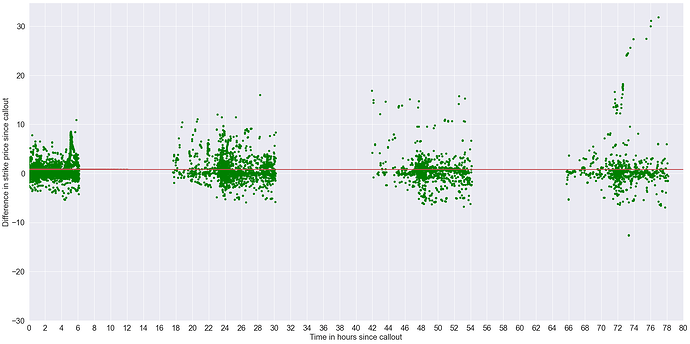

Here’s a scatter plot of time and options signals with the rocket emojis highlighted:

This theory is the same as “Just play above 60% confidence”. Speaking of:

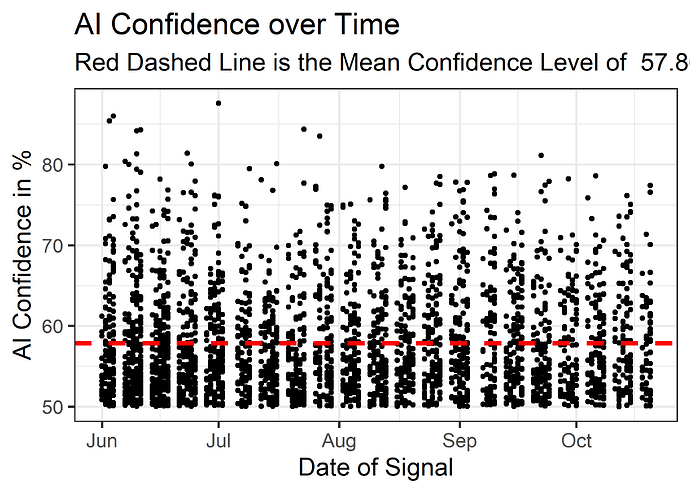

I only play over

Xconfidence levels.

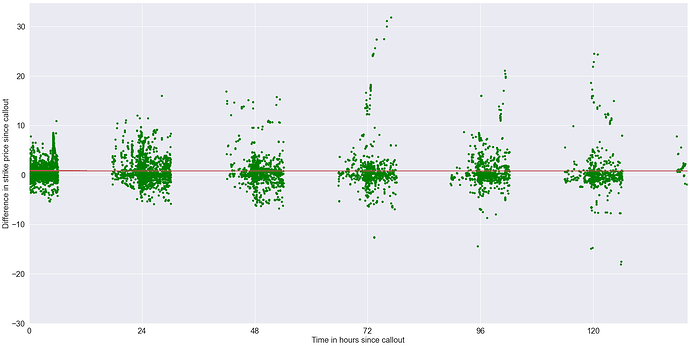

Here’s a scatterplot of the ai confidence over time.

Given that the tradytics website doesn’t really explain what the “confidence” measures (a shrewd business move on their part tbh), note how many plays are limited by such guesses as “Above 65 and you’re good” or what have you. Also the median if 55.9 if you’re into that kind of thing.

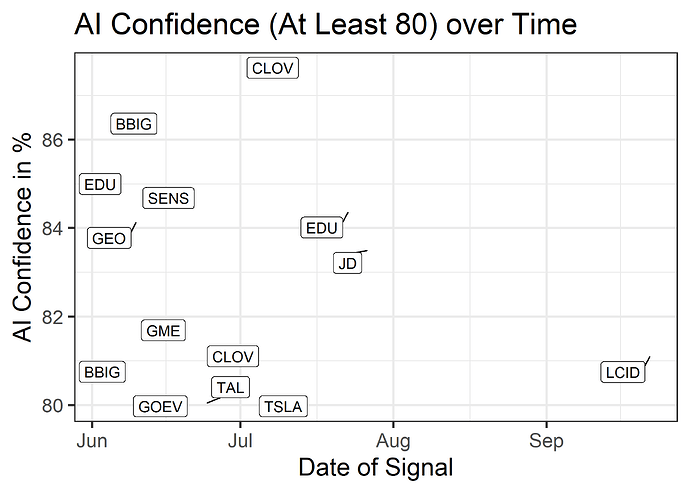

The bot is only good at reading popular tickers.

It looks like confidence above 80 is pretty rare. When we zoom in to those, it seems like reddit behavior prompts some of the bots’ read of a ticker imo.

The top seven most frequent ticker calls:

| Symbol | Number of Bobby Signals |

|---|---|

| AAPL | 97 |

| NVDA | 91 |

| AMC | 85 |

| BABA | 85 |

| TSLA | 85 |

| AMD | 82 |

| MRNA | 81 |

Is the bot good at calling popular tickers, or does it get more chances to try? That much is unclear without more analysis. Food for thought though.

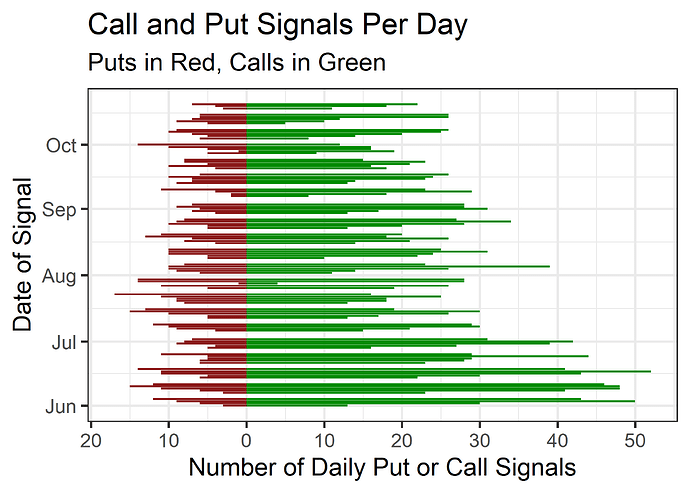

The puts are sus.

Here’s the rates of calls / puts:

Now it may be the reverse. Is the bot bad at put signals, or does it get less chances to try? I will note that conq did say a few days back “The bot can’t read the news” more or less.

On these folks theories:

I want to motivate more inquiry here. The risk of such theories became more clear to me when I got the data down.

Here I highlight a couple quick points of the Bobby data:

Virtually all of the calls here have the 1-2 days expectation of paying out. Tradytics could in theory change this part of the post, and have never done so in this dataset.

On the other hand, there are, in fact, sell signals. I know some folks have questioned their existence, and couldn’t be bothered to use discords search function. Table here:

| Buy or Sell? | Number of Bobby Signals |

|---|---|

| Buy | 3076 |

| Sell | 66 |

The average expiration date of option signals:

| Call or Put? | Average Time Until Expiration (days) |

|---|---|

| Call | 17.69 |

| Put | 22.01 |

Added this because I feel like it might be important to understanding what they mean by “confidence”

Final Thoughts

Like I said, I’m new to trading; I’m sure others will find more value in the other columns in the dataset than I do (or the links!). I put this together because I would like Bobby plays to have more principled rationales. The link to the total dataset is here: a google drive with the whole set as a .csv