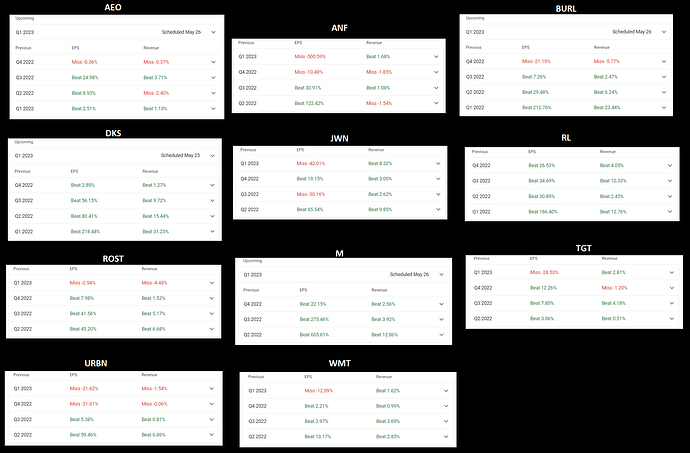

There have been a lot of clothing retailers and those in the clothing business with earnings lately and thought I would jot down some thoughts and notes about them.

American Eagle Outfitters Inc = AEO

Abercrombie & Fitch Co = ANF

Burlington Stores Inc = BURL

Dicks Sporting Goods Inc = DKS

Nordstrom, Inc. = JWN

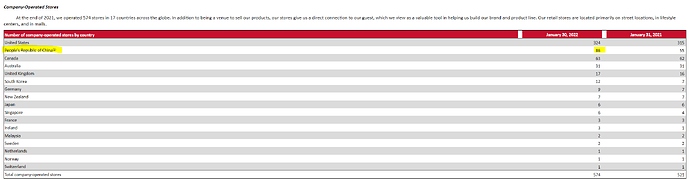

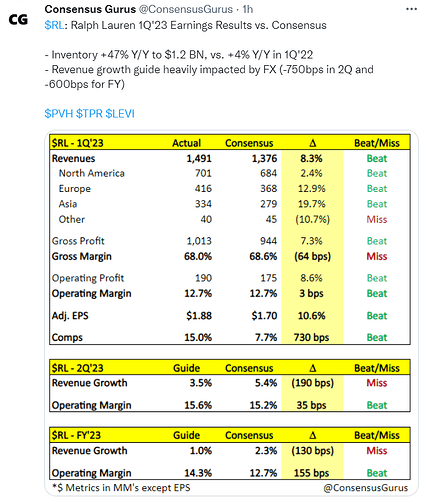

Ralph Lauren Corp = RL

Ross Stores, Inc. = ROST

Macy’s Inc = M

Target Corporation = TGT

Urban Outfitters, Inc = URBN

Walmart Inc = WMT

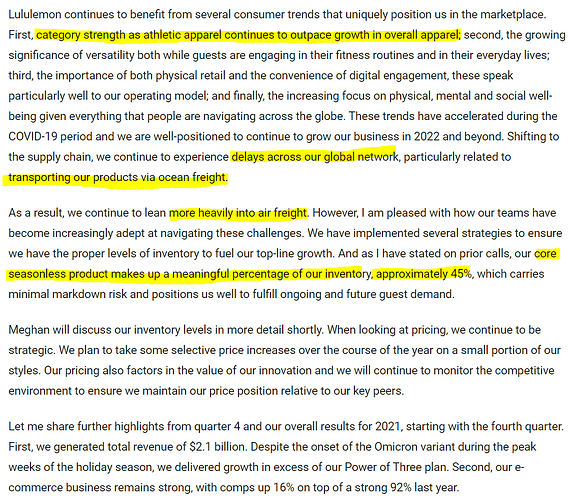

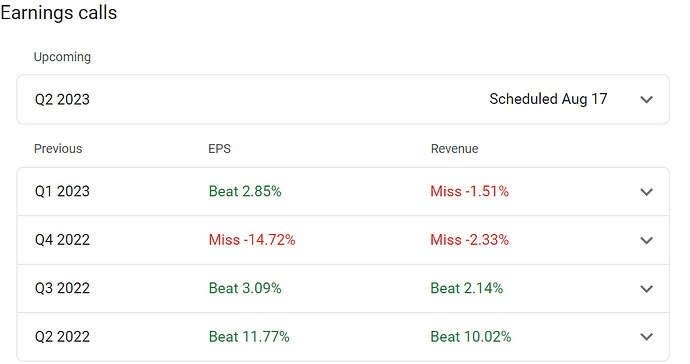

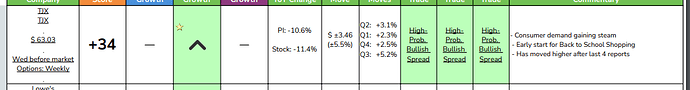

This is just a quick screen grab of all those related tickers and their past few earnings.

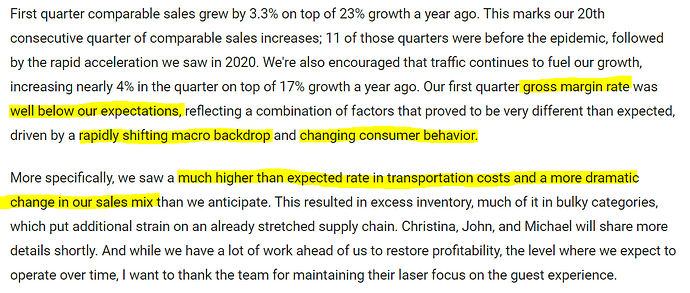

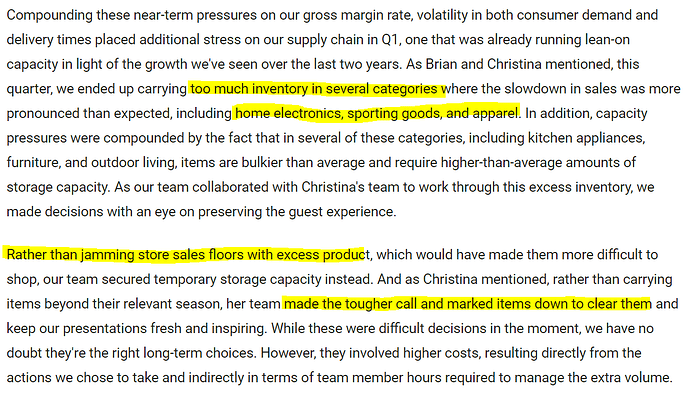

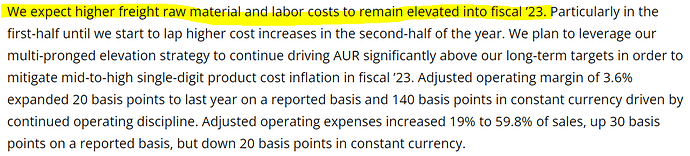

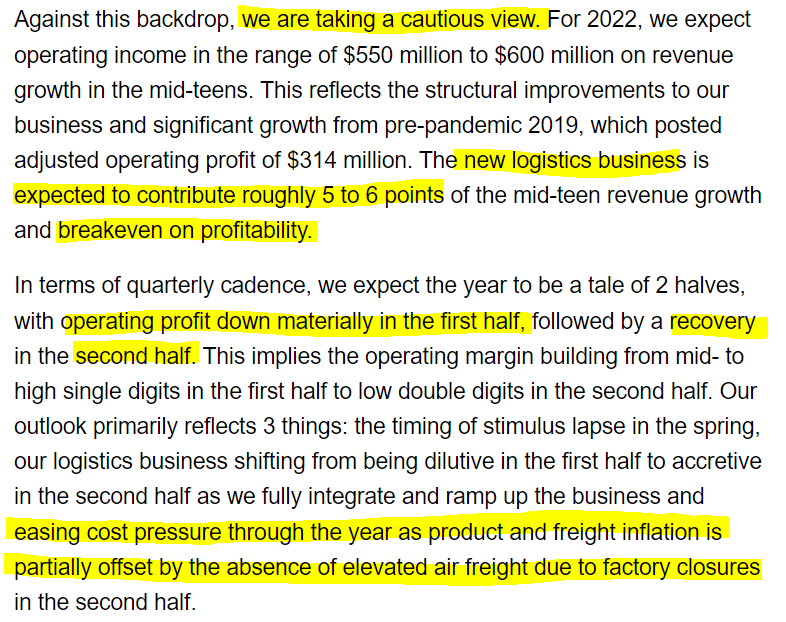

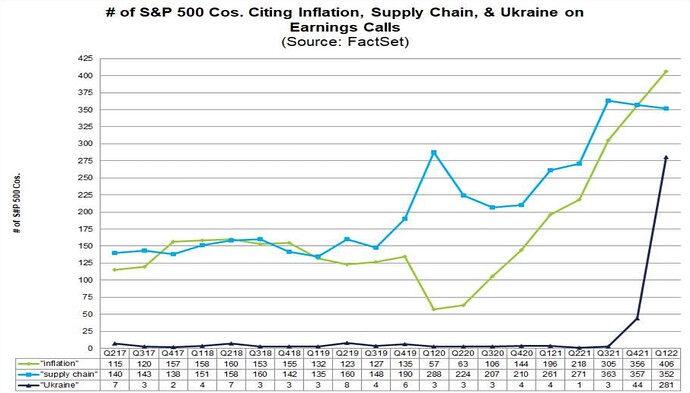

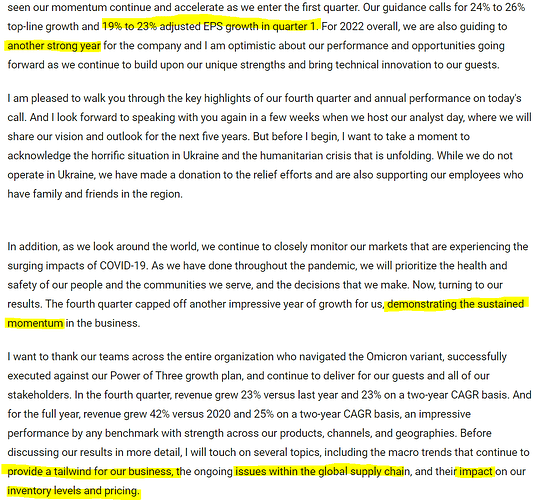

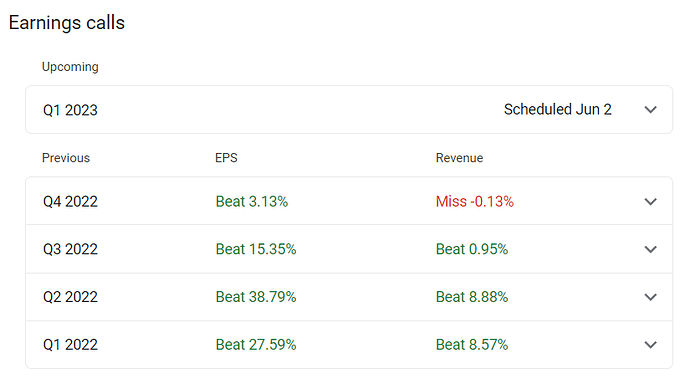

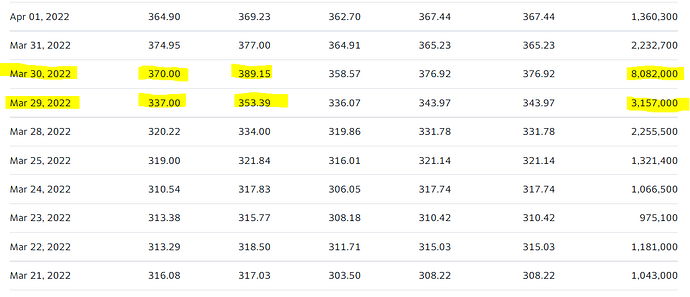

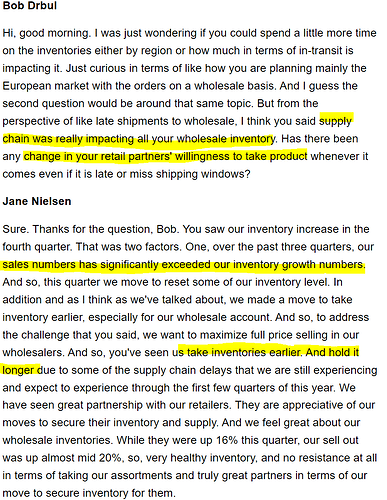

Looking through several earnings calls, the prevailing thought is the unexpected transportation/freight cost. Along with higher than expected levels of inventory.

Ex. TGT

Ex. WMT

Ex. ANF

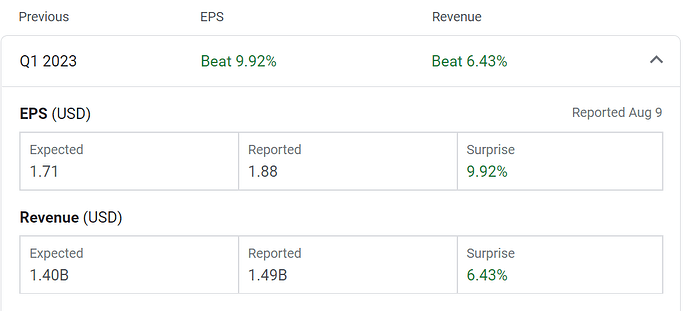

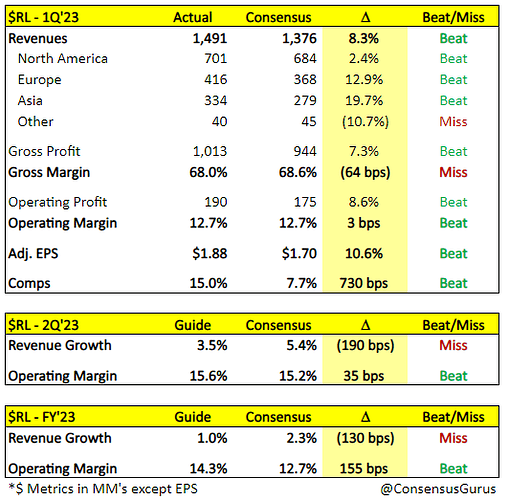

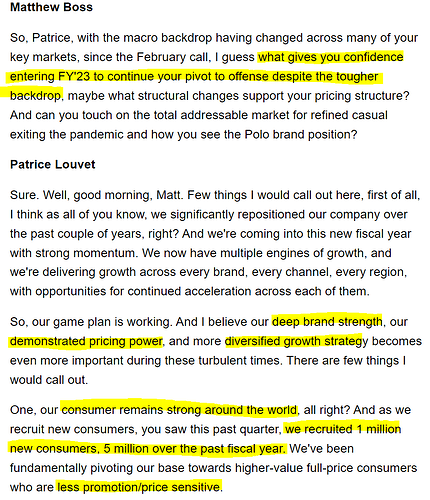

Ex. RL

Ex. ROST

Ex. URBN

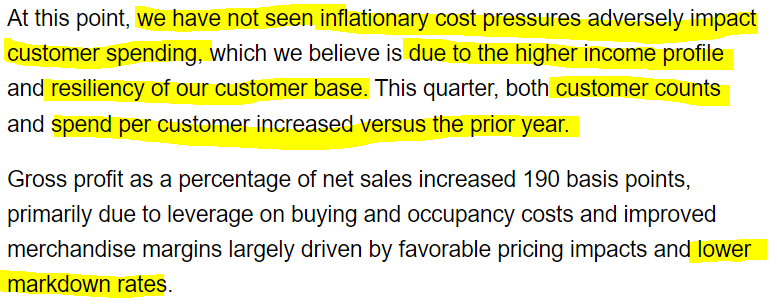

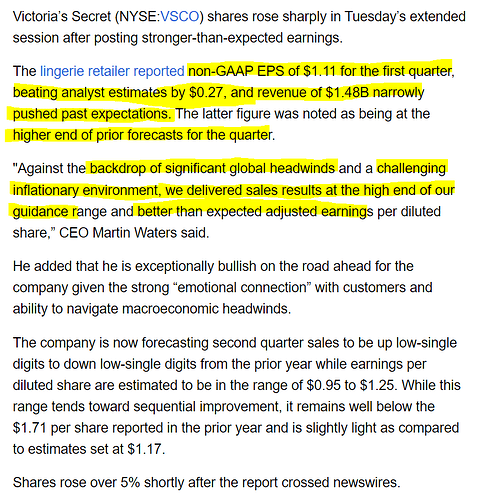

Now on the flip side we have Nordstrom earnings with this.

I could go through tons more but the overall sentiment that I get is that most companies faced much greater freight costs than expected. With the increase in fuel costs, its weighing them down as costs increase not just in transportation but also in cost of materials/production of goods. If we tie this in with expected increasing oil prices, I do not see this getting much better.

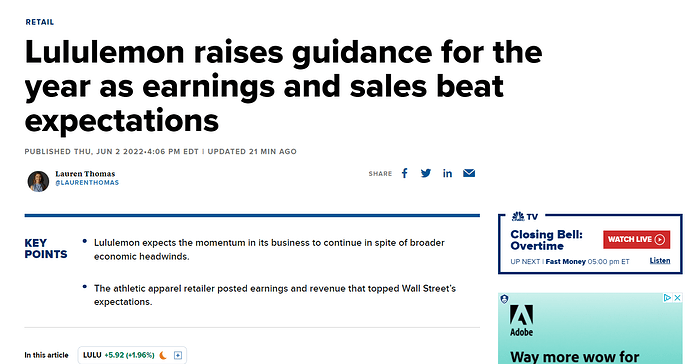

Now companies that have reported earnings already have dialed back down guidance in wake of this but there are a few that have not reported yet. Such as M, DKS, BURL and AEO. While RL and JWN both stated that they have “baked in” these elevated costs, I do think that rather their earnings are more indicative of a more resilient customer base.

JWN and RL are targeted imo to customers with more disposable income and more of the upper middle class. They are less affected by current inflationary pressure and as the world continues to open up and more events, parties, etc occur, the demand and growth will be there.

However, those of the lower middle class and low-income are going to be much more significantly hit by these increased costs especially by gas and food. So we see TGT and WMT both stating so in their recent earnings call.

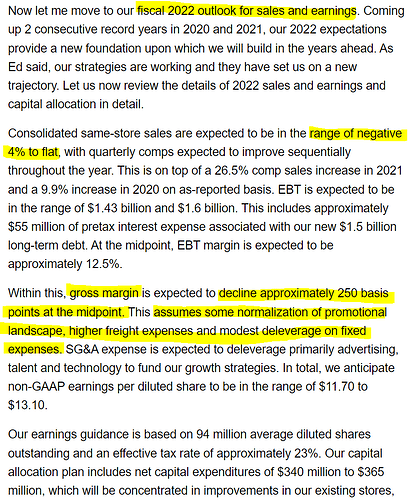

So with that being said, I think that AEO could be in a similar situation to that of ANF and DKS could also be hit.

On the previous DKS earnings call, in regards to their outlook they assumed “some normalization of promotional landscape and higher freight expenses”. One thing to be wary about is that DKS did announce share repurchase and said they would use their cash flow to do more if possible.

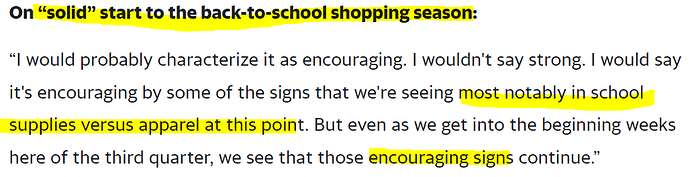

Previous AEO earnings call

Not sure how others feel but would love to hear some thoughts and particular those who think differently from me. Always great to hear the other side and see what things were missed.