The VIX Short Strategy: Profiting from Mean Recursion and Leveraged Index Decay

I’ve had several requests in the past few weeks for a DD and explanation of the research and strategy surrounding my $VIX plays. This strategy has saved my account from binary options limbo and brought me the straightforward play I’ve been wanting for a long time. This play is designed for optimal performance in the range and chop cycles of common indices. The odds are in the favor of the conservative day trader with any account size and offers the best solution I know to stagnant markets and boring chop. How about a way to profit from it daily, without having to enter the margin zone and join theta gang? The results I obtained exceeded my wildest dreams for profit and consistency from what started (and remains at its core) as a simple idea. There is so much more to be learned about this play and I’m sure this great community can add ideas to help improve and progress the strategy. This will be my complete DD on everything I have learned and researched so far with a hint of storyline, I hope you enjoy and learn something!

A couple months ago, I had a moment of inspiration which stemmed from one of those routine, mindless, and sarcastic comments found in abundance on the Valhalla Trading Floor, this one by our beloved local degenerate, Yong. The traders in general had been bemoaning the lack of direction in financial markets for weeks, and the pain of trying to profit with binary options in a stagnant market with a dying VIX. Yong’s reply? “Well just short the VIX then, you dumb fucks, easy 10x play!” At first, I passed over it lightly as with any comment meant for a joke. But the idea stuck with me and I stayed up that night, pondering. I had considered shorting the VIX as a consistent play in mid 2022, but the idea died partly because we were in a serious downtrend with dangerous VIX swings, and partly because I didn’t want to do the research and just assumed any recursion was “priced in”. Short-term, I was right, the play wouldn’t have been as good then. But long term, I should have revisited it. Which I finally did, reawakened by Yong’s offhand comment.

There are three characters of the stock market. Bull market; bear market; and range, consolidation, or chop. The bull market boasts being the default direction of the stock market and the reflection of a healthy (or booming) economy (at least in theory). The bear market boasts being the most dramatic and flashy character, drawing plenty of attention and stoking the know-it-alls who shorted before everyone else. While they are opposites, both markets have a common theme: they are great for playing options. Big and/or consistent daily moves provide good risk to return for binary options players and also a healthy premium return for theta gang. So long as you don’t get stuck fighting the trend, they are good for options traders. Then… we have the chop. Range. Consolidation. Whatever you want to call it. This market presents a problem to retail traders, and even theta gang as more time goes by. It sucks. Why? Because the market has no direction. It stagnates, teetering between the raging bears and the obstinate bulls, who argue unceasingly about where we should be in six months. Meanwhile, nothing is happening and the direction marches to the right. Binary options traders on indices don’t have time to sit and wait. They need moves, big moves, now. If they don’t get moves, they lose eventually lose money, consistently. Maybe you some wins here and there. But for the most part it’s a losing and painful struggle of your money against time. Also, the VIX steadily staircases down, eating away at the premium collected by theta gang who also lose return. So, what if we can capture this consistent rightward movement, this downward VIX trend, instead of losing money on SPY options? The answer is: we can. And the safest time to do this is in a ranging market.

The VIX is what I call a recursive index, meaning it always returns to the same average value over time. This gives anyone playing VIX an opportunity which very few market products offer: a guaranteed long-term price and direction, but with big swing moves along the way. There is always a limit to the distance and duration that the VIX will move against your position, no matter long or short. If you short and the VIX spikes, you know it will come back down at some point. If you went long and it falls, you know it will spike up on that rough period in the future. This is one of the first qualities I was looking for: odds in the favor of the market player. These odds are much better than playing a stock which can go in either direction for any period of time. The VIX on the other hand is always rubber-banded back to average. However, the odds still didn’t look good enough for me to try to make a play. That’s when I stumbled on the special weapon…

Leveraged VIX etfs. Namely, the $UVXY (1.5 long) and $UVIX (2x long). These leveraged funds seek to track the return of the real VIX using futures. A quick comment about the movement: they tend to lag behind the VIX in % movement despite the leverage because of the behavior of VIX futures contracts, something to keep in mind when trading. Now after a quick check on the decay of these guys, I knew I had what I was looking for. The etfs have lost an average of 9.8% per month since inception, a staggering rate of decay worse than any leveraged index I have seen. If you factor in all the reverse splits of UVXY back to the all-time high near inception point, a single share which trades at around $3.50 today would have cost around $200 million. Which is, quite obviously, a 99.999% loss in about a decade. This decay isn’t because the etf managers suck or liquidity is garbage. The UVXY has excellent liquidity at over 30 million daily average volume, and both are run efficiently. The monster is that recursive behavior of the VIX: the whipsaw or rubber band effect always pulling it back to average price murders the leveraged products. Now the odds are looking even better: Not only can we potentially short the VIX while above the average short or long-term trend with very good odds for success, but we also have a medium for shorting that takes serious compounded losses due to its unfortunate job of trying to follow the VIX with leverage. Serious odds in your favor to hasten gains and cushion or avert losses. Even better, based on an index that becomes predictable in a boring market. Bingo, I had the play. But how, and when, to implement, and is the return worth it? I can already hear you nerds quipping “It’s priced in bro!” No, shockingly, it isn’t priced in very well as you will see below.

I began studying historical daily VIX prices movements to see if I could detect helpful patterns on when and when not to attempt shorting volatility. I decided to look at mid term relevant data from August 2022 to March 2023, covering two complete VIX cycles and plenty of mini behavior trends. My findings and analysis which I tested in daily live trading over a period of about two months are listed below. Rules are first because they apply to the overall play and prevent you from getting hurt and taking dumb losses, with juicy ideas and tools laced throughout. One important note before diving into the results: these trends are regardless of market direction. I’m only looking at the VIX, we don’t care about time markets. Which is what makes this play so simple and sweet.

-

One of the first big takeaways and a golden rule: Stay far away from VIX before data days, news days, big earnings days, war days, etc. Remember, this is a play for those boring rangy days and markets. Avoid attempting to time VIX moves before any kind of expected news or data. Your time to jump in is after the release. Because, quite simply, your odds of success are basically a coinflip and with massive shifts in volatility due to the latest either exhilarating or perhaps apocalyptic data, it is a great way to get blown out of your position. However, there are cases where shorting volatility before data which will most likely come in “at consensus” and be a nothing-burger are very profitable and have better odds of success. For me these plays averaged a 2x return on puts after the data comes in, well, as expected and the VIX falls right back to pre-hopium (or copium) levels. I tried this strategy three times on data such as PPI, with shorting volatility before the latest CPI report being the biggest success. This is a play for the experienced VIX shorter with a higher risk tolerance and a small position.

-

The second rule: It’s usually a terrible idea to hold VIX shorts overnight (one exception being the “at consensus” data play discussed earlier). In a 3 month average period, there is about a 10.1% chance the VIX will open the morning lower, and the other 89.9% of the time, the VIX will open higher or flat from where it closed the previous trading day. Odds are against you, run! And going long isn’t a good idea either if you instantly thought it might: These moves are usually small (80% of these green VIX opens are moves less than $1), heavily priced in, and serve to steal value from both calls and puts. Another even stronger trend: the VIX loves to open higher on Monday. 91% historical average that the VIX will open higher after the weekend, and about 60% of the time by a factor of over 1%, on a Monday. These moves are regardless of market direction. Remember, we don’t want to try to time the market direction, it’s ranging anyway or maybe it’s not. We’re here to get away from that, so I made sure to build this strategy away from relying on directions. Back to the higher opens. For the most part, these make holding overnight a bad idea (with a few exceptions including the higher risk “at consensus” strategy). However, buying calls on the VIX before close on Friday afternoon and selling on Monday is a small and safe strategy which I have tested over four weekends, each time coming out with modest 10% gains on conservative strikes and expiry dates. This is just one tool in the overall VIX play toolbox. And these moves make complete sense. Every morning, the market is fresh, edgy, ready for the trend to be discovered. Uncertainty is in the air (unless we get huge pre-market stimulus money news) and the VIX is higher. As the days progresses and the market cozily prices in whatever it feels is significant for that day, the VIX usually trends downwards even on many red days and heavily on green days, as general complacency sets in. The last hour or so before close, volatility and uncertainty over what will happen the next day set in again, and VIX picks its head up. The cycle starts anew. This is more noticeable over the weekend and extended holidays: who knows what will happen while the market is closed and futures can’t trade, so volatility picks up as everyone places the weekend bets, with a higher degree of nerves and uncertainty. And this leads right into another tool in the box of the VIX short strategy: load up on puts Monday near open. Sell those (hopefully) greens calls you bought Friday and reverse to puts. There’s about a 70% chance that the VIX will suffer a withdrawal from the exhilarating high of a new week (pun intended). Now before you blindly yolo puts every single Monday, use common sense. Remember to avoid this play before an expected data Monday or big earnings if those come out on a Monday.

-

This leads me to the bread and butter, the staple tool of the overall play: Buy puts on the VIX in the morning after open, usually within the first two hours. You may have noticed the majority of the VIX daily candles are red, right? The odds are in your favor! Don’t fear the big green spikes. The majority of these happen on data days and remember, we don’t play those days. Safety! Use the UVXY index as your underlying tool for shorting to capture that excellent liquidity and juicy natural index decay. Yes, ok, you can buy options on the actual VIX index itself. I will give you three reasons on why to avoid these. First, they are European exercise. They have low intrinsic value unless very close to expiry which makes them lazy movers. Infuriating when your puts go $2 ITM and your option gains $.30 in value because of European exercise rules, trust me. However, this can also be a good reason to use direct VIX options, because they won’t lose value as quickly as American if the VIX goes hard against you. This would be a no-brainer if the second reason why not to buy them wasn’t here… Second: The liquidity on VIX options is terrible, unless they are very close to expiry. I’m talking very, very bad. Spreads so wide that it often takes a $1 VIX move for sellers to move the ask down. I’ve sat for hours bidding against algorithms, using my trading software to watch the robots mimic my moves and flinch at every turn of the market. I quickly realized that some of the models algorithms use for European exercise VIX options can be sketchy and still partially based on American models or SPY, often hilariously trying to profit from human behavior and bid by staying right behind the bid or ask to snag a “deal”, or simply making decisions based on SPX or SPY movement. Admittedly it’s fun to slowly, carefully, convincingly bid the price up to an absurd level (sometimes double the starting bid with a slightly favorable underlying move), and watch the robots reluctantly follow you up and get force filled at upper mid price on 200 puts, while you get filled on one. Then pull all your orders and execute the first market sell of the day for that option at breakeven with the one put you got as a fakeout so the robots instantly lose hundreds to other robots (or a human on the other side with brains) tanking the ask and market selling in a panic. Anyway, unless you are into this sort of thing… VIX options aren’t a great idea because it is very difficult to enter and exit positions with limit orders, and market orders will score you an instant -30% on your position. The third reason: IV on VIX options opens in the mornings at a high premium due to the stupidly wide spread, often significantly higher than an equivalent UVXY put position. Unless you can snag a miraculous morning fill, it can take hours to get filled and by that time half the day (and potential profit) is gone. Plus, you won’t be able to get that extra cherry of UVXY decay. This decay is partially priced into the cost of puts, but it only prices in a 3% monthly decline in index decay versus the actual 9% historical average.

-

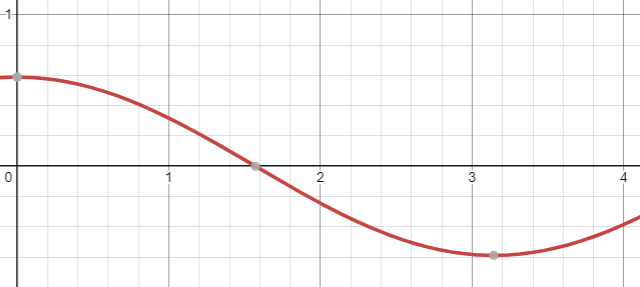

Make sure to sell your play about 1-2 hours before close. Your average daily boring little VIX play should be closed out before 3pm EST. Don’t allow the temptation for a potential hour of extra profit to get to you. In my experience, VIX shorts will lose value about 80% of the time going into close, as volatility picks up no matter market direction. Exit your position towards the end of the complacent lunch period for maximum profit and safety, the sweet spot for me is 2:30pm EST. After graphing the average daily VIX price curve assuming minimal market price movement, the VIX almost always bottoms near this time of day. The graph of the decay best matches an elongated Cosine curve. Basic equation fit is Y= 1/1.7cos(x). Notice the upwards movement towards close and the rapid decay near midday.

-

For the UVXY options Delta, it is crucial to use ATM or ITM options. I like to go with around a .6 delta for safety. This way if the VIX moves against you for an hour or two you can hold on without instantly getting stopped. If you try and play options with less than .4 delta, even a small move against you destroys the value of the option because of the 120+ IV on the strikes. This is why it’s important to stay safe behind the shield of delta so you can capture the downwards move without getting stopped out on small reversals. You need your option to move deeper ITM gradually throughout the day. If the option does not go ITM the success rate on this play is much lower. I tried degenerate OTM strikes 9 time (yikes) and lost on 8 of the tries. 7 of these stopped out in a flash dump because of the wild IV. On the other hand, my success rate with ATM or ITM strikes is over 85% overall.

If you would like to play regular VIX options, $1 OTM strikes are usually fine. Because of the different exercise system and intrinsic value the option won’t smash you as badly if it goes out of the money. -

I usually use trailing stop losses for this play, with the stop set at 15-20% on weeklies and 10% for longer expiries.

-

One-two weeks out is the best expiry to shoot for. Even though overnight holds are not the goal, the time allows you absorb more temporary setbacks without getting stopped out in dumb places, as you would with something expiring in two days.

-

Entries: The best entries for this play are sudden spikes, morning uncertainty, and flash crashes. Over 95% of the time, the VIX does not close at the HOD. This is because the market usually overreacts to fresh news, which gets priced in through the duration of the day. Strong morning selloffs on no news, cheesy lunch BBC news article flash crashes and really any spike upwards without a logical justification are excellent places to enter a VIX short. This takes some getting used to but almost half my total returns over the past two months on this play have come from entering near the peak of a spike. And make sure to average in slowly. There is never a rush. Buy one option, wait five minutes. Buy another. Keep doing this until you have desired position size. This also prevents sinking all your capital into what could be a poor entry.

I hope this DD was helpful and thanks for reading. Unfortunately, I start work tomorrow and won’t be able to reply to comments for at least a few days, but I’m sure you guys can figure it out, get some nice profits, and crucify me for all the mistakes in a jiffy. Please, let me know what you think and how it goes if you would like to try the strategy! ![]()