Roth IRA info (for those that don’t know much about it)

You can generally contribute up to $6,000 or $7,000 per year to a Roth IRA (contribution limits vary by income and age, and may change each tax year). Maxing out your annual Roth IRA contributions is one of the best ways to impact your retirement savings.

The greatest benefit of a Roth IRA is that the money in the account can grow completely tax-free. You don’t pay taxes on any activity in the account, meaning there are no taxes on any capital gains or dividends you might receive from your investments.

For those that make a ton of money, a backdoor Roth IRA is a strategy used by wealthy taxpayers to get money into a Roth IRA, even if they earn more than IRS income limits. For example, for tax year 2022, joint filers can’t contribute to a Roth IRA if they have a modified adjusted gross income of above $214,000. For single filers, the limit is $144,000.

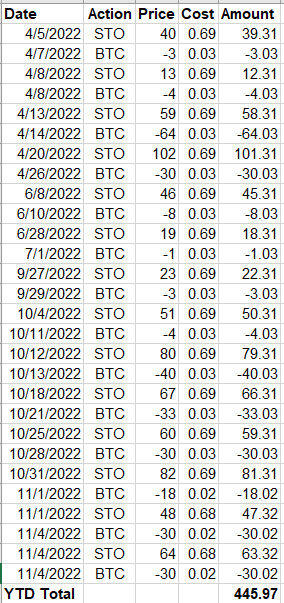

I’ve been using the backdoor approach for a number of years now and finally managed to get to 100 shares of AAPL in April 2022 (see below):

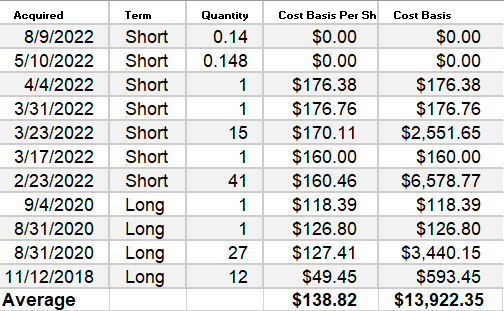

When I’m not busy with work or traveling, I like to sell covered calls on AAPL in my Roth account. Here’s my YTD:

While it’s not a huge amount, it’s slowly funding purchases of MSFT in the Roth, with a plan to sell covered calls on those as well. The is a slow process, but I’m hoping to pick up the pace for the remainder of the year, as I have been for the last couple of weeks. My strategy is STO at a ~0.2 delta and BTC at 50%.