[center][center][right]Text[/right][/center][/center]Ticker: $IMMR (Immersion Corp.)

Play Type: Long; Shares/LEAPS, long-hold. Possible swing for gapfill to the upside as well.

[u]The Company[/u]

I’m keeping my eye on IMMR for my metaverse watchlist. It’s core business model relies on dev/production/licensing of patented haptic innovation & software. They are a key component among hardware/software for the metaverse specifically for their niche in the haptics space. (Haptic feedback includes but not limited to feeling sensations from touch, impact, in some cases hot/cold, etc.)

Noteworthy Technicals: Potential Gapfill

Down -20.54% (monthly time frame); -2.87% (on the weekly).

Sector Notes: Metaverse(MV)

With other metaverse names like $RBLX & $ADSK (2 plays i was in on 12/8) moving up, and liquidity coming back into some of the beaten down metaverse plays, and small caps generally, I observe potential upside to be had particularly within metaverse(MV) small caps, as they often get sympathy runs when the bigger names that are dominant in the sector get the Pamp. Since this, along with other hardware plays haven’t really gotten their recovery, I see this as one to watch I have a share position and a starter ATM calls, expiry’s out to JAN and further.

This stock’s beaten down price action in the last month’s risk-off and oversold growth stocks has me watching for a reversal. It has held up well this week considering, and with a push of liquidity into the sector + a rallying SPY/overall market.

The biggest thing that got my attention with this play was the gapdown in the last month from ~$9.35 down to ~$7.70 and since has been sold off down to ~mid-$5 ranges.

If this can set some higher lows and take back $6.50 with some volume, i will be looking to capitalize on that potential gapfill.

Additional Notes:

On the Hardware/platforms sub-sector of metaverse plays I’ve been watching this and VUZI in particular, outside of the large core metaverse plays for a report I’ve been working on in assisting with research for a larger portfolio rebalancing, and as I am interested in (and have been) upping my portfolios MV exposure, I’ve been looking amongst the smaller hardware companies.

The biggest names among the emerging MV market are largely operating within the software/system architecture/GPUs, names like FB, ADSK, RBLX, AMD, NVDA, MRVL, etc. While it could be difficult with many smaller companies to compete for market share in that area dominated by sharks, the hardware sector for Augmented Reality (AR)/Virtual Reality (VR) for wearable tech, mini OLED displays, wearable intelligence systems, etc. has much more market share up for competition/collaboration between smaller niche companies with specialized applications.

Key Customers: Customers include automotive suppliers, gaming-device makers, and mobile-device makers. Apple, Bosch, Google, Nintendo, Samsung, Sony, and many other companies use Immersion’s haptic systems.

Other MV Companies w/in Report I’m working on, planning to share reports on individual companies produced when there is an additional technical setup forming:

$IMMR

$KOPN

$MTTR

$VUZI

$EMAN (a penny stock with military contracts and dual use applications for defense & AR/VR).

$META etf (one of my favorite plays right now for steady March upwards, buying ATM LEAPS for DEC2022, along with shares around $15 when I see it.

Catalyst(s):

Starting on JAN 5-8 CES in Las Vegas will host 1800+ leading tech companies in their respective fields and is one of the biggest tech shows for reveals and presentations of products currently in production or in the pipeline for various companies, a number of these names listed will be there, and it has the potential to shine a lot of spotlight on MV hardware plays and their roles in this exciting emerging market.

CES 2022

Metaverse(MV) Emerging Market

https://www.barrons.com/articles/the-metaverse-is-going-to-be-bigger-than-you-think-51638915709

*Caveats: I will be adding plays individually in separate threads for the several mentioned within the companies I’m researching for my current report related to a port rebalance weighting into MV hardware with lower analyst coverage as of yet. This is my second DD contribution, looking to expand largely within this sector for further posts.

Disclaimer: In my long term portfolios for a 3-5+ year investment horizon, I have Share positions and/or LEAPS on

- $IMMR

- $META (etf)

- $MTTR

- $KOPN

- $VUZI

- $EMAN

- $FB

—————

Going to update/build out further posts as my research gets more organized and I have a chance to really dig into the JAN5-8 CES show.

Update: Play on hold until indexes stabilize; I’ve hedged my long positions & got DEC23 UVXY $16c & $17.5c ‘s ; looking to hold as a hedge into CPI data, Biden talking about inflation, and will assess then, will likely re-employ that hedge for the JPOW Wednesday fed talk.

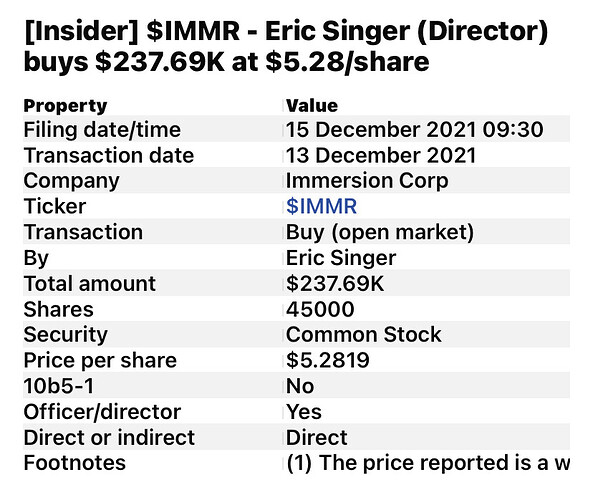

Sharing an update: Insider Buy Erik Gladwell (director)

(Edited as of 4:02pm 10/15)