So full disclaimer to get this started, I am posting this to see if you guys might have some more insight and knowledge on a potential play. I have never done a DD, so before railing me at least use some lube LOL!

I have been feeling like Disney has the potential to come back with a vengeance, since this will be the Spring and Summer Homecoming post COVID and the regulations that accompanied it. I live near the Mouse and visit him occasionally, you can definitely tell by traffic on 95 when vacationers start dropping down.

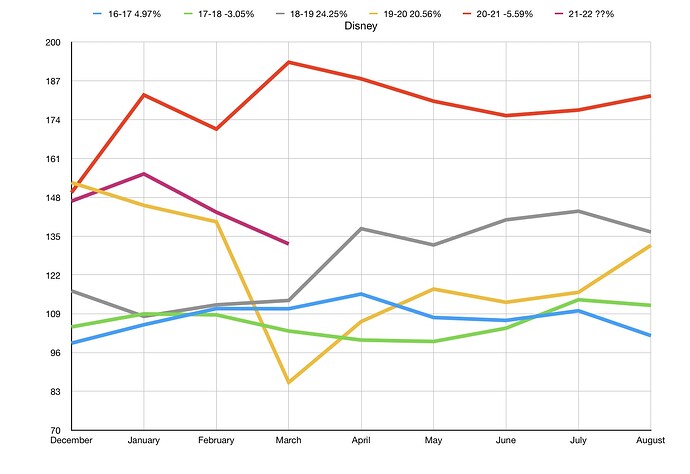

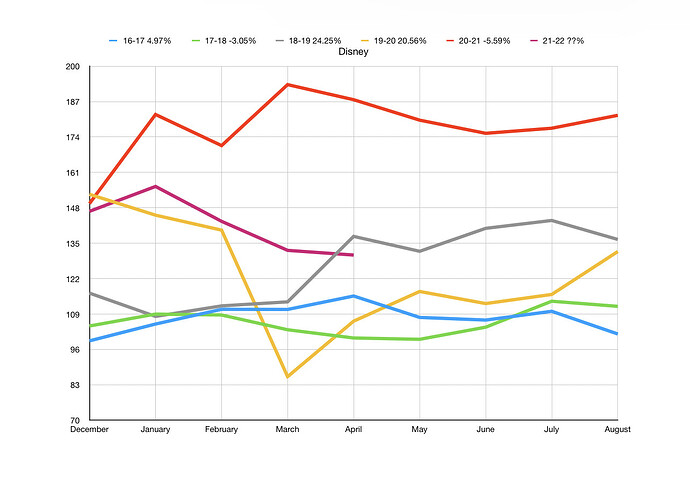

I pulled the past 6 years from Dec-August to get a feel if any of when traffic increases to its stock. This is what can be seen.

What I believe I’m seeing is similar increases in price from the Winter running to the Spring. Out of the 5 years that have passed 3 of 2 show a similar positive increase in stock price from March to April. The percent changes listed next to the year are actually the change only from March to April.

From a quick glance I think that the 19-20 COVID year looks to be a good comparable for this year as both have negative world catalysts affecting the respective years. Even during COVID the Mouse rebounded and had gains going into Spring and Summer from its March low.

So since I am a broke trader, I have started getting fills on some Mickey Mouse Clubhouse FD’s that hopefully will pay for my annual pass this year. I have Jan 2023 $250 C with .52, .40 and .37 fills. I have orders in for 2 more at .30 and 2 more at .20 in case Putin does something crazy and the market decides to drop more. Other calls getting closer to the money are pretty cheap as well just outta my league though. My target price to sell is $150-$160. Insert PepePray. Long Live Valhalla!!

Was able to get another today (Feb 14) at .35, I switched my future orders to 4 at .20.

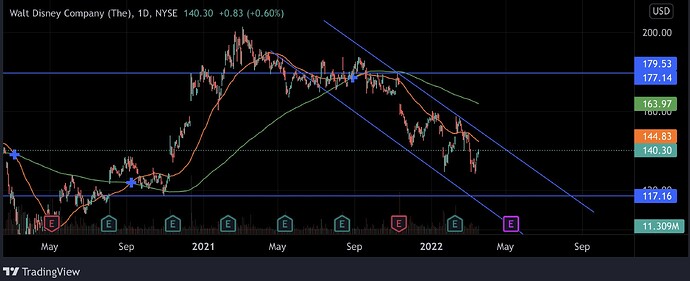

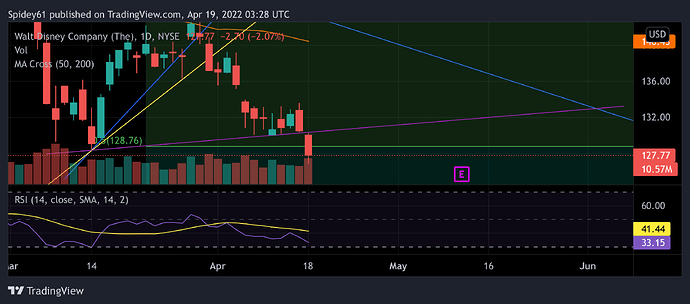

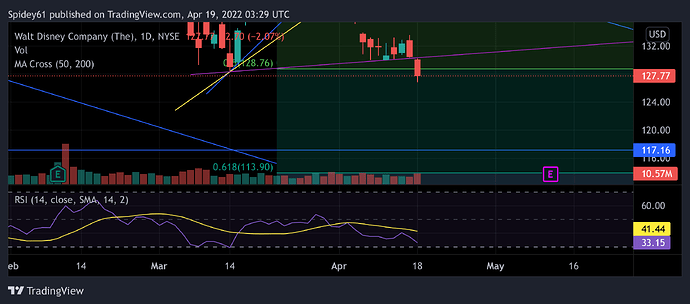

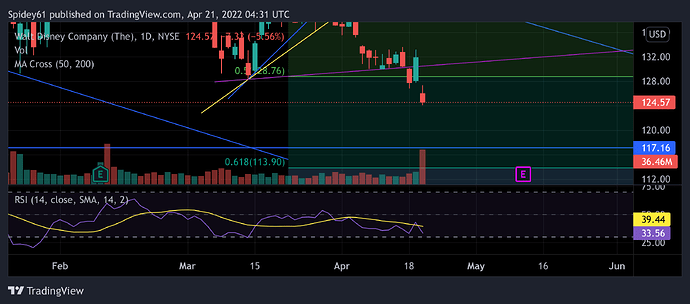

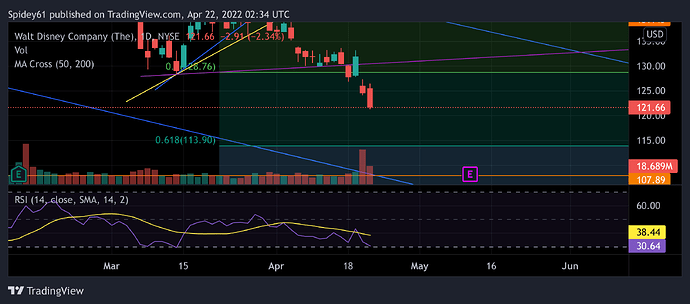

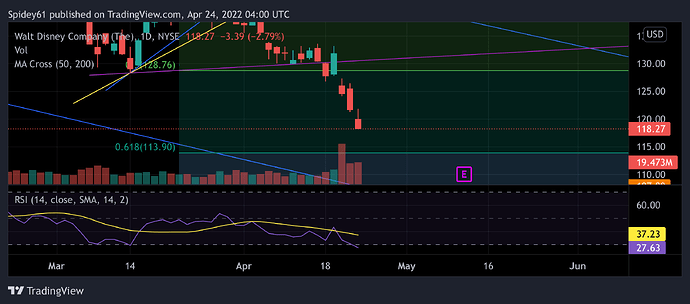

Been trying to look deeper into the Mouse chart in hopes of hopefully seeing some sort of outlook. So Disney is in what looks like a descending channel. I checked SPX and other big stocks and many are in similar channels. SPX though has broken above its channel for the past five days. The view below is an updated and mag view of the above.

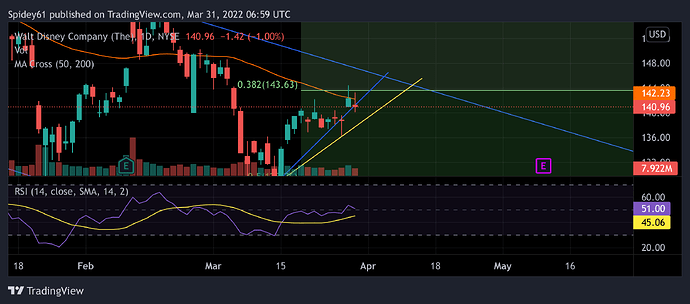

The chart above is from EOD MAR 23.

From this mag view, looks like Mid-April for a possible move up (upper channel intersection) as long as it doesn’t get rejected by the 143.65 level or a move down further in the channel by the gravity of SPX post death cross and or Cata-Putin-lyst. Kinda hoping for some more movement down to get even better fills. Would love to have 20-30 contracts before it starts moving up so I can break the sell orders into several groups.