UPS a company with a bright future in uncertain times.

ups

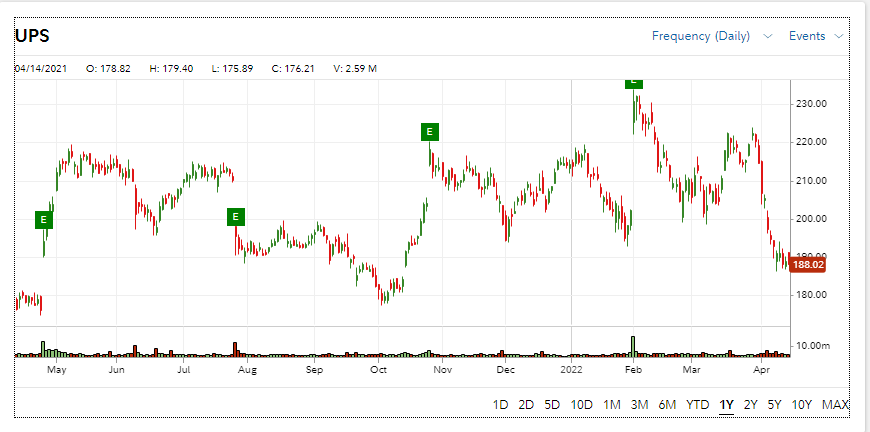

Since this is an earnings play first and foremost (thou this could also be considered a long play) I’d like to include the chart showing the direction of the company has gone on its previous 4 earnings calls. IMO the one we went down in was due to Carol Tome talking to much about how the country was opening back up from Covid and we could expect a drop in volume (We did not volume went up).

General Knowledge:

If you’re unaware who Carol Tome is look into her career first she has much to do with the direction UPS is going.

And if you do know who she is then you know one thing, she is very good at making money and developing companies to bring them into the modern era. I’d recommend looking into all the work she did at Home Depot.

Below is a link giving some feedback on her career and the original transition to UPS.

Tome’s vision for UPS was a controversial one at the start, UPS has a very unique culture which IMHO is outdated and must adapt to the times. Which is exactly what she did.

In the past UPS would take any and all volume that it could but now we have what’s called a volume cap. I do not have the updated numbers but in June of last year it was set at around 38 million packages a day (outside of the holiday season of course).

With this came the sale of UPS Freight for almost 1 billion dollars, interestingly enough most major logistics companies are leaning in this direction. Its the smaller high volume packages that generate the most overall net profit vs large and difficult to ship packages. Basically we eliminated a service that was causing UPS to bleed. Along with company wide changes in all of our infrastructure from our equipment to buildings and which is most important our workers.

Lets talk automation:

Probably the biggest driver of UPS into the future is the vast expansion into automated hubs over conventional. UPS is spending billions and billions and billions on automation. For example my building went from an old conventional site built in the 1970’s to an almost half a billion dollar machine capable of processes volumes more than double of the old building at an incredibly reduced cost. With this also came a large reduction in damages, misloads, and departure errors leading to an overall increase in customer service. My building which is now among the largest in the company is merely 1 of dozens of others being built and modified for the future of consumer logistics. UPS is investing heavily in some circumstances going all in on reworking the company through automation, and all it has done since its inception has increased our bottom line.

How does UPS vary from its competitors:

First thing you need to know is we do not under any circumstances label Amazon as a competitor. If Carol Tome called Amazon tonight and said we want to take on more of your volume they would say how much and when can we send it to you. As of 2021 roughly 30% of all UPS volume is directly associated with Amazon packages, so we Amazon does well UPS does well. Which leaves you guess it FedEx. Now FedEx announced a couple of years ago that they would no longer beholden to Amazon contracts and would now view them as a direct competitor. Its also important to note that Amazon ships through EVERYONE, if you can ship they will ship through you doesn’t matter who or what you are. Along with announcing Amazon was now a competitor they also decided to drastically reduce their Irregular operation (Odd shaped or large packages weighing more that 70+ lbs). Again trying to take advantage of the smalls volume for greater profit. What I can say from what I know is FedEx is currently in the toilet and flushing fast. Poor customer service, failing infrastructure, bad management, and terrible moral from employees. It is in my opinion without getting to deep into information I know that UPS stock will be worth more than FedEx by EOY. With that being said UPS already has a larger market cap than FedEx so keep that in mind.

Lets talk earnings:

Now outside of Carols only blunder since she became CEO all UPS earnings calls have posted green every single time. There is no short supply of good news coming out of this company ATM. Through expansion to better practices along with a vision for the company that has put it IMO a modern golden age of UPS. Now I cannot share numbers but know the last time UPS hit a golden era it saw records shattered for almost 5 years straight in every single category. And by looking at the trending lines its all going in the same direction. Record YOY profits, successful new use of technology, maintaining volume while managing cost every step of the way. UPS is a track star that had already won gold but decided to take steroids anyways because why not be better?

So with this being said It almost seems like this cannot go tits up and maybe I should just dump money into UPS for the earnings call… WRONG.

Uncertainty:

It goes without saying that no matter how much you know you never know how a play will panel out. That cannot be more true with the current situation. UPS has yet to address how the war in Ukraine has or will effect it in the near or distant future but, its important to know that FedEx will feel more pain from this because Air volume is their bread in butter. In a sense Air delivery is what keeps the company afloat. But it goes without saying it will in fact effect UPS in some way, perhaps they have put a plan in action that will look good to keep this news from impacting the company has yet to be seem nor do I know if Carol can talk her way out of it (BTW despite what I said about her blunder that woman can deliver an address).

On top of this UPS has also yet to address inflation. How this will effect service and/or prices moving forward. The most important thing to keep in mind when considering this is realizing that a vast majority of UPS volume is driven by independent customer contracts, and these contracts will not go anywhere. Now whether these contracts will be renegotiated to combat inflation has yet to be seen but, you wont see a huge impact from the average Joe/Jane. Regardless of what happens the packages will keep moving and you can bet regardless of how this earnings call goes UPS will ride this golden age into the sun.

My thoughts on earnings:

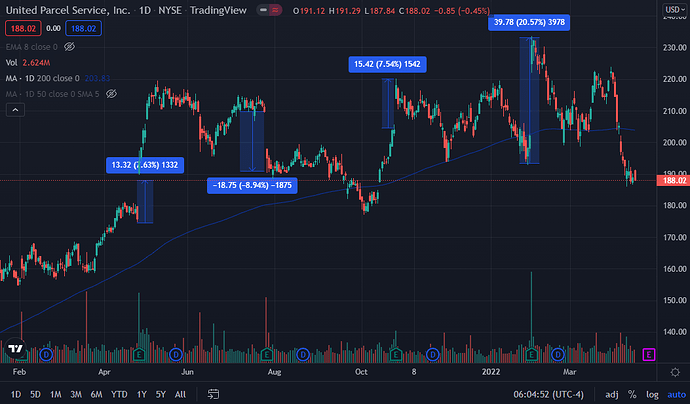

Now, with all of this being said lets get down to brass taxes. If we had no uncertainty at all I would 100% be looking to acquire a call position on UPS either on the Friday before earnings or the Monday before. I cannot stress enough that I would not even begin to hesitate. But with all of this uncertainty in the market and with the war its very hard to say. As of now it seems buying a position and selling before earnings to play the IV seems the safest and most sensible. But full disclosure I haven’t made up my mind yet, this call could very well go in UPS’s favor but with current events I believe it could just as easily go the other way. With all of that being said I will be keeping my eye on this stock like a hawk (per usual). What I will say is if we continue to see a down trend in the market and the stock price this would lean me more to the side of playing the call as originally intended. It doesn’t seem (at least for the moment) that UPS could fall below the 170-180 range, We have to much going for us currently and on the horizon.\

I currently have no option position but I do own 210 UPS shares at an average price of 195$ per share ( I am not worried at all even if it takes a while I’m not wrong (or at least that’s what I believe).

With that being follow the golden rules:

Do your own DD, never invest with money you cannot afford to lose, if you have meaningful profits or money you would not like to lose take it.

I will continue to update this thread as I acquire more information or make a better judgement.

I am not a financial advisor and this is not financial advise.

Sincerely,

Mr. UPS Man