Hey guys I’ve been wanting to write this up for a while now, but I’ve been super busy between a cross-country move and the holidays.

Apologies for the barebones nature of this post, but I’m just going to lay out a basic thesis now while I have some downtime at work and then make updates and improvements later on when I have more time.

If you pay any attention to the global coal market you’ll know that coal prices hit an all time high and then plummeted last fall primarily because the Chinese government set a price ceiling and tanked the market. Classic China stuff. Accordingly, pretty much every coal producer’s stock fell off a cliff, but many are now on the rebound and have regained significant ground.

There have been some other interesting developments in the US and globally that I think will continue to drive demand for a specific type of coal called coking coal or metallurgical coal, which is used to produce coke which is in turn used in steel production.

The first major thing is obviously the US infrastructure plan creating a big demand for steel and the coal needed to produce it.

China also somewhat recently started a trade war with Australia and banned imports of coal from the country, which was historically its largest supplier. As such, China is turning to the US–among other countries–so that the country can continue to produce steel and also so its citizens don’t freeze to death.

In addition, Indonesia (the fifth largest coal producer in the world) also restricted coal exports due to fears of falling short of domestic energy needs. At first Indonesia totally restricted exports, but they have since walked that back and allowed some trade to resume.

I think that these factors make for a strong bull case for US producers, especially those that specialize in metallurgical coal.

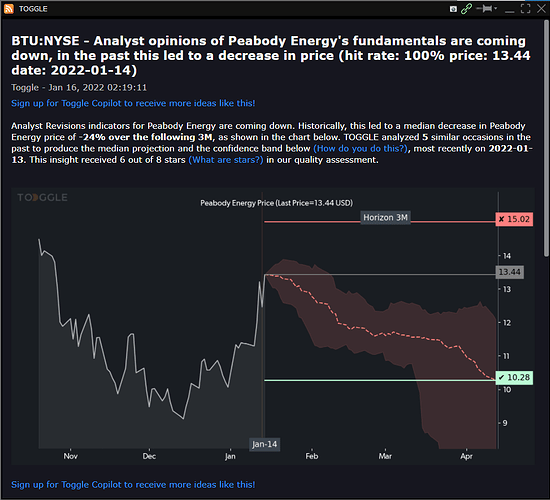

The company I’m most interested in is Peabody Energy ($BTU). Their stock hit a high of nearly $20 last fall before falling down to about $9. Currently it’s on the rebound and trading in the $13-13.50 range. The daily chart has been forming a really nice rounded bottom and after $13.50 I don’t see big resistance until about $15.50 and not until around $20 after that.

I have also been watching Warrior Met Coal ($HCC) and have profited from calls on this already, but it is already near it’s high of last fall so I’m less sure of the upside here. I’m watching for a break out of the ascending wedge it’s in currently.

There are a few other tickers on my shortlist but some of them are just too pricey for my account. They may be of interest to others here, though. Those tickers are:

- SXC - Suncoke Energy - This one is actually quite cheap

- ARCH - Arch Resources

- METC - Ramaco Resources

- AMR - Alpha Metallurgical Resources

Here are links to articles for further reading if you are so inclined:

argusmedia.com

Reuters

NPR

S&P Global

That’s all I’ve got for now. Any and all feedback is deeply appreciated. If anyone gifted in the TA department could get out their crayons that’d be really helpful too!

Disclaimer: not financial advice from not a very smart localwoman