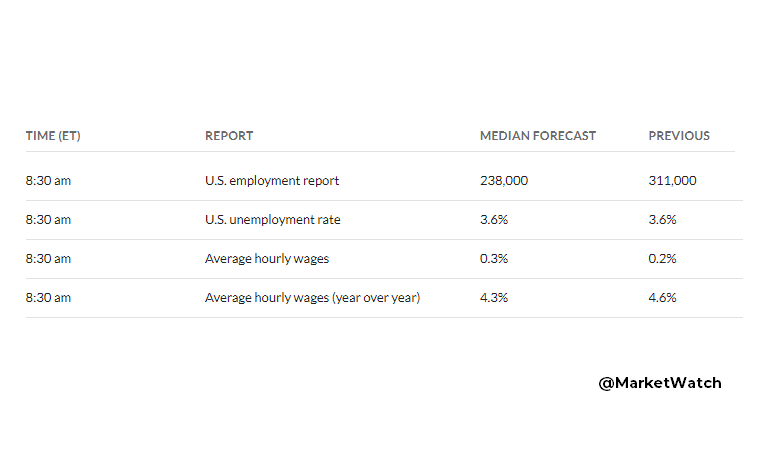

NFP seems to have landed a goldilocks print with market consensus shifting back to a quarter-point raise in interest rates now expected. Odds of a 50 basis point hike were 68% yesterday; this morning down to 28%.

SVB will likely weigh on the financial services sectors and crypto with the rest of the market seeing a counter-trend rally as this shift in interest rate expectations gets priced in.

It seems the chilling effect of the SVB closure will outweigh any optimism that might have taken hold on the jobs update.

Certain auto model-year changes will exclude them from the y-o-y basket for CPI calculations. Seems oddly timed to skew the CPI numbers. New vehicles index measuring price change

U.S. Producer Price Index - February

PPI Y/Y: 4.6% vs. 5.4% expected

PPI M/M: -0.1% vs. +0.3% expected

CORE PPI Y/Y: 4.4% vs. 5.2% expected

CORE PPI M/M: 0.0% vs. +0.4% expected

JPMorgan: “CPI doesn’t really matter. What happened over the last 3 days has done Powell’s job for him. Credit creation at banks will collapse & the economy will slow. Inflation will taper off as a result. Any rally on the view that the Fed doesn’t need to raise anymore is silly. If they don’t raise, it’s because of systemic risk to the banking system. Not a positive.”

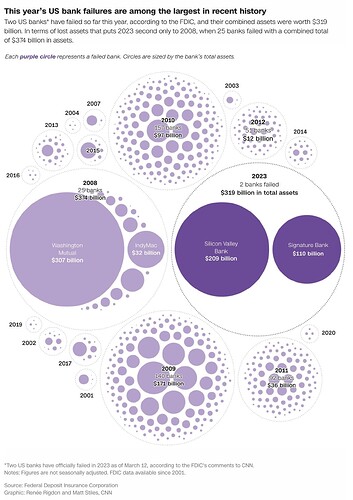

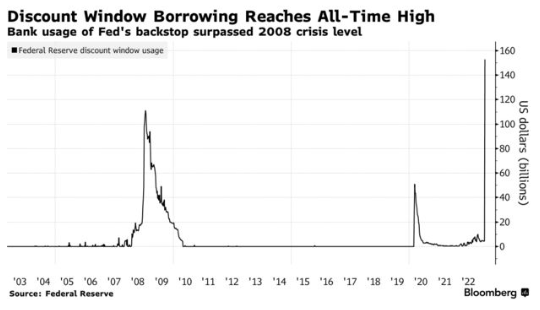

Banks borrowed a combined $164.8 billion from two Fed backstop facilities in the most recent week, a sign of escalated funding strains in the aftermath of SVB’s failure.

Data published by the Fed showed $152.85 billion in borrowing from the discount window – the traditional liquidity backstop for banks – in the week ended March 15, a record high, up from $4.58 billion the previous week. The prior all-time high was $111 billion reached during the 2008 financial crisis --Bloomberg

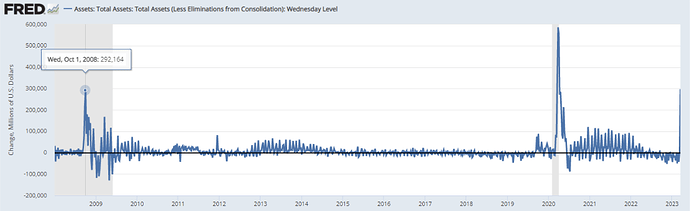

All told, the emergency loans reversed around half of the balance-sheet shrinkage that the Fed has achieved since it began tightening – allowing its portfolio of assets to run down – in June last year. The central bank’s reserve balances jumped at the same time by some $440 billion in a week – which “basically reversed all the Fed’s QT efforts” according to Capital Economics.

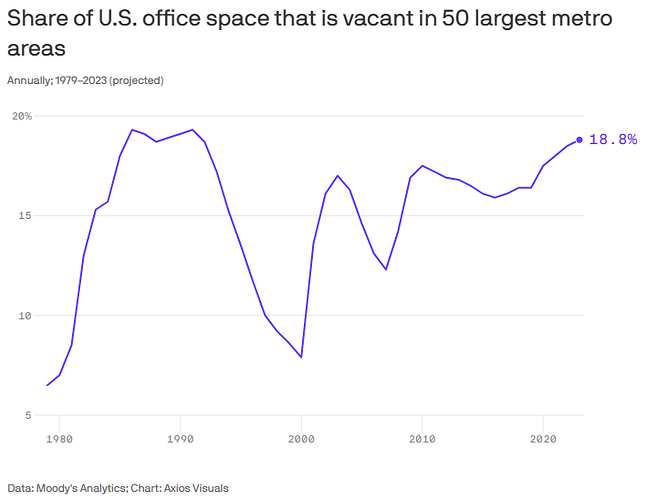

Office vacancy levels are approaching highs last seen during the savings and loan crisis in the 1980s.

A top Federal Reserve official has said she expects the US central bank to implement one more quarter-point rate rise in its battle against high inflation, despite lingering concerns about the stability of the banking system. Susan Collins, president of the Boston Fed, on Thursday said inflation across the country remains too high, arguing there is “more work to do” to get it back to the central bank’s 2 per cent target.

@FT

Following the Fed’s Collins speech, market odds for 25bp hike are up to 54%

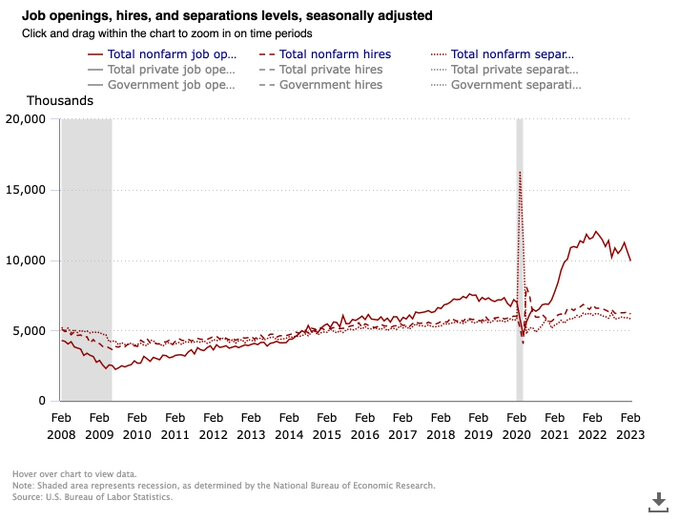

JOLTS below ten for the first time post-pandemic, not a good sign for the overall health of the jobs market.

Atlanta Fed’s GDPNow drops to 1.7%

Good read on how trading Economic Data releases might not be the most optimal trading strategy.

With the Fed’s blackout period fast approaching, Bloomberg text below is oddly specific:

Federal Reserve officials are signaling they plan to keep interest rates steady in June while retaining the option to hike further in coming months, steering market expectations ahead of a key employment report. @Bloomberg

There haven’t been many macro themes in play today other than the attention that has been placed on China’s Q2 GDP being weaker than expected and Russia suspending its Black Sea grain deal with Ukraine.

Overall, the U.S. stock market has remain wedded to its belief that the economy can avoid a hard landing, that the Fed is close to being done raising interest rates, and that the Q2 earnings reporting period will corroborate analysts’ expectations that earnings growth will return in the second half of the year.