Disclaimer and Intro

I am very new to this so please conduct your own research and correct my assumptions/statements below. As someone in the supply chain space, I’ve heard from others and know for myself that trucking companies are printing cash in this supply chain crunch. Therefore, my research started off a hunch of positive earnings reports and accompanying price run-ups.

I confirmed my hunch with some examples from last week and I think there’s enough to make an educated guess that KNX, LSTR will have strong earnings and a post-release run. If KNX or LSTR run anything like the below three did last week, there should be an opportunity to make some morning gains. It looks great for scalping and maybe some options plays.

Both companies are heavy on moving truckload freight and 3rd party logistics services, which were big winners for HTLD, PTSI and JBHT last week and had strong growth in KNX/LSTR’s Q2 2021 earnings. Both have beat EPS estimates in the last 4 quarters.

Knight-Swift KNX - 10/20/2021 before market open

Expected to beat EPS and had positive indicators from a recent Zacks article. The stock’s price has been on an upward trend but is down approx 7% from an August 30 peak

Q2 2021 Earnings Slides: https://s24.q4cdn.com/286931391/files/doc_financials/2021/q2/Q2-21-Qtr-Earnings-Slides.pdf

Zacks Q3 Research: Knight-Swift Transportation Holdings (KNX) Reports Next Week: Wall Street Expects Earnings Growth

Landstar LSTR - 10/20/2021 after market close

Expected to beat EPS - had some positive indicators from a recent Zacks article. The stock’s price has been on a upward trend all year but actually is down from its peak at the beginning of May.

Q2 2021 Earnings Release: Landstar System Reports All-Time Quarterly Record Diluted

Zacks Q3 Research: Landstar System (LSTR) Reports Next Week: Wall Street Expects Earnings Growth

Last Week’s Trucking Earnings

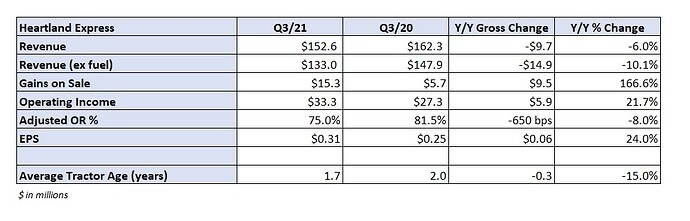

HTLD - 10/14 at 09:00

Overall: Missed, but some positive notes. Closed 10/13 at 16.28, opened at 16.47, peaked at 16.87. Pulled back at 12, lost all gains, then closed at 16.76. Closed Friday at 16.57.

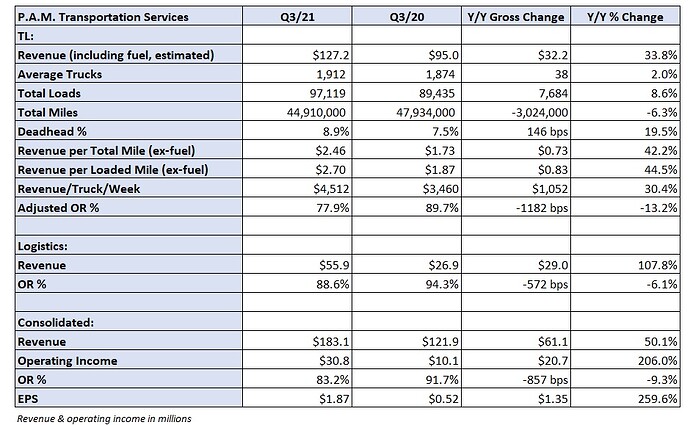

PTSI - 10/14 at 17:00

Overall: Beat. YoY rev up 50.1%, truckload rev was up 33% while logistics rev was up 108%. Closed on 10/14 at 46.09, opened at 47.50, peaked at 57.87 at around 12pm, slid, and closed at 54.5.

https://www.freightwaves.com/news/pam-transportation-navigating-the-disruptions-leads-to-a-big-q3

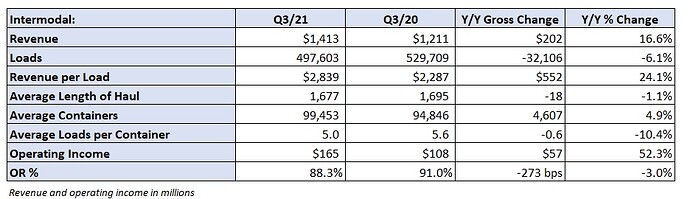

JBHT - 10/15 at 07:00

Overall: Beat. YoY rev up 27%. Closed 10/14 at 175.24. Open at 185. Close 190.55. Peak at about 192.79, 52 week high.

https://www.freightwaves.com/news/supply-chain-hurdles-not-high-enough-to-thwart-j-b-hunts-q3-beat

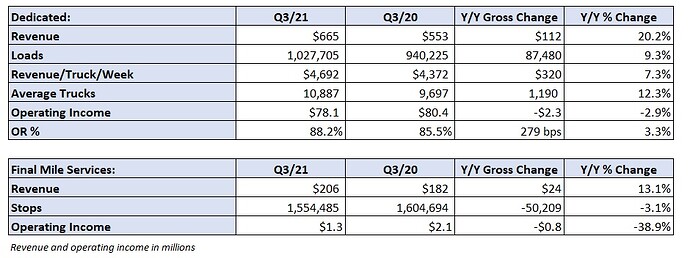

Truckload rev up 87% YoY. Logistics rev up 54%. This is in face of rising fuel costs and wages.

Intermodal rev up by 16.6% YoY but comments that delays in flipping intermodal loads have limited revenue. Customers cannot unload containers fast enough to maximize profitability.

Dedicated/final mile (large appliance delivery/install function): Rev up 20%, but income down slightly due to investments in wages and fleet

Other Supply Chain Earnings This Week

I didn’t do research into these (yet), but just wanted to point them out as potential plays:

- Canadian Pacific Railway CP Canadian Pacific Kansas City Limited Earnings Whispers

- CSX CSX Corp. Earnings Whispers

- Union Pacfiic UP Union Pacific Corp. Earnings Whispers

- Covenant Logistics CVLG Covenant Logistics Group, Inc Earnings Whispers