Beginning the Milkshake Theory thread so we can begin to discuss implications when the whole world gets margin called. @Legends @Darkitect and everyone else. Get in here and let’s get some shit down for this.

Dropping this here for later for myself Hugh Hendry on central bank propaganda, the next crisis, eurodollar market and the art of panicking - YouTube

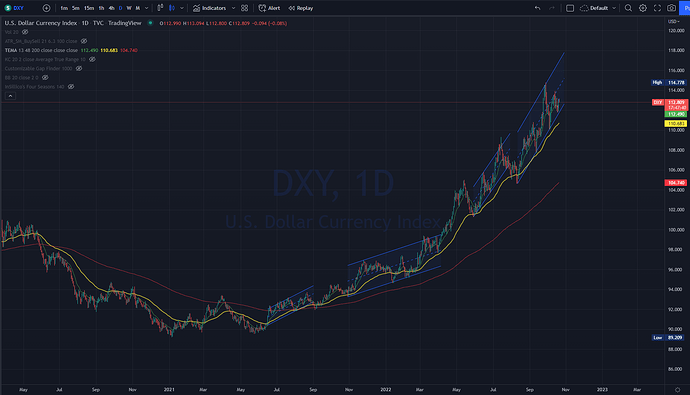

![]() lets suck it down

lets suck it down

In this video they get into some of the mechanics of how the USD can become stronger and the possible effects that will have on the rest of the world. BJ notes that Canada, Australia, Turkey and China’s economies are particularly susceptible to a stronger USD.

It’s too bad they didn’t finish off with his thoughts on the battle between treasury and the fed. Would have been interesting to see what implications he saw there, oh well…

This was pretty good, but I disagree with his response to the final question about Russia, China, and India trades and I feel its sort of foolish to undermine those actions or just brush them off as just noise. I’m sure it can be equated to a lot of nothing, but they are at least indicators that big players are getting tired of the US and its WRC status and may also be seeing some signs of that changing and how as they work their angles, how it affects us.

His take on all the fed entities being mainly a lot of noise is something I actually think is fairly spot on to a large degree. I mean look at all the months the fed was dancing around saying “inflation is transitory” or this whole “rates rising will take time to keep inflation down, but we also wanna leave ourselves room in case we need to pivot”. When you look at the way they lead the economy in a lot of ways he’s not wrong on the noise analogy. The data and market should be the primary indicator to see where the effects of inflation and rates are causing stress in the prices of equities, commodities, and also just spending (I think this is why he’s sort of dismissive of those trades and fed entities at large). They try to be that captain at the helm figurehead but ultimately it’s not hard to see they’re steering the ship in a very haphazardly way, what iceberg the economy ends up hitting is kind of the underlying thing to look for which he gave some interesting ideas on.

I’m not gonna lie tho and say I completely followed everything that man said haha so I saved it in here to reference and revisit as I look at more data points

I agree with all of this! I think some of those “icebergs” are economical factors and some of them are self interest factors which doesn’t make for a steady or safe travel. I was talking about the other sovereigns working between/with each other and sort of circumventing the USD and how he pretty much scoffed at that question (starts at 41:22) and just ended up calling it noise. And while it may just be noise now and singular actions may not affect us in any great way, it’s not always just propaganda. I do believe that while they may try to work around the US, everyone will be sucked into the upcoming mess (or milkshake lol).

I am very interested about how and what this will look like as things progress and what possible paths are left to travel as we proceed. And I think thats a huge reason to have this discussion. Not only to see how fed talk/actions are directly tied to the market, but to also understand if this part of history is greater than just market reactions. I recall Conq talking about stocking up on food and supplies for a bit during the initial parts of the Russia/Ukraine conflict and although I definitely do not like the idea of “prepping” (because why can’t we all stay calm and cool man!?), we have seen first hand how things can get out of order pretty quickly (think back toilet paper and covid or the gas runs during the summer of last year). And it sucks to sort of be in this mindset, but if the writing is on the wall, why not position accordingly and have a better understanding of where and when the unseen opportunities will reveal themselves.

Maybe (and hopefully) I am worrying too much about things, but I won’t be betting on the fed to make things right. History doesn’t seem to be on our side either, and even though we are at a much higher level technologically than ever before, I don’t think we have gotten much further in terms of spiritual evolution and how we view/treat each other which doesn’t allow for much hope in terms of the people in charge making the right decisions economically before they make the right decisions personally. It is still a very much dog eat dog world. I like the idea of things going back to normal, but I am very open to the possibilities of things taking a drastic turn and with all the different paths to take, I would like to understand which ones are the most viable/logical and get on them before the rest of the pack does. Changing of WRC, moving to the CBDC, maybe even some kind of global currency, who knows?! And further, what are the implications of each. Anyways, I’ll get off my soapbox now… lol

Thanks for putting this thread together, @navi!

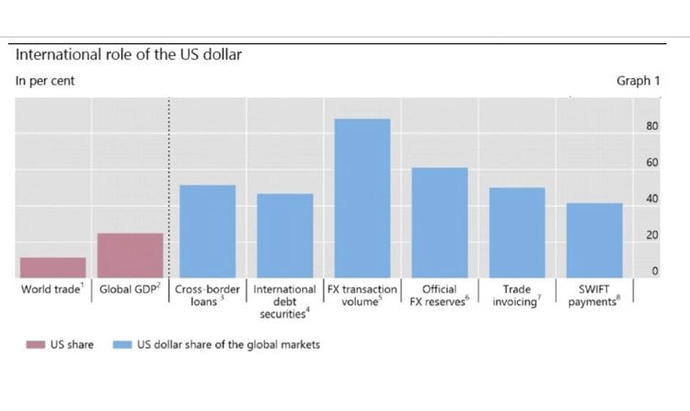

Don’t have much more to add by way of analysis but wanted to share a few pieces of background information that might come in handy as we try to ride the powerful USD.

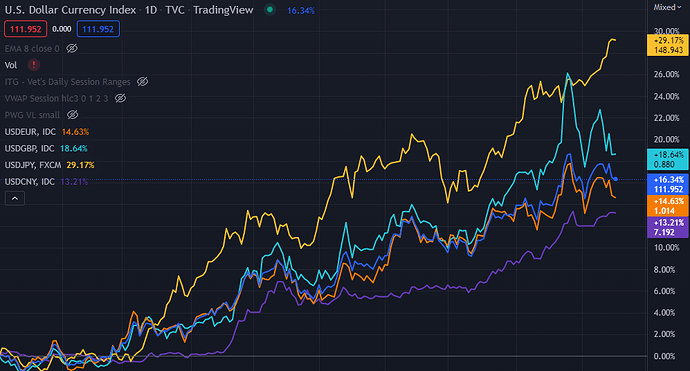

First, the currencies to keep an eye one are the EUR, GBP, CNY and JPY. The rest don’t really matter in the grand scheme of things. As you can see, Japan has lost the plot the most, when it comes to maintaining some semblance of currency balance.

Second, many things can affect exchange rates. The respective rates in each countries are one, but balance of trade (exports - imports) is another very important one. Europe going from a positive balance of trade to a negative one helped tank the EUR. Many countries also hold USD reserves. China and Japan have > 1T each. If they had to sell any of these bonds to raise USD, so that they could the USD to buy their currencies, that would send the USD down in a hurry. (Not to mention, also make bond yields rocket up.)

Finally, we have two threads, on GBP and JPY; CNY doesn’t have a thread because it is hard pegged by the CCP:

- GBP: https://forums.ascendedtrading.com/t/calls-on-gbp-because-brits-will-fight-inflation-with-stiff-higher-rates-maybe/

- JPY: https://forums.ascendedtrading.com/t/puts-on-the-yen-not-too-late-as-bank-of-japan-attempts-the-impossible-trinity/

The threads suggest ETFs one could play the currencies with.

Another data point for background:

Russia, China, India and others might try to decouple from the USD, but given the above, it will take a very, very long time.

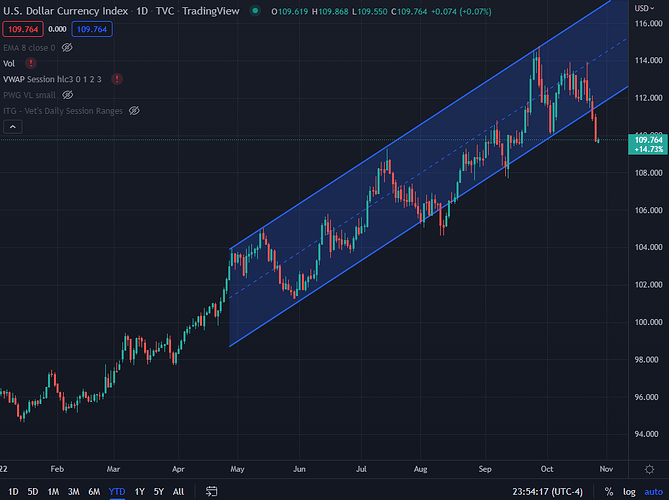

DXY charts here… starting with the 1min, which broke the trend tonight…

Thank you again EuroRich folks!

Or maybe HSE or someone else in Asia.

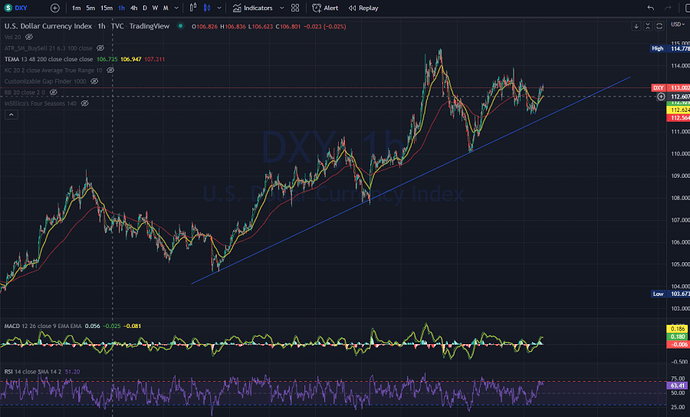

Then we have the 1hour…

Which seem to be slowing down too, if we see it break that 1hour trend line, we’ll know it will have started on its Peak platform/level.

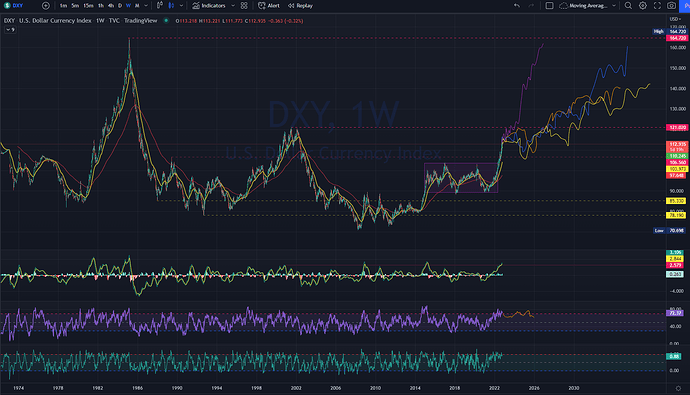

And now, the Weekly…

And I think this is the better chart to guide us for the remaining projections of the year.

- I know we will hit DXY 121, but not this month, since it needs to breathe some.

- So I’m expecting a break near this level in the immediate time.

- Check out the MACD indicator–clearly way overextended now and will curve down in the next few days.

- RSI indicator is already ahead in cooling down.

- I don’t expect DXY to break this 113 resistance anytime soon, so we should see it start trailing back down to 110.

Quick glance at the Daily candles…

Buying fatigue starting to show here.

This is my opinion and no creamy milkshake can flush it out of me.

Cap, I’m weak against milkshakes.

xxx

P.S. – looky here…

1:19am

Here’s a thread on Twitter that disagrees with the Milkshake Theory. The problem is is that this argument just tries to assert that the thesis of the Milkshake Theory are a reach without giving much in the way of evidence to suggest otherwise.

Believes that the Milkshake Thoery is very “memish” in nature. Just FYI.

https://twitter.com/Nostre_damus/status/1583255260235108352?s=20

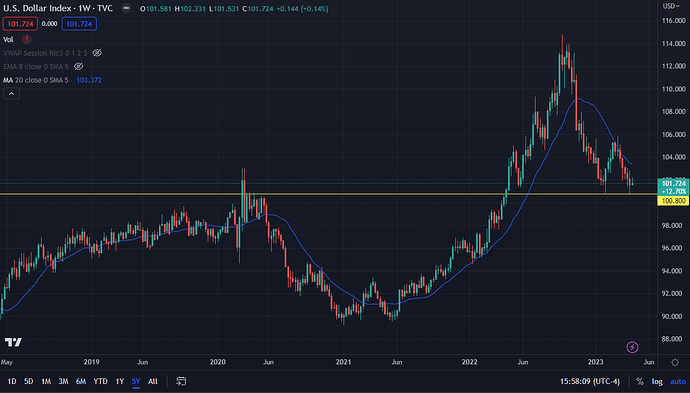

Clean-up on Aisle 7 - Milkshake Spill!

The USD broke out of the channel it was maintaining two days ago. If this is really a breakdown of USD strength, it may behoove us to also explore what happens now. Do all the things we were talking about just reverse? Or are there other effects we should be aware of, and can benefit from?

I think the concern is that the weakening dollar could undo much of the Fed’s work to curb inflation. Typically a strong dollar helps keep inflation in check by lowering the cost of imported goods. The U.S. remains a net importer, so the weakening dollar reduces U.S. purchasing power making imports less affordable. According to the Federal Reserve Bank of Cleveland, a 1% increase in the trade-weighted U.S. dollar index typically lowers nonpetroleum import prices by 0.3% cumulatively over six months.

The dollar remaining strong is one of the things the Fed is counting on to assist with curbing inflation. If the dollar is truly declining (small sample size with this recent break below the channel), inflation may actually get worse before it gets better.

This topic was automatically closed 14 days after the last reply. New replies are no longer allowed.

@Navi the Milkshake guy is back! Good interview with lots of nitty gritty info around forex.

tl;dr - It will be a while yet until the dollar milkshake goes back. Also no one wants a yuan milkshake.

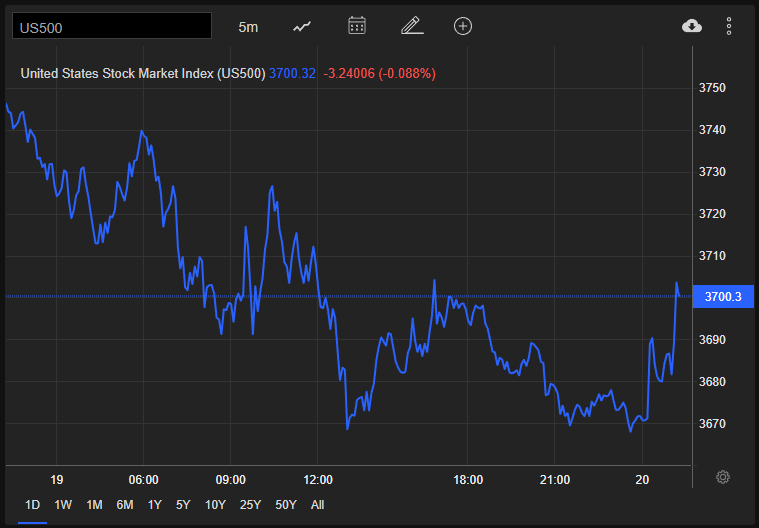

So… double bottom soon and back up again, or 20W MA breach on second retest and down? ![]()