Shifting this thread to a discussion of the posts in Today’s Economic Data so that posts there include only the data posts.

Thanks for this data, bud.

I know LEI touched -1 back in August, shouldn’t take too long now before a royal flush.

I’ll keep piling puts on 1 stock until then.

Indeed, for anyone looking for a bit more context on the LEI as a recession indicator

Yeah, I hope everyone reads up on that.

Bond yields at heights not seen since the last great housing crash, forex wars, oil related stocks booming, LMT running non-stop, and Japanese gif gracing TF after 6pm.

Way too many indications of an impending big move downward.

The data is all there right in front of us. Just have to be patient is all.

2023 will be a bloodbath.

I’ve fixed the bug causing old posts in this thread to generate TF notifications days later. Thank you for your diligence in keeping this updated ![]()

Thanks kindly, no more false alerts!

- December Pending Home Sales 2.5% (Briefing.com consensus -1.0%); Prior was revised to -2.6% from -4.0%

This big shocker in positive Pending Home Sales represents aggregate demand in the economy. First sign of fed easing and demand starts rushing back in.

Jpow needs to tread the Wednesday FOMC conference carefully.

I usually catch these updates on the forum activity stream in Discord, but thank you for posting these every day dude, they’re really nice breakdowns of each day and the added context is mucho appreciated by dummies like me ![]()

Thank you kindly!

Really like reading your breakdown of economic indicators, helps put numbers in perspective!

Thanks kindly!

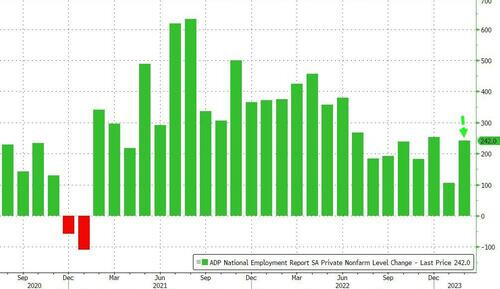

Tomorrow watch out for ADP numbers versus JOLTS. A soft landing as per JPow entails JOLTS to decrease while maintaining decent employment numbers.

Therefore, I think:

- Soft Landing (Bullish) would be ADP more than expected vs JOLTS less than expected.

- Stronk Economy (Bullish = Bearish = Bullish = Bearish) would be ADP more than expected vs JOLTS more than expected. In the current specific macro climate though I believe a stronk economy would be “bearish” because it is inflationary, and right now the markets are fearing inflationary data.

- Recession AKA Hard Landing (Bearish) would be ADP less than expected vs JOLTS less than expected

Correct me if I’m getting that wrong. Thanks.

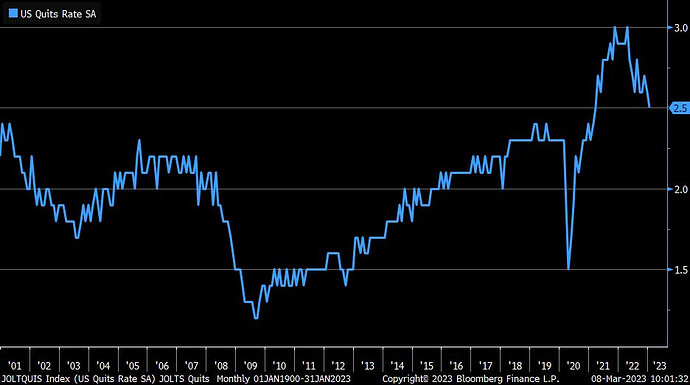

JOLTS quits rate moved down in January to 2.5%, which is still elevated relative to history but lowest since March 2021

Private payrolls rose by 242,000 in February, better than expected, ADP says

January JOLTS job openings at 10.82M vs. 10.55M est. & 11.23M in prior month (rev up from 11.01M)

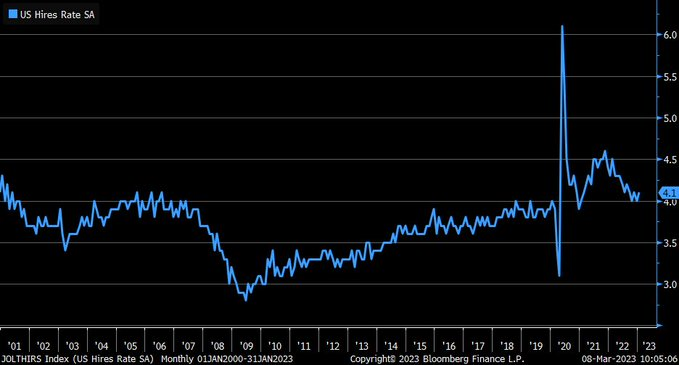

JOLTS hires rate edged up to 4.1% in January … down from 4.3% a year earlier

So looks like the ADP and JOLTS are suggesting a stronger economy than forecasted, for these prints.

- Stronk Economy (Bullish = Bearish = Bullish = Bearish) would be ADP more than expected vs JOLTS more than expected. In the current specific macro climate though I believe a stronk economy would be “bearish” because it is inflationary, and right now the markets are fearing inflationary data.

However, Friday will be showing more jobs data that JPow specifically referred to in his recent testimonies I think? Should be more relevant than ADP.

JOLTS though… more job openings than expected is not what the fed is hoping for.

US jobs market has remained stubbornly robust, numbers out today do nothing to shift this narrative. The market seems to be pricing in a half-point hike next cycle instead of the quarter-point previously expected.

With market participants concerned about a tighter labor market driving the Fed to keep raising rates, today’s higher than expected initial claims reading provided a measure of hope that Friday’s employment report will be on the softer side as well and prove to be a placating factor for the Fed.

Non-farm Payrolls at 311,000 came in higher than expected (225,000 forecasted) compared to 517,000 previous.