Remember when everyone was panicking about WEAT? Trust in the process and this is why averaging down is important. Nothing in the play changed and @Conqueror saw that and took advantage of it as well as keeping everyone calm with logic and reasoning. Also big thanks to @thots_and_prayers and the rest of the mod team for keeping TF level headed. I know discord is down, so sorry if this isn’t really a contribution to the thread but it’s important to note these over-reactions and take advantage of them. There is also probably other plays like WEAT, where the market overreacted. Looking into it.

Starting to look into the commodities ETF, DBC - might allow broad exposure to community price run-ups without having to (or in addition to) banking on specific commodities running.

Composition:

| FUTURES | % OF NET ASSETS |

|---|---|

| NY Harbor ULSD* | 14.33 |

| Brent Crude | 13.60 |

| Gasoline | 12.85 |

| WTI Crude | 11.80 |

| Wheat | 6.98 |

| Gold | 6.70 |

| Aluminium | 6.06 |

| Corn | 5.34 |

| Soybeans | 5.24 |

| Natural Gas | 5.16 |

| Zinc | 4.83 |

| Copper | 4.53 |

| Sugar | 4.36 |

| Silver | 1.61 |

*ULSD - Ultra-low Sulphur Diesel

Has been on a secular uptrend these last 10 days:

With Putin’s orders to stop exports of most things other than gas and oil, all commodities should become more expensive.

Because this is an ETF, option premium is not that bad. And this has decent liquidity, though not great. Looking at the 7/15’s.

Here’s something interesting. With the Ukraine invasion, the spike in the price in aluminum actually makes it profitable to SHIP aluminum reserves from China to Europe:

Interesting find. Any idea why the options chain only has 4 strikes above the underlying?

@Groupie ETFs tend to be fairly slow-moving, and a basket of commodities are probably less boring only when compared to utilities. Options on this commodity-basket ETF would have played a role in hedging, while the speculators would have played with the individual commodities directly. The lack of many strikes above the underlying therefore probably reflects the fact that there was no anticipation, and therefore demand, for a multiple standard deviation move. Thus, the MMs didn’t offer them.

Here’s the 5-year chart for the ETF. We are indeed in interesting times … who would have thought commodity baskets would start to go parabolic!

Before Ukraine, assuming they havent added strikes since then, it was trading at $23 and had 9 strikes above. It WAS plenty of cushion.

Not sure what impact it will have, but I did hear from an employee that Deloitte is closing their offices & eliminating all jobs from Russia and Belarus, but it has not yet been announced.

A bit of news for natural gas. The second article includes many tickers for possible plays:

$CHK $AR $EQT $OVV $LNG and of course $UNG

I think Dustin has mentioned some of these in VC.

https://finance.yahoo.com/news/natural-gas-stocks-watch-europe-230000146.html

That report looks like it should be released at noon eastern time today(2.5 hours after market open). So that would be when I’d expect any large movements of WEAT today.

I concur on this point, we may be seeing pre-report positioning by large players. The overnight grain markets are usually driven by chinese purchasing and they have a very large incentive to try and suppress grain prices as much as they can.

It does look a bit overweight on fuel sources. It’s -5% PM today vs -1% DBA

Utilized the 5% down to snag 7/15 24C ![]()

The downward price movement is probably a combination of talks of peace, “progress” with Maduro/Venezuela on oil, and needing to let off some steam after going up, up and up. Difficult to see Putin backing down that easily, so expecting commodity prices to remain under pressure.

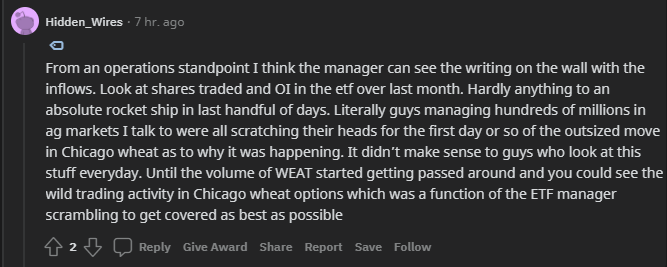

I started researching the futures contracts the $WEAT ETF holds today and came across this comment on /r/commodities:

Source: https://www.reddit.com/r/options/comments/t9syjy/capitalizing_on_the_coming_wheat_shortage/hzwo047/?context=3

They also suggest that Chicago SRW futures spiked due to the increased activity in the WEAT ETF:

I’ve not had the time I wanted to look into it today and try to understand/verify this so I’m posting it here in case anyone has knowledge on wheat future contracts or the time to dig deeper into this.

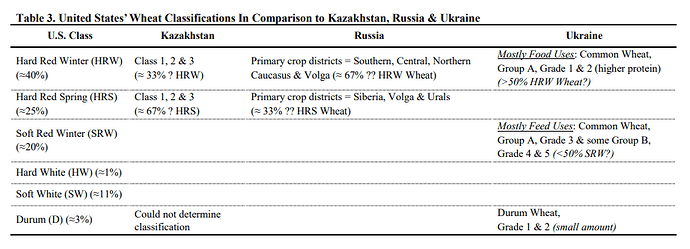

From the small bits I’ve read I can see the implication that the black sea region’s (Russia, Ukraine, Kazakhstan) winter wheat yields are heavier on HRW (Hard Red Wheat) than SRW (Soft Red Wheat). However I’m struggling to find a clear and direct source for this as different countries/regions use different names for grades of wheat and I can’t find a source for volumes exported by grade. I did find this chart showing a comparison of classifications:

Source: https://legacy.farmdoc.illinois.edu/nccc134/conf_2014/pdf/OBrien_Olson_NCCC-134_2014.pdf

I’ve not had the time outside work to go into this properly so it might not be relevant, hopefully someone with a better understanding can take a look.

said comment: https://www.reddit.com/r/options/comments/t9syjy/capitalizing_on_the_coming_wheat_shortage/hzwo047/?context=3

Did some digging and found these two articles on WEAT.

- https://finance.yahoo.com/news/sales-shares-weat-commences-223400152.html

- Teucrium’s Crop Of ETFs Flourish

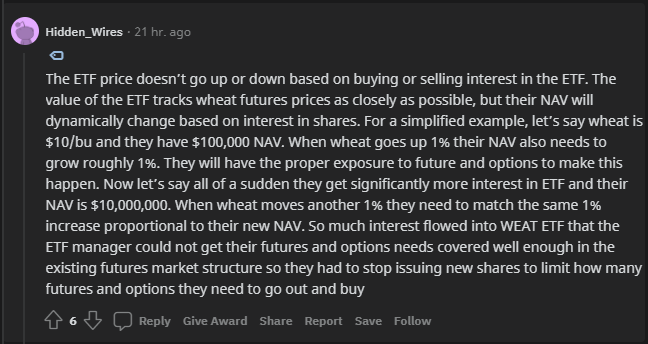

My understanding, which could be wrong so feel free to correct me, is that because the limit of shares available was reach and creation of new shares was halted this created a deviation from the NAV of the CBOT WEAT futures. The futures and NAV are supposed move towards each other. Since the influx of interest in WEAT due to Ukraine war and the halt shares this caused WEAT premium to increase causing the price to go up and increase the deviation between it and the futures it holds.

Still need to do more research into if this really is bearish or bullish. If the redditor from the link above is correct then it might be bearish since WEAT only tracks Chicago WEAT futures which might not be as affected as other wheat futures.

I believe this is correct and we need to be careful on our calls for WEAT. I have been averaging down but will be looking to get out on any pop we get. This has paid multiple times but I think we need to move on and take profit if we see it. Nothing to worry, but just my goal on my remaining calls.

Congress cleared the first major federal spending legislation of President Biden’s administration on Thursday, approving a $1.5 trillion measure with substantial increases for domestic and national security programs, along with $13.6 billion in emergency aid for Ukraine as it battles Russia’s invasion.

“The package provides $145 billion to invest in new aircraft, ships and other vehicles, including 13 new Navy vessels, a dozen F/A-18 Super Hornets and 85 F-35 Joint Strike Fighters. It also provides a 2.7 percent pay raise for all 2.1 million uniformed service members as well as the approximately 750,000 civilian employees in the Defense Department.”

Personally I am not buying that “different kinds of wheat” theory from reddit. Maybe in normal times but if a country has no wheat I dont think people will care if it is hard or soft wheat, or corn for that matter. My theory is this will play out over a few months not a few days, as problems mount. I also dont think anyone living in the US or Canada is going to have problems getting wheat but countries that rely on imports will be where the effect comes from.

This was a great listen.

In an interview for the upcoming FRONTLINE documentary “Putin’s Road to War,” journalist Julia Ioffe discusses Vladimir Putin’s invasion of Ukraine — and why she believes the Russian leader is now “more dangerous than he’s ever been at any point in the last 22 years.”

“What he has opened up with this invasion is unthinkable,” Ioffe tells FRONTLINE. “And because he is losing and because the sanctions and the Ukrainians are humiliating him, because he is backed into a corner, he is the most dangerous he has ever been, because it is now existential for him.”

Although she doesn’t get into it, the market implications are probably that Russia reopening plays are far, far away, and Europe will probably get worse before it gets better.