Like everyone else here, I’ve come across tons of articles talking about blocking SWIFT. One article said, “It means there is going to be a catastrophe on the Russian currency market on Monday,” said former Russian Central Bank Deputy Chairman Sergei Aleksashenko. “I think they will stop trading and then the exchange rate will be fixed at an artificial level just like in Soviet times.”

Putin was expecting to wrap this invasion up quickly, and it looks like that isn’t going to happen. The economic impact to the Russian population over a needless invasion is a ticking time bomb for Putin. Once the hardships start we might start to see massive protests and riots over there.

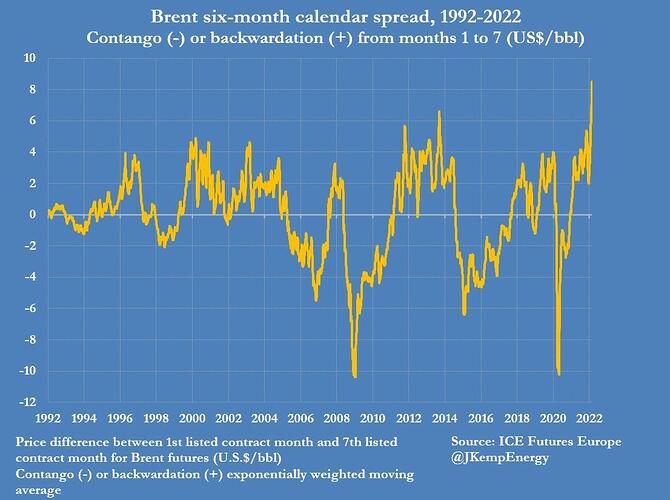

We also saw that uptick in uranium at the end of the day, I’m not sure if that was just algos or people starting to hedge with the idea that the oil/gas flow from Russia to Europe might stop (either voluntarily by Europe for sanctions, or by Russia in retaliation). We still have over a month of winter. We can only ship so much oil & lng to Europe as our prices are already getting out of hand. I posted tickers before, I’m going to be keeping a close eye on them this week (along with all energy companies). France gets like 75% of their energy from nuclear. The countries over there are a mix of pro & anti nuclear, but with this conflict I think they are all going to get cozy with nuclear real quick before they have a massive energy crisis.

Cyber security could also become a hot play this week if we get more news of attacks, and attacks on NATO countries. Remember what happened when that pipeline in the US was hit by ransomware?

Don’t underestimate the “staples” and “value” stocks this week. i.e. WMT, AMZN, PG, KO, PEP, COST, TGT, PM, MLDZ, MO, CL, BRK.B, TSN, HRL, etc…

Even if Putin pulls out tomorrow, I feel that economic sanctions are going to continue against Russia. The whole time he was claiming this was just an exercise and obviously it was not. Europe (and the rest of the world) can’t simply go back to the previous status-quo. At the very least they will likely demand massive (and I mean MASSIVE) demilitarization of Russia in exchange to remove sanctions. Which we all know Russia isn’t going to go for that unless Putin ousted and a much more progressive leader is elected.