Thank you. Looking for info like this. Yea it ain’t doing shit so I might enter puts again. Ty

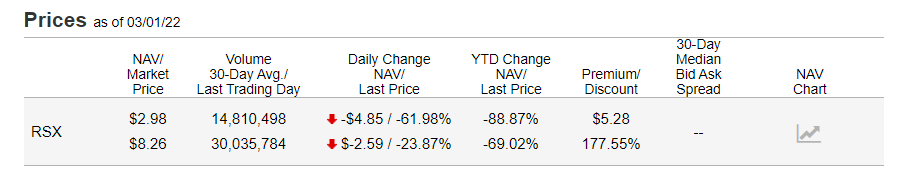

So this was discovered by @Shadowstars in trading floor, but RSX new NAV is $2.98…

It’s not about 10B. It’s about sentiment. I think my post came across too strong. I don’t really think “shorts are screwed”. Just saying I’ve seen weirder things happen when a bunch of stupid coalesces.

TD help line said it’s prob a glitch for OZON and always check nasdaq trader.com for halts as their database gets updated from that and TOS software shows correct price. Option pricing has always got weird when stocks halt but this was odd. Better to check than not, so options still same price around 1.07 for this strike and no concern yet.

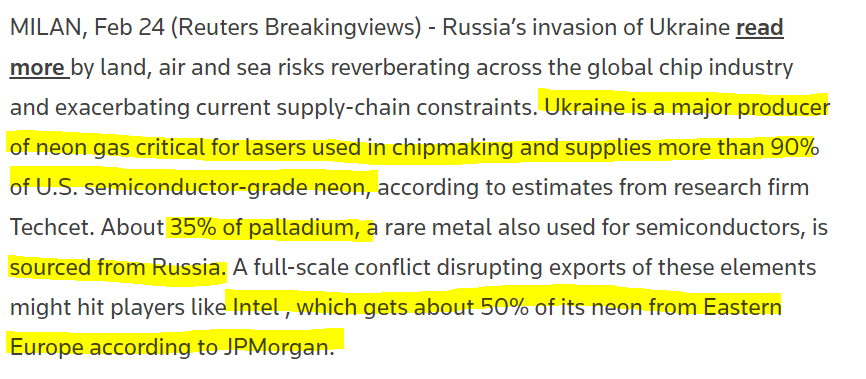

I’ve been hearing a lot about Ukraine’s role in neon production today, it seems like its being talked about more. Russia will fight back by tightening neon exports and if Ukraine is in their control, the semiconductor space will be hurting for neon. Bearish for hardware producers.

You would need a significant amount to change.

Just looking at RSX and the doing a rough calc on those with USD prices listed and changes from 2/23 to 3/1, those 21 holdings had a total market cap change of approximately -362 billion USD. ($362,703,545,450 USD)

Overheard a comment about the neon issue in one of my daily podcasts. The worry is there, but there may be not as much of an issue as they originally thought. From Protocol:

“We don’t think the prospect for higher prices is really an issue (even at 10x neon costs are a tiny fraction of the industry’s cost structure) though it may favor larger players over smaller ones in terms of getting supply,” Rasgon wrote. “But potentially putting a significant fraction of purification capacity at risk sounds somewhat ominous for an industry already struggling with shortages."

SIA downplayed the effect of any shortages, saying in a statement that the industry has a “diverse set of suppliers of key materials and gases” that the conflict between Russia and Ukraine won’t immediately disrupt. Evercore analyst C.J. Muse wrote in a research note that his checks revealed there will be enough neon in the chip industry for as long as the next year.

That’s definitely some good news.

Because it looks like Ukraine is currently a pretty big player in the chain.

XOM will not invest further in Sakhalin-1 and instead will begin the process to exit the venture

The Russian govt is probably off by an order of magnitude. Or two.

When the Euro crisis happened, ECB Prez Draghi said the ECB will do “whatever it takes,” and the market knew they could, and would. When COVID happened, the US pumped trillions into the economy, and the rest of the world opened taps to proportionate extents. Similar interventions that conveyed overwhelming support at massive scale were deployed after the 2008 crisis, 9/11, even going back all the way to WW II (Marshall Plan).

In comparison, the Russian economy is in tailspin, and just the 16 companies listed in the Reopening thread have a market cap of $180B. Let alone the rest of the market. $10B really isn’t going to make much of a dent.

And because this is Russia, folks also know that the support will mostly be targeted toward the companies owned by the most powerful oligarchs. So not really a general market support per se.

If anything, this might function as a negative signal - “This is all the govt can do to support companies? Wow they are screwed!” Bit like the Lehman days when Paulson thought he could get by on the cheap, and then really had to open up the wallets when market was near panic.

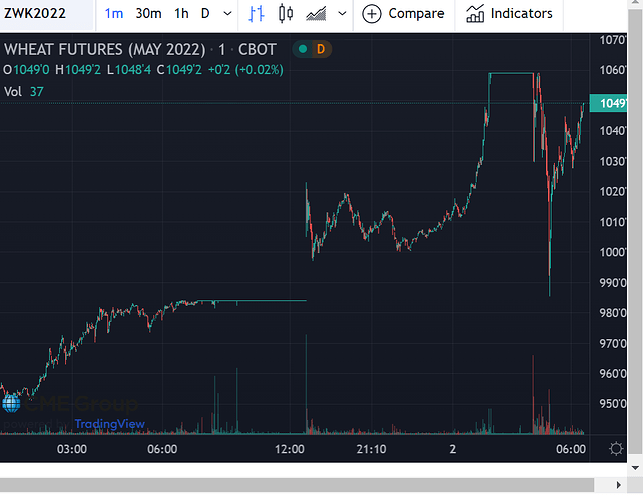

Wheat Futures appear to be maxed out already after a significant gap up.

Edit: They crashed right back down, are now flying up again. Something to monitor if you’re playing WEAT today.

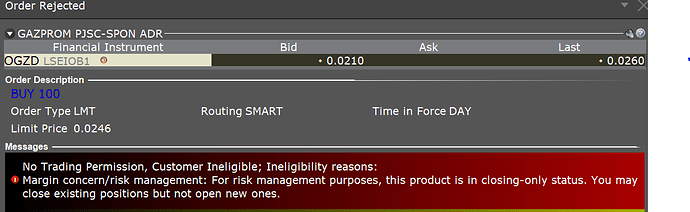

As far as I see this is a broker level decision currently, but it is definitely significant and would explain the crazy drop today on these.

Going to be watching WEAT again today. Small $, but big % gains yesterday.

But what institutions are going to be investing in Russia right now? Their risk management teams would shit a brick.

Ok, Ok. I’ve been sufficiently chastised. I was wrong and was speaking from past trauma LOL.

Not sure anyone has mentioned it or not but ERUS another Russian ETF might be worth looking at. As of yesterday NAV at $5.12 with it currently around $10.50 pre market.

https://www.ishares.com/us/products/239677/ishares-msci-russia-capped-etf

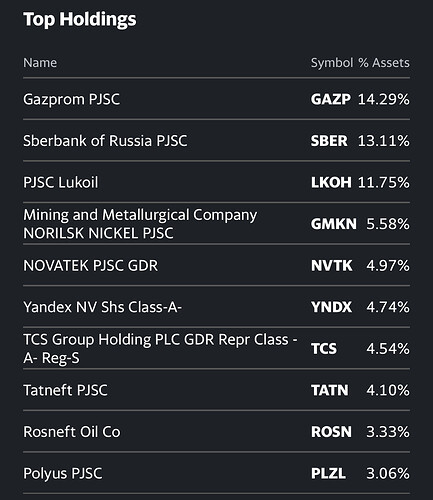

Thanks for the mention. I may go in if it’s not blocked by ETRADE. Here are the holdings for anyone curious. Same companies sanctioned and divested, but with higher % holdings.

Good eye. This was brought up in TF but unfortunately has no options so you would have to directly short it (which I know nothing about).