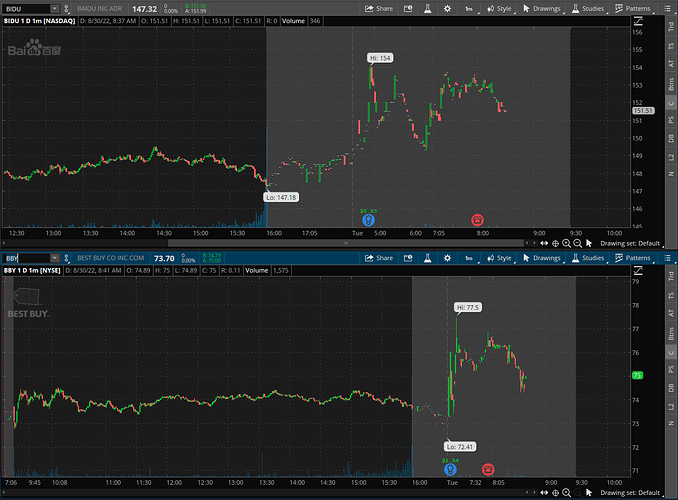

[color=#d4a218]Best Buy Co., Inc., ($BBY)[/color]

Best Buy Co., Inc., ($BBY) is confirmed to report earnings at approximately 7:00 AM EST on Monday 29th. The consensus estimate by the Earnings Whisper is for $1.36 per share on a revenue of $10.27 billion. BBY reported 1st Quarter April 2022 earnings of $1.57 per share on revenue of $10.6 billion. Revenue fell 8.5% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 18% expecting an earnings beat. Short interest is considered to be unhealthy with 6.00% of the float being sold short. The stock has drifted higher by 6.99% from its open following the earnings release. Option traders are pricing in a 7.8% move on earnings.

[color=#d4a218]Baidu, Inc., ($BIDU)[/color]

Baidu, Inc., ($BIDU) is confirmed to report earnings at approximately 4:30 AM EST on Monday 29th. The consensus estimate by the Earnings Whisper is for $0.83 per share on a revenue of $4.45 billion. BIDU reported 1st Quarter March 2022 earnings of $2.15 per share on revenue of $4.5 billion. Revenue grew 4.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 57% expecting an earnings beat. Short interest is considered to be healthy with 2.38% of the float being sold short. The stock has drifted higher by 5.62% from its open following the earnings release. Option traders are pricing in a 7.3% move on earnings.

[color=#d4a218]HP Inc., ($HPQ)[/color]

HP Inc., ($HPQ) is confirmed to report earnings at approximately 4:15 PM EST on Tuesday 30th. The consensus estimate by the Earnings Whisper is for $1.05 per share on a revenue of $15.87 billion. HPQ reported 2nd Quarter April 2022 earnings of $1.08 per share on revenue of $16.5 billion. Revenue grew 3.9% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 52% expecting an earnings beat. Short interest is considered to be healthy with 4.89% of the float being sold short. The stock has drifted lower by 4.71% from its open following the earnings release. Option traders are pricing in a 6.6% move on earnings.

[color=#d4a218]Hewlett Packard Enterprise, ($HPE)[/color]

Hewlett Packard Enterprise, ($HPE) is confirmed to report earnings at approximately 4:05 PM EST on Tuesday 30th. The consensus estimate by the Earnings Whisper is for $0.26 per share on a revenue of $6.97 billion. HPE reported 2nd Quarter April 2022 earnings of $0.39 per share on revenue of $6.7 billion. Revenue grew 0.2% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 36% expecting an earnings beat. Short interest is considered to be healthy with 2.22% of the float being sold short. The stock has drifted lower by 0.69% from its open following the earnings release. Option traders are pricing in a 7.5% move on earnings.

[color=#d4a218]PVH Corp., ($PVH)[/color]

PVH Corp., ($PVH) is confirmed to report earnings at approximately 4:15 PM EST on Tuesday 30th. The consensus estimate by the Earnings Whisper is for $2.00 per share on a revenue of $2.21 billion. PVH reported 1st Quarter April 2022 earnings of $1.94 per share on revenue of $2.1 billion. Revenue grew 2.1% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 56% expecting an earnings beat. Short interest is considered to be healthy with 3.01% of the float being sold short. The stock has drifted lower by 1.33% from its open following the earnings release. Option traders are pricing in a 11.1% move on earnings.

[color=#d4a218]Chewy, Inc., ($CHWY)[/color]

Chewy, Inc., ($CHWY) is confirmed to report earnings at approximately 4:05 PM EST on Tuesday 30th. The consensus estimate by the Earnings Whisper is for ($0.12) per share on a revenue of $2.48 billion. CHWY reported 1st Quarter April 2022 earnings of $0.04 per share on revenue of $2.4 billion. Revenue grew 13.7% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 53% expecting an earnings beat. Short interest is considered to be unhealthy with 24.71% of the float being sold short. The stock has drifted higher by 68.17% from its open following the earnings release. Option traders are pricing in a 13.5% move on earnings.

[color=#d4a218]CrowdStrike, Inc., ($CRWD)[/color]

CrowdStrike, Inc., ($CRWD) is confirmed to report earnings at approximately 4:05 PM EST on Tuesday 30th. The consensus estimate by the Earnings Whisper is for $0.27 per share on a revenue of $515.47 million. CRWD reported 1st Quarter April 2022 earnings of $0.29 per share on revenue of $487.8 million. Revenue grew 61.1% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 81% expecting an earnings beat. Short interest is considered to be healthy with 5.56% of the float being sold short. The stock has drifted higher by 24.53% from its open following the earnings release. Option traders are pricing in a 9.8% move on earnings.

[color=#d4a218]Express, Inc., ($EXPR)[/color]

Express, Inc., ($EXPR) is confirmed to report earnings at approximately 6:45 AM EST on Wednesday 31th. The consensus estimate by the Earnings Whisper is for $0.09 per share on a revenue of $479.62 million. EXPR reported a 1st Quarter April 2022 loss of $0.10 per share on revenue of $450.8 million. Revenue grew 30.4% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 57% expecting an earnings beat. Short interest is considered to be healthy with 8.47% of the float being sold short. The stock has drifted lower by 27.80% from its open following the earnings release. Option traders are pricing in a 23.47% move on earnings.

[color=#d4a218]Broadcom Limited, ($AVGO)[/color]

Broadcom Limited, ($AVGO) is confirmed to report earnings at approximately 4:15 PM EST on Thursday 1st. The consensus estimate by the Earnings Whisper is for $9.55 per share on a revenue of $8.37 billion. AVGO reported 2nd Quarter April 2022 earnings of $8.39 per share on revenue of $8.1 billion. Revenue grew 22.6% on a year-over-year basis. Investor sentiment going into the company’s earnings release has 70% expecting an earnings beat. Short interest is considered to be healthy with 1.32% of the float being sold short. The stock has drifted higher by 2.66% from its open following the earnings release. Option traders are pricing in a 6.13% move on earnings.