No options. Would have to short directly so more risk

Unfortunate. Would have been nice

DEM has options and is far from all time lows. Here are all ETFs with Russian exposure. ETFs with Russia Exposure

Missed that part… sorry for the false hope.

Although XOM is at a relative high, it seems like a serious buy at the currently oil prices with current near term outlook. Today they released a plan to “double earnings”. With XOM as a dividend stock, it feels like this is a safe bet for a healthy return unless I’ve missed something.

Didn’t intend to call you out, was just point out that this is a little different in that, there’s way too much negative sentiment.

No worries. My feelings weren’t hurt.

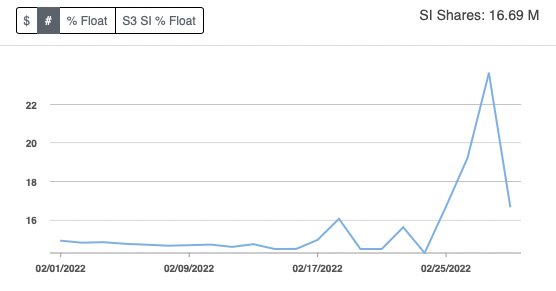

Looks like we had some decent short profit taking of roughly 5M shares according to s3. Wouldn’t really look too much into this at this point but it would explain why some of the downward is limited at the moment.

Adding @Shadowstars RSX holdings watchlist:

With the movement it’s had today, I would like to see it break below the 8 level. Ultimately below the 7.80 level.

Added some analysis of the SPY correlation moves on RSX intraday to highlight what we’re seeing on the stock while its waiting to do its gap trick in AH: https://forums.ascendedtrading.com/t/spy-tracking-and-what-it-means-for-tickers/13091/4?u=conqueror

To add

BIDEN IS REPORTEDLY BANNING RUSSIAN SHIPS FROM ENTERING US PORTS

Manchin saying bill to ban Russian oil in the works!!

Already down to zero in the US i believe so no real effect

Just saw this eMail from Robin Hood - Might scare some people out - those who can sell or maybe cause so limit orders for when things unlock - Tin Foil Hat - Thoughts

An update on your options positions and Russian sanctions

Hi -----------,

We’re reaching out with an update about certain options positions you may hold. Due to stock exchange trading halts, you may not be able to open or close positions, and your positions may expire worthless.

Why is this happening?

In response to Russia’s attack on Ukraine, the US Treasury has announced sanctions to disconnect Russia from global economic access. Below is a list of underlying securities that are halted or may become halted in the future:

Stocks

MBT

MTL

OZON

QIWI

RSX

VEON

YNDX

ETFs

DVYE

ERUS

RUSL

RSX

SDEM

Please note that this list is not exhaustive and may change based on government action, updates from stock exchanges, or changes at our execution venues.

Do I need to take action?

Your options contracts are still held at Robinhood, but you may not be able to open or close affected positions. If trading halts last through expiration date, your positions may expire worthless.

This is a rapidly evolving situation and we are here to support you. For more information about how these securities might be impacted by the ongoing geopolitical conflict, please visit our Help Center.

- The Robinhood Team

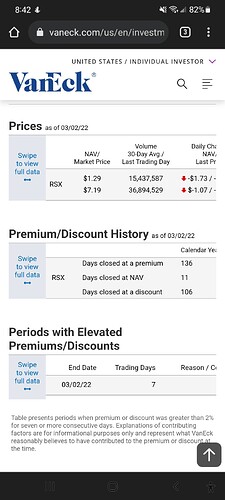

Filing today for RSX on the Fintel website here

Most intriguing parts to me are these two lines.

The Fund will temporarily suspend new creations of its shares until further notice.

During this time, the Fund may not meet its investment objective, may experience increased tracking error and may experience significant premiums or discounts to the Fund’s NAV and wider bid-ask spreads

Does the halted creation of new shares prevent ETF price dilution?

Second part seems to suggest VanEck might have a relaxed obligation to make RSX meet NAV.

Edit: TF says news is leaning quite bearishly. Could be a precursor to delisting (in which case people will dump the stock)

Unless they are WSB’ers of course

MSCI to Remove Russian Stocks From Emerging Market Indexes

By Justin Baer

MSCI Inc. moved Wednesday to drop Russian stocks from its influential indexes that track emerging markets after the invasion of Ukraine shuttered the Moscow Exchange and left global investors unable to sell their holdings.

“MSCI received feedback from a large number of participants, including asset owners, asset managers, broker dealers, and exchanges with an overwhelming majority confirming that the Russian equity market is currently uninvestable and that Russian securities should be removed from the MSCI Emerging Markets Indices,” the company said in a statement.

The index compiler said Russian securities would be moved to “Standalone Market” status from “Emerging Markets” on March 9.

FTSE Russell also announced plans on Wednesday to remove Russian stocks from its indexes.

“Russia will be deleted from all FTSE Russell Equity Indices effective from the open of Monday, March 7,” the firm said.

Just something that I saw on my scrolling news,

Palm oil is another one thats been running. Ukraine deport a lot of vegetable oil and palm oil is being used as a substitute in countries like India.

https://www.tradingview.com/chart/D1aGVO3S/?symbol=MYX%3AFCPO1!

Don’t know if someone posted this here already but another company worth a look might be $RIO. Russia happens to be the largest producer of diamonds. The diamond industry is worried about supply and sanctions.

$RIO might be a good investment because it’s not only in diamonds but other precious metals and materials. Going to look into this more.

Just parking this here. If duplicate please remove.