$GRNA (GreenLight Biosciences) is a new ex-SPAC that ticker changed on 2/3/22. It used to trade as the SPAC, $ENVI. During it’s time as a SPAC, it never traded above the ~$10 NAV except 11/30/21 where it hit $10.11 on only 8,104 volume.

With the trust at ~20.7m shares, I am looking for a 95.2% redemption of shares from the 2/2/22 shareholder vote. A 95.2% redemption or more of shares would put $GRNA around 1m free float or less.

An observation I have made on ex-SPACs (with no options) is that if the float is 1m shares or less, there is a higher likelihood of it moving thinly. (See $ANGH, Anghami, as a recent example in which, according to Twitter, has around a 365k float)

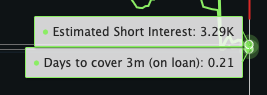

Additionally, $GRNA has and has had no shares to borrrow on it per shortablestocks .com

Last, but not least: New PR on them just came out regarding their agreement to field a station in Spain to boost research and development for key plant health projects.

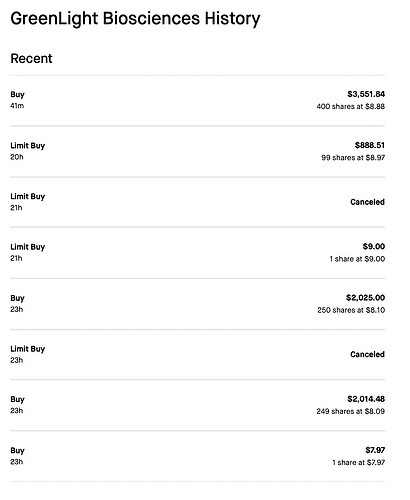

I am not sure what it will do in the upcoming days and ex-SPAC redemption plays are super risky and never guaranteed, but I do have a small position just in case as a lotto.

What do y’all think, will we see high redemptions?

Disclaimer: I am not a financial advisor. Do not take this post as financial advice. Do your own research. Consult a professional investment advisor before making any investment decisions.

UPDATE (2/8/22): Yesterday after-hours, after this post, it was announced in the 8-K that 19.5m shares have been redeemed, leaving the free float with 1.2m shares at the moment.

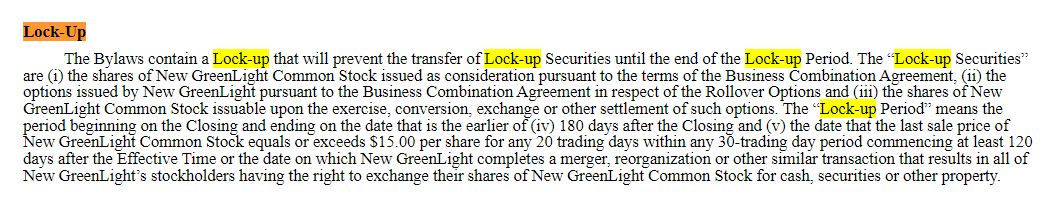

What about lock-up?

If if understand it correctly the lock up period ends on 2nd of June or when the share price is equal or higher than 15$ per share for longer than 20 days within a 30 days time period, within this 120 days period. This can be found in the S-1.