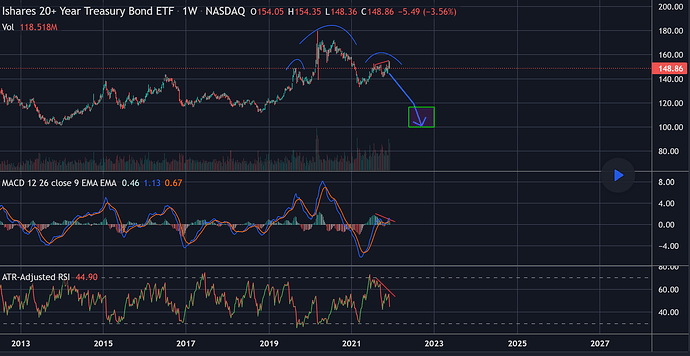

TLT- iShares 20 Year Treasury Bond ETF — This offers exposure to long-term Treasuries with a maturity of 20 years or greater for investors in an ETF format. As demand for long-dated bonds increases, this chart moves upward. Similarly, TLT moves inverse to 20+ year bond yields.

Background Info

There is a great mispricing in the bond market because of the Fed’s intervention. When short-term rates drop to near-zero, the fed will buy the long end of the curve to lower yields. By lowering long-dated yields, the Fed is encouraging other lenders (whether mortgage or business) to lower their rates effectively resulting in QE.

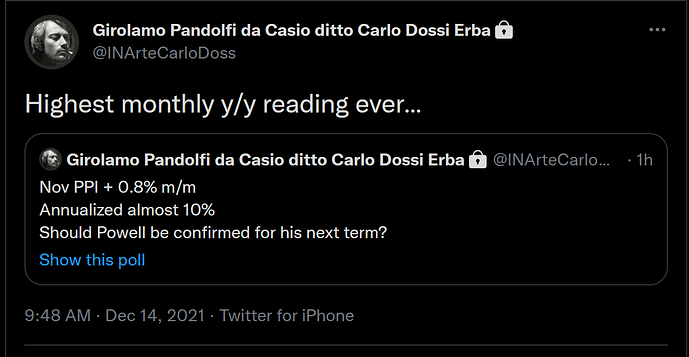

The Fed was currently purchasing ~$80B in treasuries on Nov 1 and is supposed to taper $15B each month. This taper would effectively lead to 0 purchases by mid '22. Higher inflationary pressures would cause the Fed to speed up its taper.

The Opportunity

As a bond investor, you’d like to at least breakeven on your investment by the time of maturity. Hence, the effort into “bond breakeven rates”. Currently, the 20Y treasury has a yield of 1.86% while the breakeven rate is 2.6% as of Dec. 1. So, when the Fed stops suppressing yields, the 20Y+ yields would at least come up to where market demand would be at breakeven.

If TLT were to return to its respective price of the breakeven for the 20Y, TLT would drop to ~$120/sh. If inflation continues to run hot, you’ll see this fall even further. However, the play is just betting on the mispricing in 20Y+ yields as a result of a manipulated market returning to a free market.

If you’re familiar with George Soros’s GBP play when it moved from a manipulated market to a free market, I believe this is similar. For those that don’t, the GBP was effectively overvalued at a fixed rate and GS put pressure on them to break free of the fixed-rate causing the GBP to tank.

The Risks

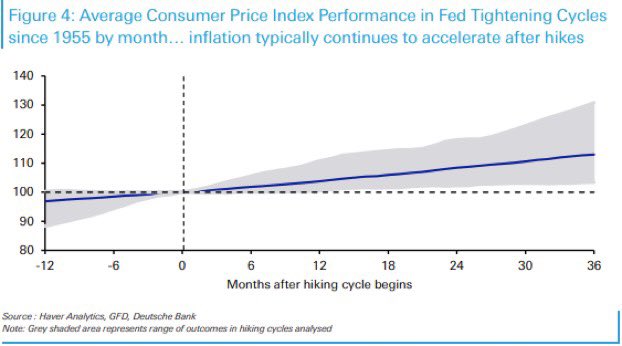

Steepening of the long end of the yield curve occurs during times of inflationary pressures. So, if the market has deflationary pressures, this would cause the long end of yields to fall and TLT to rise (and ultimately you getting rekkt). One deflationary risk that many people are pricing in is the Fed hiking their FFR from 0.00-0.25% to 0.25-0.50%.

Counterargument to Rate Hikes

I believe that the Fed cannot hike rates despite their publicly stated intentions. The reason is, the economy is fragile (not necessarily weak). With the now Omicron outbreak and every preceding/following outbreak the economy is stressed. The Fed historically hikes rates during periods of economic strength and resiliency. Furthermore, the effective rate needed to stop inflation is much higher than the US government can afford. So, inflation will continue to run hot similar to the 1940s, not the 1970s. The reason for this is that the US was a net debtor then, as it is now. In the 1970s, the US was a net creditor nation and Volker could afford to raise FFR to 20%. Essentially, I believe the Fed’s hands will be tied and forced to let inflation run and let technology force the deflation over the next decade.

LMK what you all think. If I’m allowed, I can let you know the specific strikes I’m looking at .

Cheers.