Hello!

I’ve been wanting to make a journal for a while now, I believe it’s essential to learn from our mistakes and that will be easier by keeping track of what I’ve done/what I’m planning on doing.

This objective of this journal is to learn how to play SPY like a pro

I won’t do any callouts during trading hours unless I see a clear pattern forming; I’ll instead update my journal at the end of the day (hopefully) purely for my own interest.

I’ve already held a private trading journal, but I’ve always ended up dropping it, hopefully I’ll take care of this one a bit better.

[size=4]Introduction[/size]

First of all, I love trading, I love every single aspect of it, I want to do it until the day I retire, so this server for me isn’t about enabling my gambling addiction, it’s about making sure I learn as much as possible in the shortest amount of time to benefit me long-term

[size=3]My trading experience timeline:[/size]

-I started trading in 2016 (16 at the time, 21 now) on a paper account, I only played gold because it moved nicely intraday and my broker didn’t allow stocks, so I was unaware you could even buy that.

-I traded gold for about 2 years on that paper account, regularly doing 1k-50k challenges (1:25 leverage)

After that I switched to a live account and turned 500€ into 5000€ in about 3 months still trading gold (1:10 leverage)

-1 ½ year break

-Started trading stocks in November 2020 with $BNGO, I wanted to start with a bang, so I scoured the internet trying to find THE play, and found this, rode it from 0.5$ to 10$.

-I then re-took a break and the very next stock I played was GME, and I forgot everything I had learned for the last 3,5 years. I bought at ~10$ and sold at ~70$ on the way down. After that my focus for the next 6 months was finding “the next squeeze” (with some success from time to time)

-I then joined a trading community and lost 4k + 140$ in membership fees in 2 months

-Took another break until IRNT and found Valhalla

So, all in all I have about 3 years’ experience

There you go, that was all of it

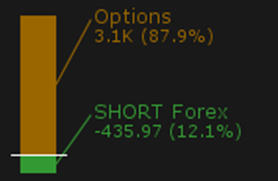

Now for the fun part: I have my 4k back

The 26th of Jan 2022 was the first ever option contract I played but I had decent entry-level knowledge about options from hearing about it so much

I had a very lucky week and nailed every single earnings plays I made thanks to the forum and the trading floor. FB, UPS, AMD. And that brought my balance to 1.1k just in time for the challenge.

The objective of this journal is to learn how to play SPY the same way I learned to play Gold.

The gains I made on gold might have been luck, but at the time I was looking at the chart 10 hours a day and after a while I could tell where it was headed just by looking at it, no need for lines, indicators or whatever.

So, the objective is to arrive to a same state with SPY

So far, I haven’t had any success trading SPY options at all (-435$) but it’s a fee I’m wiling to pay to learn.

It’s going to be a learning experience, I will lose a lot, I’m 100% ok with it (I might trade with a paper account, not sure yet)

Now, for my first update.

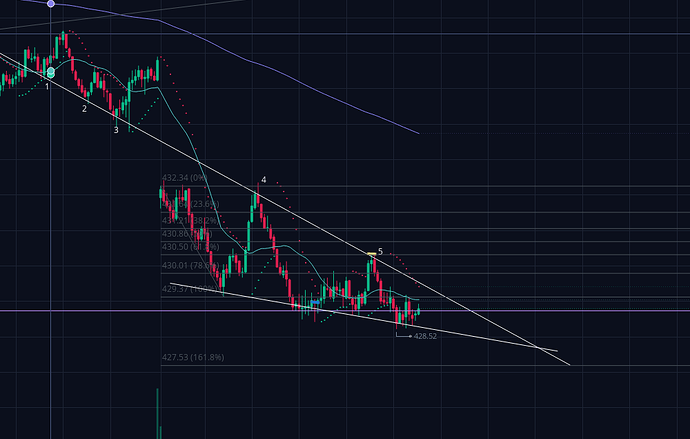

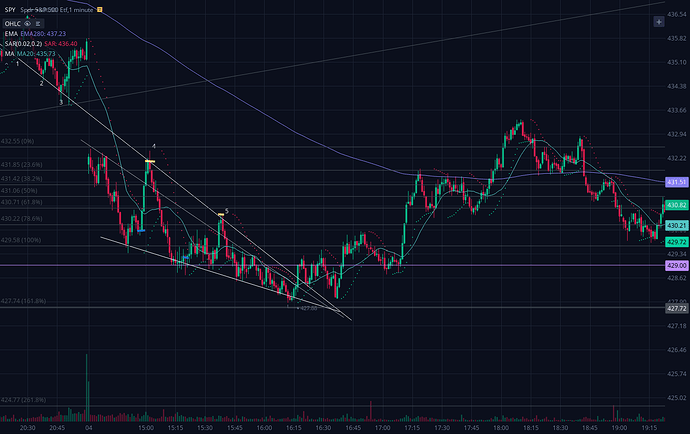

[size=4]March 3rd 2022[/size]

I had spy puts that stop triggered during an unexpected run-up & came out at break-even, I was too distracted with RSX, and couldn’t act on it to take profit.

So first lesson: when you have shit open on spy, keep watching.

See? I’m learning already

See you tomorrow ![]()

PS: Pardon any typos or whatever, English isn’t my first language