Thanks for putting this thread together, @navi!

Don’t have much more to add by way of analysis but wanted to share a few pieces of background information that might come in handy as we try to ride the powerful USD.

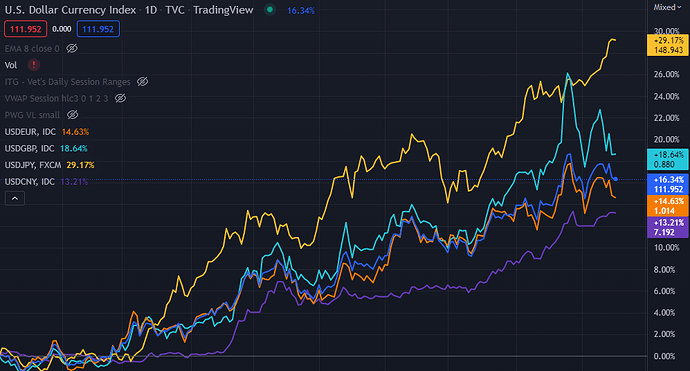

First, the currencies to keep an eye one are the EUR, GBP, CNY and JPY. The rest don’t really matter in the grand scheme of things. As you can see, Japan has lost the plot the most, when it comes to maintaining some semblance of currency balance.

Second, many things can affect exchange rates. The respective rates in each countries are one, but balance of trade (exports - imports) is another very important one. Europe going from a positive balance of trade to a negative one helped tank the EUR. Many countries also hold USD reserves. China and Japan have > 1T each. If they had to sell any of these bonds to raise USD, so that they could the USD to buy their currencies, that would send the USD down in a hurry. (Not to mention, also make bond yields rocket up.)

Finally, we have two threads, on GBP and JPY; CNY doesn’t have a thread because it is hard pegged by the CCP:

- GBP: https://forums.ascendedtrading.com/t/calls-on-gbp-because-brits-will-fight-inflation-with-stiff-higher-rates-maybe/

- JPY: https://forums.ascendedtrading.com/t/puts-on-the-yen-not-too-late-as-bank-of-japan-attempts-the-impossible-trinity/

The threads suggest ETFs one could play the currencies with.