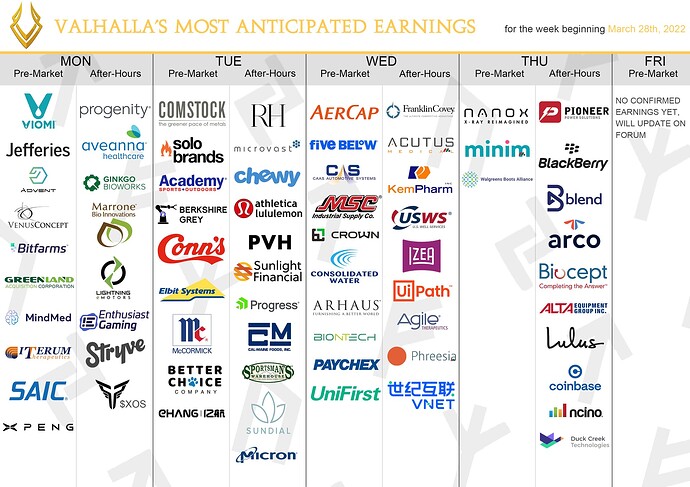

XPeng Inc. ($XPEV)

XPeng Inc. ($XPEV) is confirmed to report earnings at approximately 5:05 AM ET on Monday 28th. The consensus estimate is a revenue of $1.05 B by the Earnings Whisper. The company said it expects fourth quarter revenue of $1.11 billion to $1.17 billion. Investor sentiment going into the company’s earnings release has 74% expecting an earnings beat. Short interest has decreased by 37.9% since the company’s last earnings release while the stock has drifted lower by 26.79% from its open following the earnings release. It is important to note there has been an inflow of $900 M and an outflow of $954 M by institutions since their last earnings release. In comparison the market cap is $23.36 B. Option traders are pricing in a 14.89% move on earnings and the stock has averaged a 3% move in recent quarters.

Dave & Buster’s Entertainment, Inc. ($PLAY)

Dave & Buster’s Entertainment, Inc. ($PLAY) is confirmed to report earnings at approximately 4:15 PM ET on Monday 28th. The consensus estimate is for $0.59 per share on revenue of $368.01 M by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 72% expecting an earnings beat. Short interest has increased by 12.3% since the company’s last earnings release while the stock has drifted higher by 31.54% from its open following the earnings release. It is important to note there has been an inflow of $240 M and an outflow of $168 M by institutions since their last earnings release. In comparison the market cap is $2.15 B. Option traders are pricing in a 10.77% move on earnings and the stock has averaged a 12% move in recent quarters.

Progenity, Inc. ($PROG)

Progenity, Inc. ($PROG) is confirmed to report earnings at approximately 4:00 PM ET on Monday 28th. The consensus estimate is a revenue of $0.25 M by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 65% expecting an earnings beat. Short interest has decreased by 56.1% since the company’s last earnings release while the stock has drifted lower by 53.8% from its open following the earnings release. It is important to note there has been an inflow of $7.11 M and an outflow of $1.118 M by institutions since their last earnings release. In comparison the market cap is $270.19 M. The stock has averaged a 35% move in recent quarters.

Academy Sports and Outdoors, Inc. ($ASO)

Academy Sports and Outdoors, Inc. ($ASO) is confirmed to report earnings at approximately 8:00 AM ET on Tuesday 29th. The consensus estimate is for $1.28 per share on revenue of $1.77 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat. Short interest has decreased by 18.8% since the company’s last earnings release while the stock has drifted lower by 11.6% from its open following the earnings release. It is important to note there has been an inflow of $256 M and an outflow of $469 M by institutions since their last earnings release. In comparison the market cap is $3.32 B. Option traders are pricing in a 12.94% move on earnings and the stock has averaged a 10% move in recent quarters. The company said it now expects fiscal year earnings of $7.21 to $7.31 per share on revenue of $6.675 billion to $6.74 billion. After the last two earnings the stock dropped significantly but proceeded to run during the day, averaging a 12.5% move upwards.

Micron Technology, Inc. ($MU)

Micron Technology, Inc. ($MU) is confirmed to report earnings at approximately 4:00 PM ET on Tuesday 29th. The company said it expects second quarter earnings of $1.85 to $2.05 per share on revenue of $7.30 billion to $7.70 billion. The current consensus earnings estimate is $1.83 per share on revenue of $7.28 billion for the quarter ending February 28, 2022. The consensus estimate is for $1.97 per share on revenue of $7.51 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 84% expecting an earnings beat. Short interest has increased by 1.98% since the company’s last earnings release while the stock has drifted lower by 7.72% from its open following the earnings release. It is important to note there has been an inflow of $5.77 B and an outflow of $1.87 B by institutions since their last earnings release. In comparison the market cap is $84.71 B. Option traders are pricing in a 10.03% move on earnings and the stock has averaged a 5% move in recent quarters.

RH ($RH)

RH ($RH) is confirmed to report earnings at approximately 4:05 PM ET on Tuesday 29th. The consensus estimate is for $5.61 per share on revenue of $932.22 M by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 82% expecting an earnings beat. Short interest has decreased by 21.68% since the company’s last earnings release while the stock has drifted lower by 45.21% from its open following the earnings release. It is important to note there has been an inflow of $1.07 B and an outflow of $8.10 B by institutions since their last earnings release. In comparison the market cap is $7.74 B. Option traders are pricing in a 13.60% move on earnings and the stock has averaged a 16% move in recent quarters.

Chewy, Inc. ($CHWY)

Chewy, Inc. ($CHWY) is confirmed to report earnings at approximately 4:10 PM ET on Tuesday 29th. The company said in its shareholders letter it expects fourth quarter revenue of $2.40 billion to $2.44 billion. The consensus estimate is for ($0.07) per share on revenue of $2.42 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 59% expecting an earnings beat. Short interest has decreased by 7.21% since the company’s last earnings release while the stock has drifted lower by 7.31% from its open following the earnings release. It is important to note there has been an inflow of $517 M and an outflow of $258 M by institutions since their last earnings release. In comparison the market cap is $19.29 B. Option traders are pricing in a 16.64% move on earnings and the stock has averaged a 12% move in recent quarters.

Sundial Growers Inc. ($SNDL)

Sundial Growers Inc. ($SNDL) is confirmed to report earnings at approximately 6:45 PM ET on Tuesday 29th. The consensus estimate is a revenue of $26.39 M by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 66% expecting an earnings beat. Short interest has decreased by 36.56% since the company’s last earnings release while the stock has drifted lower by 33.1% from its open following the earnings release. It is important to note there has been an inflow of $25 M and an outflow of $4.23 M by institutions since their last earnings release. In comparison the market cap is $1.01 B. The stock has averaged a 25% move in recent quarters.

BioNTech SE ($BNTX)

BioNTech SE ($BNTX) is confirmed to report earnings at approximately 6:45 AM ET on Wednesday 30th. The consensus estimate is for $8.12 per share on revenue of $4.57 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 75% expecting an earnings beat. Short interest has decreased by 47.58% since the company’s last earnings release while the stock has drifted lower by 22.83% from its open following the earnings release. It is important to note there has been an inflow of $813 M and an outflow of $799 M by institutions since their last earnings release. In comparison the market cap is $40.34 B. Option traders are pricing in a 12.34% move on earnings and the stock has averaged a 15% move in recent quarters.

AerCap Holdings N.V. ($AER)

AerCap Holdings N.V. ($AER) is confirmed to report earnings at approximately 7:00 AM ET on Wednesday 30th. The consensus estimate is for $1.71 per share on revenue of $1.23 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 38% expecting an earnings beat. Short interest has increased by 41.97% since the company’s last earnings release while the stock has drifted lower by 5.12% from its open following the earnings release. It is important to note there has been an inflow of $1.00 B and an outflow of $940 M by institutions since their last earnings release. In comparison the market cap is $7.29 B. Option traders are pricing in a 13.91% move on earnings and the stock has averaged a 4% move in recent quarters.

Five Below, Inc. ($FIVE)

Five Below, Inc. ($FIVE) is confirmed to report earnings on Wednesday 30th, however, the time has not been confirmed yet. The company said it expects fourth quarter earnings of $2.36 to $2.48 per share on revenue of $985.0 million to $1.005 billion. The consensus estimate is for $2.48 per share on revenue of $1.01 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 43% expecting an earnings beat. Short interest has increased by 19.17% since the company’s last earnings release while the stock has drifted lower by 20.83% from its open following the earnings release. It is important to note there has been an inflow of $791 M and an outflow of $539 M by institutions since their last earnings release. In comparison the market cap is $9.13 B. Option traders are pricing in a 11.84% move on earnings and the stock has averaged a 5% move in recent quarters.

BlackBerry Limited ($BB)

BlackBerry Limited ($BB) is confirmed to report earnings at approximately 5:05 PM ET on Thursday 31st. The company said it expects fourth quarter earnings of $2.36 to $2.48 per share on revenue of $985.0 million to $1.005 billion. Investor sentiment going into the company’s earnings release has 63% expecting an earnings beat. Short interest has decreased by 33.04% since the company’s last earnings release while the stock has drifted lower by 18.06% from its open following the earnings release. It is important to note there has been an inflow of $79 M and an outflow of $53 M by institutions since their last earnings release. In comparison the market cap is $4.34 B. Option traders are pricing in a 19.60% move on earnings and the stock has averaged a 11% move in recent quarters.

Coinbase Global, Inc. ($COIN)

Coinbase Global, Inc. ($COIN) is confirmed to report earnings at approximately 4:00 PM ET on Thursday 31st. The consensus estimate is for $1.03 per share on revenue of $1.69 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 33% expecting an earnings beat. Short interest has not changed since the company’s last earnings release while the stock has drifted higher by 15.05% from its open following the earnings release. It is important to note there has been an inflow of $2.68 B and an outflow of $706 M by institutions since their last earnings release. In comparison the market cap is $40.19 B. Option traders are pricing in a 9.34% move on earnings and the stock has averaged a 10% move in recent quarters.COINBASE’S EARNINGS ARE PUSHED BACK TO A LATER DATE, NOT HAPPENING ON THURSDAY ANYMORE.

Walgreens Boots Alliance Inc ($WBA)

Walgreens Boots Alliance Inc ($WBA) is confirmed to report earnings at approximately 7:00 AM ET on Thursday 31st. The consensus estimate is for $1.38 per share on revenue of $33.65 B by the Earnings Whisper. Investor sentiment going into the company’s earnings release has 72% expecting an earnings beat. Short interest has increased by 10.72% since the company’s last earnings release while the stock has drifted lower by 13.37% from its open following the earnings release. It is important to note there has been an inflow of $1.09 B and an outflow of $349 M by institutions since their last earnings release. In comparison the market cap is $40.35 B. Option traders are pricing in a 7.25% move on earnings. The stock has little to no movement during earnings but strong movement during the days that follow.