Background

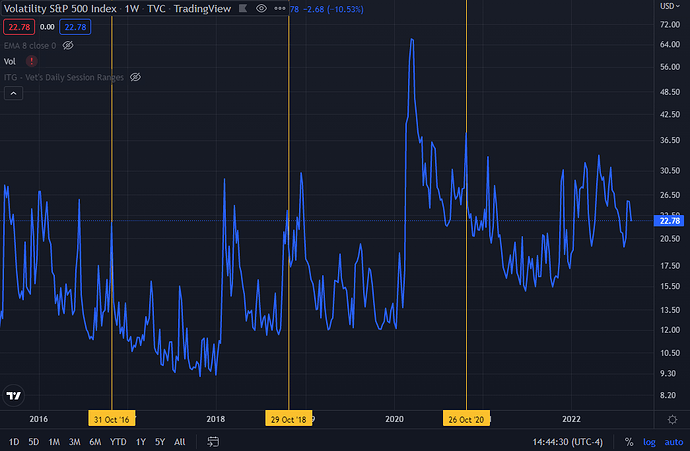

Midterms are on Nov 8, 2022. Elections have historically seen volatility spikes just prior to them since they do tend to be close, followed by vol crush. Since the odds of which party will win which part of Congress has swung back and forth a few times, we can expect this uncertainty-fueled volatility to continue. This provides an incredible opportunity to play this predictable vol event by positioning ourselves early.

Needless to say, let’s do keep the politics out of this. Of course, we’ll have to discuss policy outcomes and their effect on the market, but ideally void of value judgments. (Which also means we might be making money from outcomes we do not personally support ![]() )

)

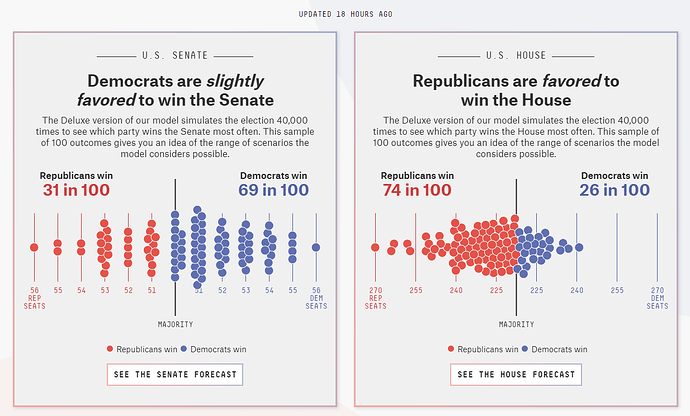

(Source: FiveThirtyEight.)

Some folks are nibbling on this already (though I have no idea what Cem is on about):

Plays

First, it is too early to get into this play right now. We need CPI, quarterly opex and FOMC to pass. Vol should be even lower at the end of Sep, and we can then load up. Never too early to start scheming though!

Two rather obvious sets of tickers to start us off with:

- VIX/UVXY

- mainstream energy (e.g. XLE) and renewables energy (e.g. TAN) ETFs

If it becomes exceedingly clear which party will win both chambers, there could be directional moves before elections too. E.g. Democrats = XLE down, TAN up. And Republicans = XLE up, TAN down.

We do want to release these trades before election date. And then position for the likely vol crush fueled rally after.

Would request our more seasoned vol and options traders to guide us on how to play this event vol best using ICs, diagonals etc. since it looks like theta will kill straddles, let alone naked calls or puts. Including if selling vol is an option.

Resources

A video from the CEM Group on some of these dynamics, from 2018:

Tastytrades talks about the 2016 vol setup (ignore the first 7 mins):

TD talk on trading volatility:

Walkthrough of double calendar trade, from SMB Capital: