Impressive. Interested in your entry strategy. What are you looking at? I’m getting profitable with SPY scalps, but seems like every time I enter it drops a bit more, and I need to average down to see green. Trying to get better.

For most of my scalps (excluding news events and big catalysts,) I am looking at established supports and resistances while also watching AAPL. Usually if AAPL pops, SPY pops. Although this is not always the case such as this last week with all the bank fun.

I also look for consolidation that lasts around 15 min from any big drops (although this has bitten me in the ass before) if there’s consolidation like this, I would look at what the major underlyings are doing to see if I can expect a pop. Multiple times this week it has dropped from consolidation mainly due to overall market downtrend and the banks going for a nice bleed.

You can play those drops pretty well on the call side too. Look for any previous supports that is has bounce on or that is has held recently. But once again, this can go wrong based on news and overall market sentiment.

I also find myself in places where I have to average down and this is also my biggest weakness. I overcommit to averaging down a lost position instead of cutting.

Also, unless you’re scalping within a 1m candle, don’t watch the 1m. It’ll drive you crazy

EOW Post.

Was terribly busy with work this week and couldnt focus a whole lot on trading.

I was able to play FOMC and Powell though and made the majority of this week’s gains during that day. That was a very successful day of trading from being pretty cautious and not holding through the drop and the meeting.

Played SPY calls prior to FOMC, watched the market reaction to the release, played SPY calls and exited before Powell spoke. Then played calls as soon as Powell was done and got out of those faily quickly. Glad I did because the market decided to take a little poo after the post-powell pump.

Even though it was a light trading week, I am still up 3.3k and the account is at 33.5k.

Hopefully everyone else saw green this week.

Have a good weekend everyone.

![]()

EOW post.

Slow week as I didn’t get to trade much with work being busy.

Took some 400c 1DTE SPY gambles to hold overnight on Monday which I don’t usually do. Closed those for a loss,

After LULU earnings, took a 370 FD call that I averaged down on and took a loss on those as well.

Super small positions that didn’t hit the account hard at all. Either way, both were trades I shouldn’t have taken.

I also made the decision to switch from Webull to ToS last night. Mainly to get better fills, have a more robust interface, and to dabble in futures in the evenings where I am behind the computer.

So I completely emptied out my Webull account and have to wait for it to hit my bank, then will transfer over 30k to TD/ToS. This is probably going to take over a week so it’s a good possibility I won’t be trading this coming week.

I might just paper trade on ToS in the meantime to get used to the new interface and find a setup that fits my trading style. (Shoutout to those of you that shared their setup with me)

Overall, I’m going to start taking trading a little more seriously this week since my company counterparts have a lot of holidays this month due to Passover so it should give me the flexibility to actively trade.

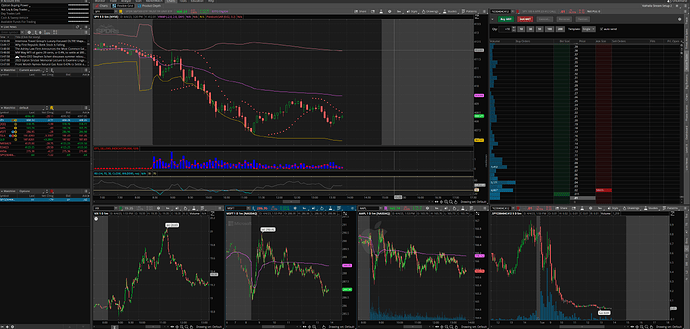

So while I am waiting on TD to process my deposit so I can begin trading on ToS, I’ve been messing around with different layouts based on a couple of y’alls setups and Conq’s stream setup.

This is what I’ve currently come up with and am just writing down these thoughts to make sure it makes sense:

I have three different watchlists on the left; Current Positions, General Tickers, and one devoted for options.

General Ticker Watchlist is linked to the big chart.

Option Watchlist is linked to the Active Trader and the chart below. If an option I want doesn’t exist on the watchlist, I can just select it via the dropdown in Active Trader.

The Three charts under the big chart are mainly there so I can keep on eye on SPY’s big movers and VIX.

Overall, I can tell this will take some getting used to. I am super impressed with the customization capability this has and makes me question why I have waited so long to switch over.

Looks really solid! Here are a couple tips for optimizing the platform so it runs as fast and smoothly as possible:

**1. Increase the max memory allotted to the platform -

-

Login Screen . Click on Gear at bottom left

-

If you have 4GB of RAM, set the min/max to 512/1536

-

If you have 8GB of RAM, set the min/max to 1024/3072

-

If you have 16-32GB of RAM, set the min/max to 4096/6144

2. Change Internal Settings from Default:

-

Setup> Application Settings> System> Change to: REAL TIME (No Delay) Data.

-

Setup> Application Settings> System> Active Trader – AT Rate: 0, Price Ladder: 3.

3. Delete USERGUI Folder:

- Exit TOS and Right Click> Open File Location > Select the USERGUI folder and delete it.

*4. Remove volume from AT ladder: Worth doing if you experience input lag when placing orders.

Alright, first week of trading on ToS has been a success, well three days of trading at least since my funds didn’t clear TD until Tuesday and I have military duty tomorrow. Anyways, what a beast of a platform.

I am able to chart and mark levels so much easier which drastically helped when identifying more supports and resistances.

Positions played this week: AAPL, QQQ, and SPY.

First time playing AAPL and QQQ in quite a while since I mainly stick to SPY.

Going to keep this short since it was a pretty boring trading week.

P/L for the week is $1,730 not including contract fees.

![]()

Mid-week update.

Man, ToS is a beast.

My setup is very comfortable now and I can scalp/trade with ease.

Last few days I’ve mainly focused on SPY of course, but today I decided to play a heavier hand on SPX.

Still only trading a few contracts to get used to the price fluctuations, but overall I like it better than SPY for day-trading. I don’t have to buy as many contracts as I usually do with SPY. My starter SPY positions are anywhere from 5-10 depending on the strike and premium.

I still mainly watched the SPY chart due to the price action being mainly the same from what I can tell.

So far this week, I am up somewhere around 2k. P/L for a given time frame is harder to tell on ToS.

Wish me luck in my SPX endeavors.

![]()