I didn’t see any updated topic in regards to any of the semiconductor stocks so I decided to make one here.

Some of the big semiconductor tickers I am looking at in this discussion are as follows.

Don’t have time to comment on everything I want to say at the moment so I will slowly be updating this over the course of the next few days.

Also reason why I am looking into them now is that earnings is coming up soon for them.

However the tickers I plan to cover are as follows:

NVDA (Nvidia) (2/22/23)

AMD (Advanced Micro Devices) (1/31/23)

INTC (Intel)

QCOM (Qualcomm) (2/2/23)

Of these four, INTC just recently had their earnings for Q4 2022.

INTC Earnings:

So far we see that INTC dropped nearly 10% in AH (will have to see how the markets open up tomorrow). A lot of the drop could be due to a few factors.

My thoughts for the drop are as follows:

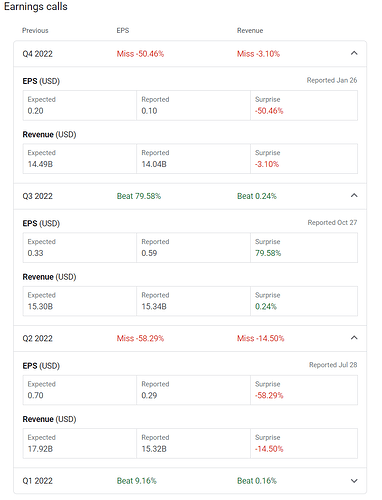

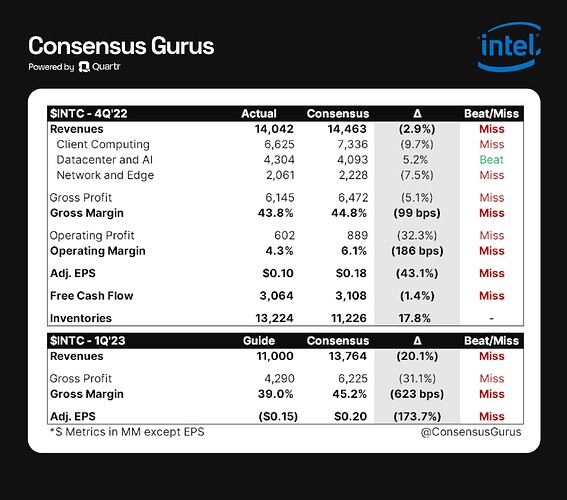

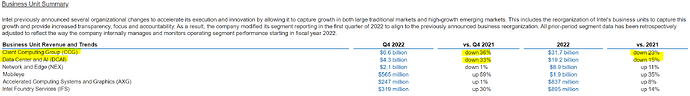

1). They had a pretty big miss in regards to their top line figures for this recent quarter in regards to EPS/Rev.

2). Their Q1 Future Guidance offers a very bleak outlook as they revise down heavily.

3). Greater than anticipated slowdown in the PC market.

Excerpt here from Computer Weekly:

The PC market has experienced its largest decline ever, according to analyst Gartner. Preliminary results by Gartner shows that worldwide PC shipments totalled 65.3 million units in the fourth quarter of 2022, a 28.5% decrease from the fourth quarter of 2021.

Gartner said that this figure represents the largest quarterly shipment decline since it began tracking the PC market in the mid-1990s. Gartner’s previous market data also showed poor sales of new PCs. For the year, PC shipments reached 286.2 million units in 2022, a 16.2% decrease from 2021.

Now there are also a few other things to consider. I am not sure as to how large of an impact.

4). Lack of progress on Intel Arc GPUs. Intel introduced the idea of them launching their own GPU line/division with the Arc/Alchemist back in Q2 2021. Since their official launch in Q2 2022, the GPU launch has been pretty awful. Lots of bad reviews stemming from not only bad quality, terrible drivers, terrible support, and overall lack of optimization. Any notions of Intel being able to take any market share away from the two top dogs of AMD/NVDA have gone absolutely down the drain and even though Intel was aiming for the low/budget range for GPUs where AMD/NVDA don’t really offer much of a solution, sales for the cards have been abysmal.

More thoughts and information to come. Just wanted to jot down a few things right now while I had a little bit of time and had the ideas fresh on my mind before I forget some of it.