Updating with thoughts from the TGT earnings call.

So as mentioned before and also from their previous earnings inventory was an issue and they took some pretty big hits on trying to clear out the big ticket items with major reductions.

However, I do see that as a potentially good thing if they can quickly pivot and target the right products/goods that consumers are buying now. Spending is still “growing” but in different categories.

An interesting point for me is that they are continuing to spend money into capex (capital expenditures) to improve their stores, open new ones and improve their distribution networks.

Everything seems to be on track, regarding capex and stock buybacks.

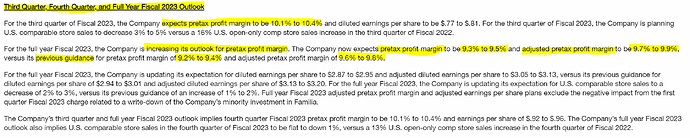

And they are expecting fall margin to be 6% vs 3% in the spring.

Also promising early numbers for fall sales with back to school.

So looking back to WMT and now TGT, a pretty positive picture is being painted with things looking to pick up. However, I will note here for next quarter earnings that inflationary pressures could throw this pretty much into wack and a lot seems to be banking on doing well for fall sales/holidays.

Now to touch on TJX.

Now this was an interesting question for me.

With an interesting reply.

So overall, based on what TGT, WMT, and now TJX have stated. Looking like most companies if they did revise down their initial “Q2” figures then with guidance being much more positive of the back half of the year, they could trend upwards.

FOMC still needs to play out tomorrow but initial reaction doesn’t seem to be too wack or out of expectations which could mean with a nice CPI print the following quarter could see continued growth.

BBWI has earnings today which I’ll try to glance over to get some more color and context but tomorrow PM with Kohls I think they hold up well, all the other retailers will run.

So ceteris paribus, I am looking to play ROST calls tomorrow to play the IV increase and maybe KSS if a positive trend run is established if their earnings look good.

edit: for clarification I changed ROSS to its actual ticker sign of ROST.