ESSC

While the January calls for ESSC aren’t exactly a terrible idea, I will take a moment to say that this specific play is not expected to continue into next week. T+2 theories have never worked out in our research and all evidence points to a run having happened this week if one was to come. I’m going to properly digest ESSC more next week, but all I’ll say is that we’ll keep a watch on it and if something looks to be forming, we’ll call it out.

Take a Breath

This weekend, take a break. I know a lot of people here took a hit on ESSC. Whether you lost your cost basis, or you’re upset about gains that weren’t realized, it’s probably best if you take some “you time” this weekend to get your head clear:

- Go for a walk.

- Go grab some dinner.

- Go see a family member you haven’t seen in awhile.

- Take a weekend trip.

- Do a movie marathon.

- Do something nice for your spouse if you have one. If you don’t, treat yo self.

Just do something that isn’t obsessing about stocks and your current position. If you’re in a constant state of panic, you’ll never be able to clear your mind enough to obtain the confidence you’re going to need to come back from it. Someone asked me privately how I bounce back from huge losses and I feel like my strategy for it is simple and super delusional so I think everyone here will have no problem following it:

- I take a break like I said above, which is arguably the most important and often neglected part. You. Yes you. Get the fuck outside, or stay inside I don’t care, just don’t worry about stocks and shit this weekend.

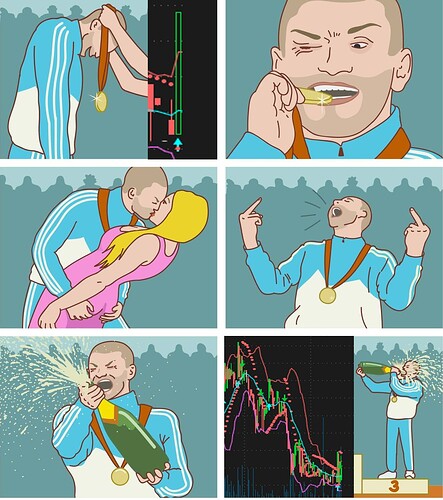

- I look at what could have been as an achievement. Using IRNT as an example, I look at how much I was up as a win. I look at it as an example of what I’m capable of. I was able to get in on a play early, I rode the fuck out of it and I saw more money than I had ever dreamed I could’ve made flow into my account. Unrealized gains are gains my friends in times like this. You accomplished something that most traders don’t. Most traders struggle to ever see green at all. But you did that and more. Sometimes, we need to be the guy in the AGC meme:

[floatl][/floatl] - I figure out where I went wrong. What happened, how can I change my approach to ensure that should the opportunity arise again, I’m ready for it. This is crucial, you’ll never grow as a trader if you don’t harness what you have now and use it as motivation and drive to never feel like this again. If you didn’t cover your cost basis, learn how to do that shit, if you didn’t trim, learn how to do that shit. Learn how to make sure that you’re ready to fuck up whatever opportunity comes next… because there will be one. There always is another play.

- I double down on the delusion. For plays like these I look at how often they occur and I think “This was a ticker that I knew nothing about two weeks ago. I took a position and saw a fuck ton of green from it”… and then:

- I FUCKIN DO IT AGAIN BITCHES. Because you and me? We’re fucking awesome. You know how many of these fucking plays we’ve fucking played in the last fucking month? Like fucking four. FUCK YEAH. Get fucking hungry, get fucking motivated, did you hear a bell? Oh, you did. Oh, well I guess… OF COURSE YOU FUCKING DID BECAUSE I’M FUCKING THAT SON OF A BITCH RIGHT NOW AND THE LITTLE DINGS ARE JUST THE SOUNDS OF ITS SUBMISSION TO MY SUPERIORITY. I’m coming back after my own personal Rocky montage ready to knock the fuck out of whatever play comes next because we. are. GODS. You are, I am, we all are, together.

The only way you truly fail in life is if you let your losses rule you. If you learn from your mistakes and correct the flaws they’ve exposed you will constantly get better and will at some point reach your peak as an individual, which I have faith is a life that makes you happy and comfortable. This play was sidetracked by forces that are in our control. I for one am excited to see what happens when we do so. There will be another play my friends, it’s back to work in #analysis-due-diligence in the meantime.

To quote Zach Morris “I fucking love penis”… shit wrong quote… “I love you guys”. Have a good weekend.

This post is proudly sponsored by: wish.com